- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Blogs by Members

- Credit Management (CM) - SAP S/4 HANA

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Before moving into details, let's see some of the differences between ECC and HANA with regard to Credit management.

| Credit Management (CM) | |

| ECC | S/4 HANA |

| CM comes under Sales and Distribution module | CM comes under Financial Supply Chain Management |

| Relevant master data is the customer in SAP | Relevant master data is BP in SAP with a separate role for CM |

| Credit exposure is monitored at credit control area level | Credit exposrue is monitored at credit segment level |

| Credit limit rules are not available | Credit Rules engine is available |

| No connectivity to 3rd party Risk rating systems | Connectivity is available |

Master data for Credit Management

In S/4 HANA, the credit management master data is maintained in BP master data. For this, we need to create a new role as Credit Management under the relevant BP.

Once you create the credit management role, you can see there are two parts activated for CM. We maintain all the CM related data within these two sections.

- Credit profile

- Credit Segment data

Credit Profile

The credit profile contains four main sections namely;

- Scoring

- External Credit Information

- Further Information

1. Scoring

1.1 Rules

Credit rules are defined in the system in order to calculate the credit limit and the score. In the configuration path below you can create the rules to calculate credit limit and score with user defined formulas

1.2 Score

Score is calculated by the system based on the formula defined in the above configuration path. The calculated score can be overwritten with manually entered values.

1.3 Risk Class

You can create risk classes in the below configuration path. We can assign the score ranges to each risk class, once the score is calculated by the system, the risk class will be picked automatically in the master data.

1.4 Check Rule

Here we can define how the system should check the credit exposure of a particular customer. There are three main ways of checking this.

1.4.1 Statistical check - With this credit check system will consider all the open sales orders/open delivery/open billing/open FI documents in the system and calculate the credit exposure.

1.4.2 Dynamic Check - With this credit check system will consider all the open sales orders/open delivery/open billing/open FI documents in the system and calculate the credit exposure. But the open items will be limited depending on the time horizon we define in the system. Ex: If the horizon period is 1 month, system will check all the open documents mentioned above which belong to the last 1 month only. Items older than that period will not be considered.

1.4.3 Default - All checks active - In default check, system will consider the open sales order value and billing documents posted to FI but not paid by the customer yet.

2. External Credit Information

You can maintain the customer credit ratings provided by the external parties in this section. For this you need to create the rating procedures in the system ex: Moodys, and define the ratings given by them.

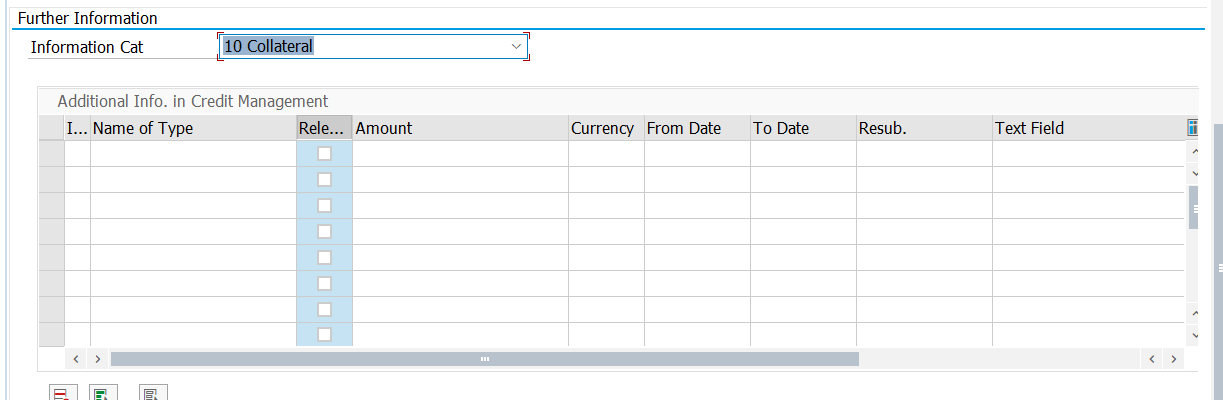

3. Further Information

Under this section you can maintain all types of collaterals maintained by the customers like guarantees/insurances/exception for credits etc. In the below table you can maintain this data with the amount and validity period. You can mark "Relevant for credit check" if you need to include the collateral during the credit check.

Credit Segment Data

The most important data under this section is the Credit Segment. Credit Segment represents a seperate unit under credit management which can be defined based on the business area and other credit management controls for each business area. For an example if you have multiple sectors in the business as Agriculture, Retail, Services you can create separate credit segment for each of this business area. Else you can create one credit segment for the entire company.

There is a main credit segment which will be assigned to the customer by default. You can define other segments with different credit limits which will be under the main segment.

Credit Limit

You can manually provide the credit limit for the customer instead of allowing system to calculate the limit using the credit rules and formulas.

You have the option to simulate the credit check and see how the system will calculate the credit exposure with different credit limits. (Yellow highlighted icon). Credit exposure will show the current open document value of the customer compared with the credit limit, and the utilization as a %.

Display liability option will give an overview of the credit exposure with a breakdown of the open documents and its value. So that it will be easy for you to know what the open documents are considered for the credit exposure of a particular customer.

The above is a basic overview on SAP S/4 HANA credit management master data. Hope this article will help for the beginners who are interested in this topic.

- SAP Managed Tags:

- SAP Financial Supply Chain Management

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

aATP

1 -

ABAP Programming

1 -

Activate Credit Management Basic Steps

1 -

Adverse media monitoring

1 -

Alerts

1 -

Ausnahmehandling

1 -

bank statements

1 -

Bin Sorting sequence deletion

1 -

Bin Sorting upload

1 -

BP NUMBER RANGE

1 -

Brazil

1 -

Business partner creation failed for organizational unit

1 -

Business Technology Platform

1 -

Central Purchasing

1 -

Charge Calculation

2 -

Cloud Extensibility

1 -

Compliance

1 -

Controlling

1 -

Controlling Area

1 -

Data Enrichment

1 -

DIGITAL MANUFACTURING

1 -

digital transformation

1 -

Dimensional Weight

1 -

Direct Outbound Delivery

1 -

E-Mail

1 -

ETA

1 -

EWM

6 -

EWM - Delivery Processing

2 -

EWM - Goods Movement

4 -

EWM Monitor

1 -

EWM Outbound configuration

1 -

EWM-RF

1 -

EWM-TM-Integration

1 -

Extended Warehouse Management (EWM)

3 -

Extended Warehouse Management(EWM)

7 -

Finance

1 -

Freight Settlement

1 -

FUB_Strategy

1 -

FUBR

1 -

Geo-coordinates

1 -

Geo-routing

1 -

Geocoding

1 -

Geographic Information System

1 -

GIS

1 -

Goods Issue

2 -

GTT

2 -

IBP inventory optimization

1 -

inbound delivery printing

1 -

Incoterm

1 -

Innovation

1 -

Inspection lot

1 -

intraday

1 -

Introduction

1 -

Inventory Management

1 -

Localization

1 -

Logistics Optimization

1 -

Map Integration

1 -

Material Management

1 -

Materials Management

1 -

MFS

1 -

New Feature

1 -

Outbound with LOSC and POSC

1 -

Packaging

1 -

PPF

1 -

PPOCE

1 -

PPOME

1 -

print profile

1 -

Process Controllers

1 -

Production process

1 -

QM

1 -

QM in procurement

1 -

Real-time Geopositioning

1 -

Risk management

1 -

S4 HANA

1 -

S4 HANA 2022

1 -

S4-FSCM-Custom Credit Check Rule and Custom Credit Check Step

1 -

S4SCSD

1 -

Sales and Distribution

1 -

SAP DMC

1 -

SAP ERP

1 -

SAP Extended Warehouse Management

2 -

SAP Hana Spatial Services

1 -

SAP IBP IO

1 -

SAP MM

1 -

sap production planning

1 -

SAP QM

1 -

SAP REM

1 -

SAP repetiative

1 -

SAP S4HANA

1 -

SAP TM

1 -

SAP Transportation Management

3 -

SAP Variant configuration (LO-VC)

1 -

SAPTM

1 -

SD (Sales and Distribution)

1 -

Shotcut_Scenario

1 -

Source inspection

1 -

Storage bin Capacity

1 -

Supply Chain

1 -

Supply Chain Disruption

1 -

Supply Chain for Secondary Distribution

1 -

Technology Updates

1 -

TMS

1 -

Transportation Cockpit

1 -

Transportation Management

2 -

Visibility

2 -

warehouse door

1 -

WOCR

1

- « Previous

- Next »

- Premium Hub CoE – DSC Knowledge Bits Series in Supply Chain Management Blogs by SAP

- Drive productivity, safely and sustainably, with SAP manufacturing solutions in Supply Chain Management Blogs by SAP

- Hiring - SAP Solutions Analyst in Supply Chain Management Q&A

- SAP S/4 Hana SD Advanced Returns Management in Supply Chain Management Q&A

- Early Stock Simulation for PMR documents Posting- Consumption & Consumption Reversal in Supply Chain Management Blogs by SAP

| User | Count |

|---|---|

| 5 | |

| 5 | |

| 3 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |