- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Demystifying Depreciation Reversal in SAP

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Reversing depreciation may be necessary for a variety of reasons, such as correcting errors, revaluing asset values, or reflecting shifts in patterns of usage

In this comprehensive blog, we will delve into the complexities of depreciation reversal within the SAP ecosystem. We will demystify the concept, navigate through the steps involved in the process, and shed light on the impact it can have on an organization's financial statements. By the end of this blog, you'll be equipped with the knowledge needed to wield depreciation reversal in your SAP arsenal, ensuring your financial records accurately mirror the dynamic nature of your business operations.

As commonly understood, after the execution of the depreciation live run for a specific period and company code, it records depreciation for all assets for that period. Once the depreciation is posted, SAP does not provide a built-in solution for reversing these entries. However, as previously noted, there might be various reasons necessitating the reversal of depreciation postings. Failure to address these corrections promptly could adversely affect period-end processes and lead to inaccuracies in the company's financial reporting. Therefore, it is crucial to rectify any errors in depreciation postings.

There are 3 possible approaches to manage depreciation reversal;

- Remote Service Offered by SAP

For those clients which has a legitimate obligation to reverse a depreciation posting, SAP offers a remote service, but this is not a standard solution and not freely available. Although I have heard about its existence, I cannot confirm if any clients have chosen to utilize this service.

- Resetting Transaction – OAGL

SAP introduced this program primarily to aid in the initial configuration and setup of a new system. It's essential to emphasize that executing the depreciation reset (transaction OAGL) is inappropriate for a live system, it should NEVER be executed in a live system. To illustrate, during the initial implementation phase, it's common to run the depreciation program multiple times to address issues related to account assignment, reporting, depreciation calculation, authorization, and more.

Furthermore, it's important to be aware that whenever this program is run, your user ID is logged within SAP, which provides a very easy-to-follow audit trail if it were ever necessary to track down who ran the program.

NEVER USE the transaction OAGL for resetting posted depreciation. Doing so it will erase all posted depreciations in asset accounting while leaving the FI posting untouched. Manual reversal of the FI posting is imperative.

It's notable that this program is exclusive for SAP ECC system and is not available in SAP S4.

- Utilizing the standard 0000 Depreciation key within the Asset master and subsequently re-executing depreciation for the same month.

As previously mentioned, posted depreciation cannot be directly reversed. However, there is a workaround we can do. While we cannot reverse depreciation postings once they have been executed, SAP permits the re-execution of depreciation multiple times for the current period. For instance, if depreciation has already been carried out for period 07, any alterations made to an asset subsequently we can re-run depreciation for period 07. As a result, any incremental modifications to the assets which are modified after depreciation postings would be appropriately reflected in the postings.

Should the need arise to effectively reverse depreciation, the following steps should be undertaken:

- Determine the specific asset for which depreciation reversal is required. If the impact extends to all assets, then encompass all relevant assets in the consideration.

Asset identified with depreciation key of straight line.

Asset with Straight line depreciation method

- Once the assets have been identified, proceed to modify the depreciation key to '0000'. SAP offers a predefined depreciation key, '0000', which can be assigned to halt the depreciation.

- Many clients will have custom mass change program, if not we can use substitution rule to make the mass change. Make a use of custom mass change program or substitution rule and update the depreciation key to ‘0000’ in the asset master for the impacted depreciation area.

Changing depreciation key to 0000 in Asset Master

- Upon updating the depreciation key to '0000', the system will reflect the reversal of all previously posted depreciations of the current year in the subsequent period. To illustrate, if we are currently in period 07 and changed the depreciation key to '0000' in asset master, the reversal of depreciation will show in period 08. This is because depreciation for period 07 has already been executed.

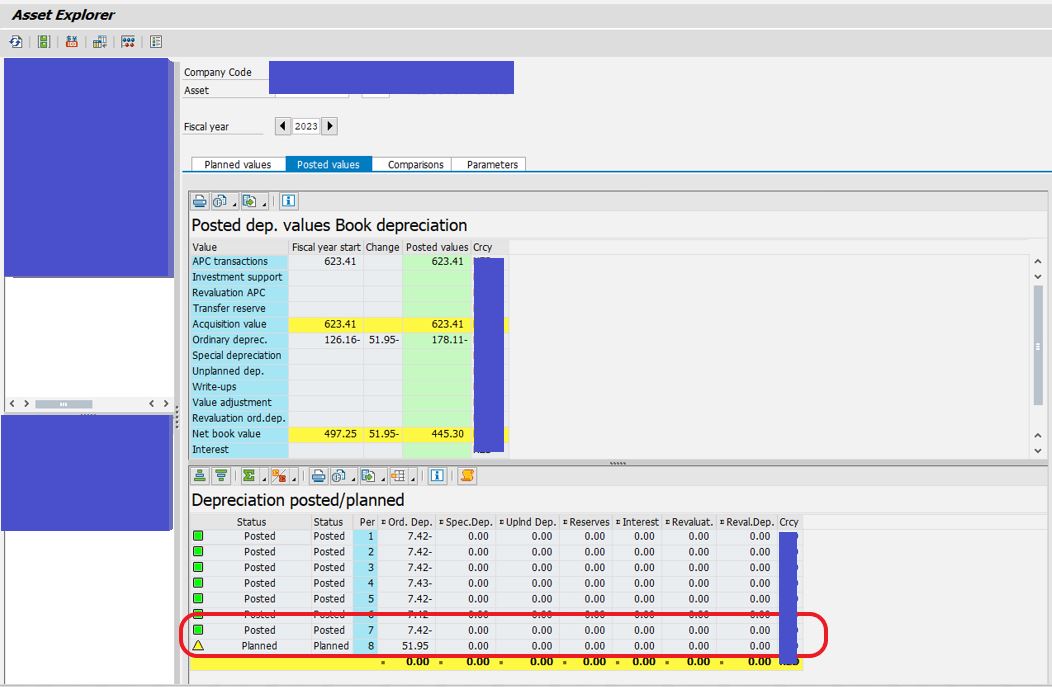

Depreciation Values are getting reverse in period 08

- Proceed to re-run depreciation for period 07. The system permits the re-execution of depreciation for the same month. This action will result in the posting of depreciation reversals from period 01 to 07 within period 07.

Depreciation reversal in period 07

- After executing depreciation, proceed to make or update the asset master (For example, change of depreciation key or change in useful life) that prompted the reversal of depreciation postings. For instance, in this scenario, the adjustment involves switching the depreciation key from straight line to diminishing balance.

Updating depreciation area 01 with diminishing balance method depreciation key

- Once depreciation key is updated, system will display the newly calculated depreciation based on the revised depreciation key in period 08. This adjustment will show up in period 08 since depreciation for period 07 has already been executed.

Revised depreciation calculation

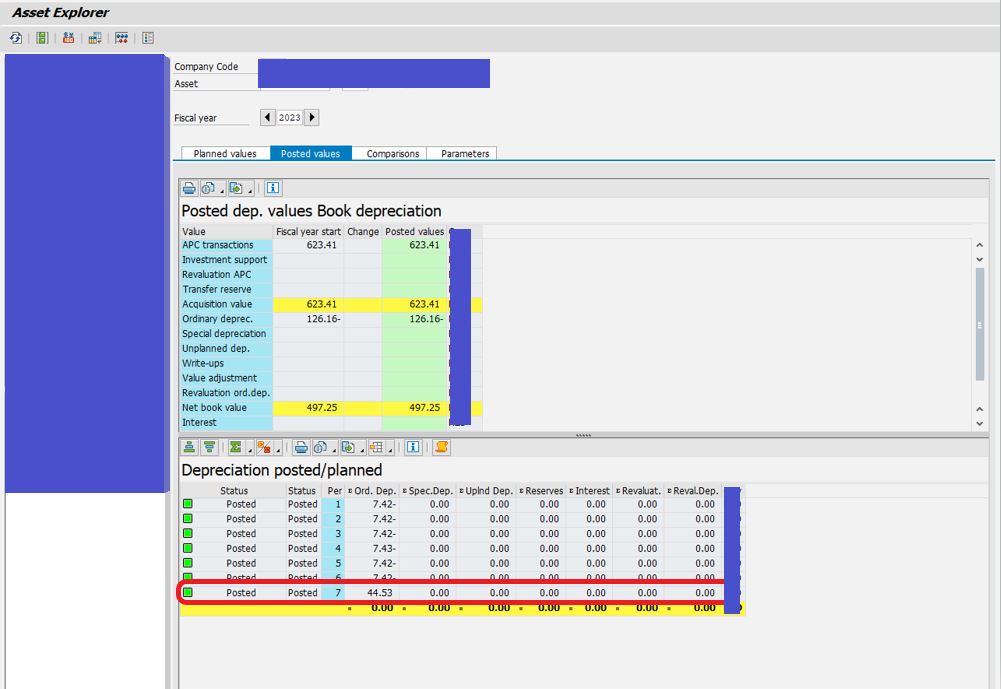

- Proceed to re-run depreciation for period 07. The system permits the re-execution of depreciation for the same month. Once depreciation is re-run for period 07, system will post the adjustment (catch up) from period 01 to period 07 in period 07 itself.

Actual posted depreciation after re-run

- Generally, two categories of assets will exist in the system: Assets which are acquired in the preceding year and assets those are acquired in the current year. The outlined modification will solely affect postings within the current year (for both the type of Assets acquired in preceding year and current year), leaving previous year's postings unaffected.

This approach enables us to rectify the depreciation postings effectively.

Upon rectifying the depreciation postings, the process of period-end closure will be finalized, resulting in accurate data representation within the financial statements.

Conclusion:

Now, I guess this blog has given a good understanding on how to reverse and rectify depreciation postings. While direct reversal of depreciation postings is not possible, the utilization of workarounds, such as re-executing depreciation by changing depreciation keys in asset master, provides a reliable method to address corrections. By following the outlined steps and considerations, organizations can navigate the complexities of depreciation reversal, safeguarding the precision of their financial statements and enabling informed decision-making.

Thank you, readers, for sparing time to read my blog. I would like to hear your feedback or thoughts on this blog. Please provide the same in a comment.

- SAP Managed Tags:

- FIN Asset Accounting

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

| User | Count |

|---|---|

| 9 | |

| 4 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |