- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Q&A

- How is tax code determined in Sales Order when Con...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

How is tax code determined in Sales Order when Condition Type has no access sequence?

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 03-22-2024 2:05 AM

Hello

I am from Korea. pls consider my poor english.

It is my first question here.

I have been working on SD module for a year.

I have just learnt the process of tax code determination while creating Sales Order.

It is determined by Pricing Procedure ,Condition Type, Access Sequence and Condition Table.... etc

But I have recently found a case where tax code is not input by that process.

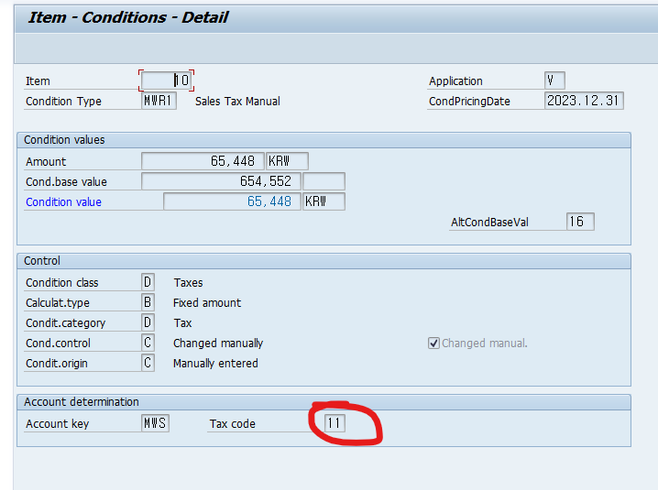

Although a condition type (MWR1) has no access code, after pricing procedure it gets tax code

see below screenshots..

1. In a Sales Order

2. Condition Type MWR1

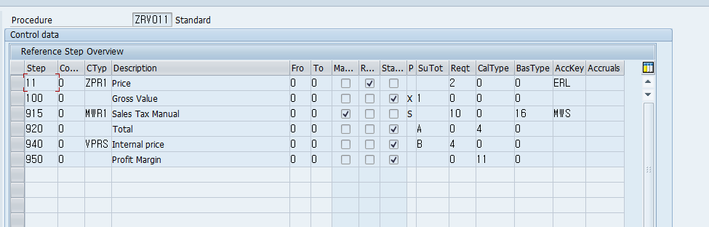

3. Pricing Procedure

Actually there is no problem in the SAP system running.

It is just from my curiosity and for my learning.

Thank you in advance.

- SAP Managed Tags:

- SAP R/3,

- SD (Sales and Distribution)

Accepted Solutions (0)

Answers (1)

Answers (1)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

For your tax condition type MWR1, standard Account Key MWS is assigned. Go to OB40, select this Account Key and double click on "Rules" tab where you can see all tax codes assigned to that Account Key. Also check in FTXP, where you can see the tax percentage would have been assigned to this condition type

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Freight Generation in Data Collation Document using Freight Rate Table or Pricing Multireference in Supply Chain Management Blogs by Members

- WOCR Determination in SAP EWM Based on Specific Requirement- Part 1 in Supply Chain Management Blogs by Members

- Dynamic BIN Determination Based on Specific Requirement in Supply Chain Management Blogs by Members

- Freight Charges Missing in Purchase Order Output/XML (S/4 HANA Public Cloud) in Supply Chain Management Q&A

| User | Count |

|---|---|

| 7 | |

| 4 | |

| 3 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.