- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Adapting to Kuwait's vendor retention Compliance w...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Greetings to the SAP community!

In this blog, we shine the spotlight on a powerful feature rolled out specifically for Kuwait - the Retention Payment Control functionality in SAP S/4HANA public cloud CE2402. As Kuwaiti firms grapple with complex vendor payment retention regulations, SAP presents a localized functionality that drives simplicity and efficiency in compliance.

Regulation Overview

Before we dive into the feature's specifics, it's crucial to understand the context. As per the Executive By-Laws to Corporate Income Tax Law No.2 of 2008 (Law No.2 of 2008) issued by the Ministry of Finance (MOF) of Kuwait, under Articles 16, 37 to 39, every business entity, authority, and ministry in Kuwait is mandated to adhere to certain requirements.

- a) Inform the Kuwait Tax Authority (KTA) about the beneficiaries of their business operations, including contractors, sub-contractors, service providers - along with company names and addresses,

- b) Submit to the KTA a copy of the related contract(s), and

- c) Retain 5% from all invoices paid out to beneficiaries - both GCC and non-GCC entities. This retained amount can only be released when these beneficiaries provide a valid Tax Clearance Certificate (TCC) or a No Objection Letter (NOL) issued by the KTA.

These requirements represent formidable challenges to businesses. However, with our Retention Payment Control functionality, SAP S/4HANA CE2402 offers solutions that ease this compliance burden.

Harnessing SAP S/4HANA Retention Payment Control

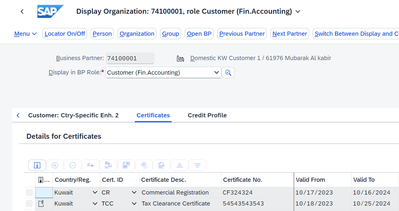

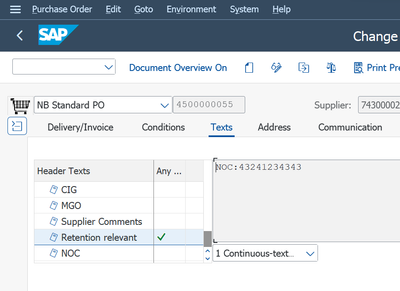

In the light of these legal requirements, our system ensures that TCC and NOL are maintained accurately. For a TCC, it's maintained in the 'Certificates' tab of the 'Business Partner' app. Conversely, NOL is maintained as a header text in the purchase order as shown below.

TCC certificate maintained in Business partner certificates tab in the role FLCU00.

NOL certificate maintained as a header certificate in the purchase order.

When a purchase order is posted, our system validates whether a TCC or NOL is attached. It ensures TCC document's validity on the posting date of the retention document or the existence of NOL in the header data of the purchase order. Given the mandatory nature of these documents, this localized functionality allows withholding of 5% of payment until these documents are presented.

By automating these checks and validations, the new functionality delivers efficient operations and full compliance with law requirements.

Concluding Remarks:

Incorporating S/4HANA Public Cloud as your strategic partner ensures seamless compliance and surges operational efficiency.

Before we appreciate the ingenious solution, let's delve into the pitfalls of not utilizing such an advanced system.

Without the efficiencies provided by S/4HANA's Retention Payment Control functionality:

- Companies could risk potential legal repercussions and significant fines due to non-compliance with local Kuwait regulations. A simple human error could cause a failure to withhold the mandatory 5% from invoices, thereby incurring hefty penalties.

- Manual checks of TCCs and NOLs can be time-consuming, laborious, and are inherently prone to errors. This can inject uncertainty into your business operations and disrupt smooth function.

- The task of tracking and releasing retained payments can prove to be complex and complicated, potentially leading to delays in financial reconciliations and impacting operational efficiency.

Adopting SAP's S/4HANA public cloud CE2402 eliminates these constraints and impediments. The system simplifies tax compliance, enables accurate tracking, and reduces errors, thereby making financial reconciliations swift and hassle-free.

To navigate the complex tax landscape of Kuwait, the localized solution of the Retention Payment Control feature is indispensable. Adopting smart solutions like SAP S/4HANA public cloud CE2402 can equip your business with a significant competitive edge.

References:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

160 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

220 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- Working with SAFe Epics in the SAP Activate Discover phase in Enterprise Resource Planning Blogs by SAP

- Five Key assessments for a Smooth ECC to S/4HANA Transformation in Enterprise Resource Planning Q&A

- Downloading Your Business Configuration Adaptations in SAP Central Business Configuration in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 8 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |