- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Blogs by SAP

- Customer downpayment in S4HC – temporary workaroun...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Case: you would like to receive customer downpayments and report them to the Hungarian Tax Authorities (NAV)

Following description contains two parts:

Part 1. End-to-end description of the customer downpayment process, including preparatory steps

Part 2. DRC – Online Invoice registration for Hungary – reporting for DP and Final invoices

Part 1. End-to-end description of the customer downpayment process

- Preparation

Create a special FI Accounting document type (eg DP) which will only be used for clearing incoming customer downpayments

- Process steps

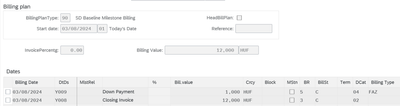

- Create a sales order with a billing plan (eg. OR) (Role: Internal Sales Rep)

- Optional: print downpayment request from the order (standard printout has to be adjusted) (alternatively, use a wordprocessor)

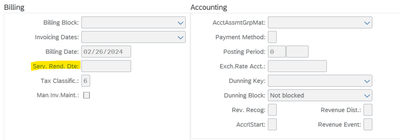

- After the customer payment, the date of services rendered has to be updated in the order (administrative process: bank accountant informs SD accountant about the receipt of payment),

- Create SD downpayment invoice (FAZ) from the order (Role: Billing clerk)

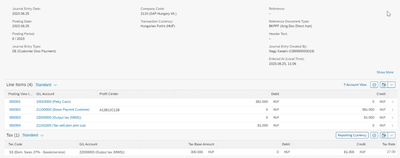

- Clear incoming payment with the special Accounting document type from the preparation step (eg. DP) (Role: AR_ACCOUNTANT, App: Post incoming payments)

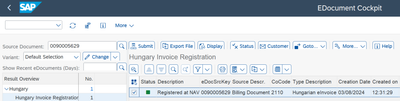

- Edoc will be generated with the SD billing document number as source document (see Part 2.)

- Create SD final invoice – which will contain the respective DP invoice (s) as separate item(s) (with minus sign)

- Edoc will be generated with the SD billing document number as source document (see Part 2)

- Print SD final invoice (adjustment might have to be made in the standard printout)

Part 2: Steps for the DRC Online Invoice Registration (component: CA-GTF-CSC-EDO-HU):

2.1. Preparation

2.1.1. Activate FI source for the company code, (Role: BPC Expert)

2.1.2. The Accounting document type used for the clearing (eg DP) should be assigned in the eDocument customizing, (Role: BPC Expert)

2.1.3. No special enhancement needed for the Final invoice (for invoices in local currency)

2.2. Process steps

During the downpayment process, eDocs will be automatically created in the following cases:

- Clearing incoming downpayment – eDoc for downpayment is created and displayed in the eDoc cockpit (advanceIndicator tag set to “TRUE” on item level)

- Posting of the final invoice – eDoc for the final invoice is created and displayed in the eDoc cockpit (containing the DP items with the advanceIndicator tag set to “TRUE”, DP invoice number, clearing date and exchange rate)

- SAP Managed Tags:

- SAP Document and Reporting Compliance,

- SAP S/4HANA Cloud Localization,

- Localization

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Business Trends

169 -

Business Trends

24 -

Catalog Enablement

1 -

Event Information

47 -

Event Information

4 -

Expert Insights

12 -

Expert Insights

39 -

intelligent asset management

1 -

Life at SAP

63 -

Product Updates

500 -

Product Updates

66 -

Release Announcement

1 -

SAP Digital Manufacturing for execution

1 -

Super Bowl

1 -

Supply Chain

1 -

Sustainability

1 -

Swifties

1 -

Technology Updates

187 -

Technology Updates

17

- SAP Business Network Asset Collaboration and Classification Content by ECLASS: FAQs in Supply Chain Management Blogs by SAP

- Improved ETA/ETD Handling in Supply Chain Management Blogs by SAP

- SAP TM: BP type ahead search based on assigned org.unit in Supply Chain Management Blogs by SAP

- A mystery during the file upload to a planning book in Supply Chain Management Blogs by Members

| User | Count |

|---|---|

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |