- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- OECD BEPS 2.0 Tax Calculation and Reporting – Stor...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Introduction

Hello everyone and welcome to the extension of the story behind SAP Profitability and Performance Management OECD BEPS 2.0 Tax Calculation and Reporting sample content. In case you still have not read the first part of the blog post and you want to, visit the link.

In blog post, “OECD BEPS2.0: More than just a Hot Topic!”, we have obtained general understanding about the topic, it’s importance and the steps in calculating the necessary KPIs. Hope blog was beneficial to all of you, who do not have accounting and taxation knowledge, but are keen on understanding the problematic of taxation.

In this blog post, I will give you insight into the sample content story and show how end user can benefit from this analytical solution. Then you will understand why this sample content is becoming more and more popular among potential users. So, let’s begin.

Process Flow

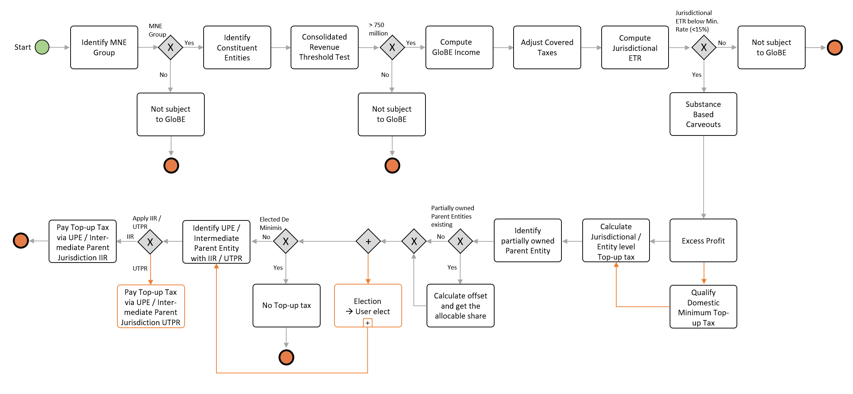

Already mentioned Five Step Approach in determining top-up tax liability for MNE has been introduced by OECD and explained in detail in previous blog. Therefore, in our sample content, we have followed Five Step Approach in compounding the top-up tax amount. The overall process flow is replicated on the screen.

First, we need to include in our calculation only entities that are part of the MNE Group. In case they are individual entities, they should not be included.

Second, a threshold check should be performed. Once an MNE group is above the threshold value, calculation of the GloBE Income, Adjusted Covered Taxes and Effective Tax Rate is performed.

In case ETR is above 15%, the calculation is aborted. Otherwise, we are continuing with the calculation of Substance based Carveout and Excess Profit. Different kinds of calculations on the jurisdiction level are performed considering elections and offset mechanism.

As a result of the overall calculation, we will have information about the ultimate parent entity, intermediate parent entity, and who is willing to apply IIR and pay for top-up tax.

Process Application

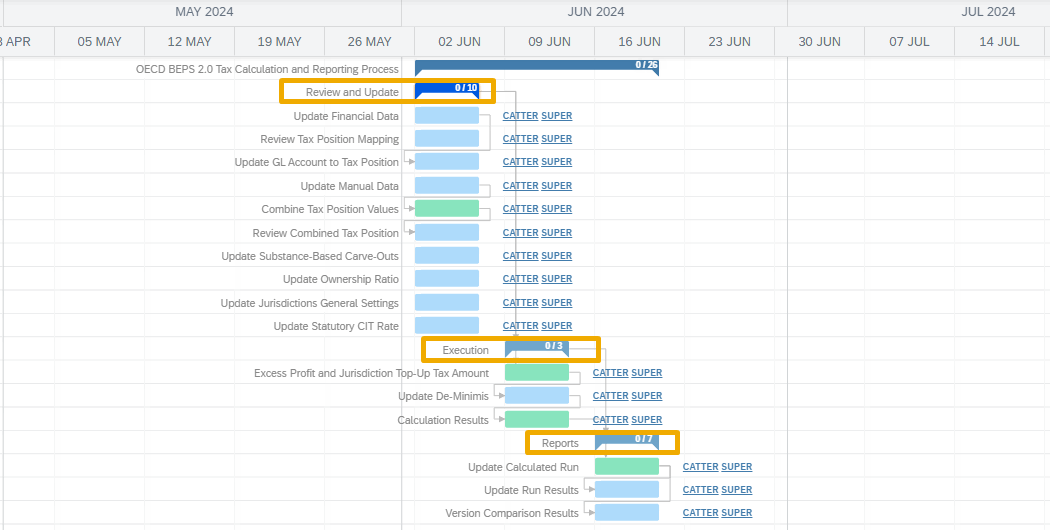

To track the flow of the OECD BEPS 2.0 Tax Calculation and Reporting, user should rely on application process screen and predefined template.

As you may see from the Screenshot below, Activities are divided into three node: Review and Update, Execution and Reports. Review and Update activities, according to the timeline schedule should be performed prior to execution function. Upon finalizing Review and update activities, overall calculation should be triggered by executing function. At the end, reporting part is available.

Due to the role-based screen, different users can access different parts of template based on the system role and organize activities under each node, according to their preferences and business needs. Hereby, predefined process look incorporates example showing dual control of the process activities, meaning that users from CATTER team are assigned to perform activity, whereas users assigned in SUPER team can review and approve or reject activity. This is important because of the four eyes principle. All activities and changes are restricted by time frame, meaning after due date expires, activity will be locked for editing and user will not be able to make any changes.

End user has as well possibility to open activities through native web screen by clicking Launch or to analyze it directly in the Microsoft Excel by clicking Launch in Excel. Regardless of the way and preferences, user will have live access to data base, meaning that changes will be reflected in Microsoft Excel and system as well.

Calculating the Top-Up Tax Amount

Goal of the OECD BEPS 2.0 Tax Calculation and Reporting sample content is performing calculation of the top-up tax amount based on retrieved data taking into accounts different thresholds and elections. In the end, end user will have comprehensive list of the reports containing overview of the different KPI’s.

Activities within the Review and Update node give end user possibility to review, amend and manage data which will be used in calculation, and which will trigger whole calculation. Therefore, user will be able to amend the data coming from the financial statements in the Update Financial Data by launching the query and expanding the Balance Sheet and/or Profit and Loss Hierarchy. End user has possibility to change the data in the leafs fields and the node fields will be automatically changed, due to the flatting hierarchy implemented. After saving the changes, overall calculation will be affected with amendments.

As overall calculation is done on the Tax Position level, end user has possibility to review Tax Position Mapping in the Review Tax Position Mapping query. After getting familiar with the mapping between Tax Position, Tax Position Node and Tax Position Top Node, possibility to affect the mapping is given in Update GL Account to Tax Position. As you can see from the Screenshot below, Fines and penalties are mapped to Policy Disallowed Expenses. In case mapping is appropriate, than 1 should be stated in the Active/Inactive Column. Otherwise, we can amend to 0, which stands for Inactive, and the mapping will be changed. As well there is possibility of adding new lines and perform new mapping between GL accounts and Tax Positions by choosing from the master data.

Except data coming from the financial statements, we have as well given possibility to upload/retrieve data from other sources in Update Manual Data. As you can see on the right Screenshot, end user is possible to make changes there as well.

Upon all those setting have been performed, by triggering Combine Tax Position Values all changes previously made will be collected and data will be consolidated to tax position regardless of the source. Results of the mapping together with the amounts assigned will be visible in the Review Combined Tax Position. After assigning values to the tax position, decision related to substance based carve out ratio, ownership structure and CIT rate should be made. Despite ratios are prescribed by OECD for ten-year period, we have given flexibility there as well.

Last, but not the least, are changes related to the company code. Namely in the Update Jurisdiction General Settings, election Excluded/Included entity should be made together with decisions if companies are active/inactive and number of employees. Therefore, end user should be able to anticipate if company falls into any of listed categories: Governmental Entities, International Organizations, Non-profit Organizations, Pension Funds, Investment Fund or Real Estate Investment Vehicle that is the UPE of the MNE Group. If that is the case, than for that company it should be stated 2 in Excluded Entities column and it will not be subject to the operative provisions of the GloBE Rules however its revenue is still taken into account for purposes of the consolidated revenue test.

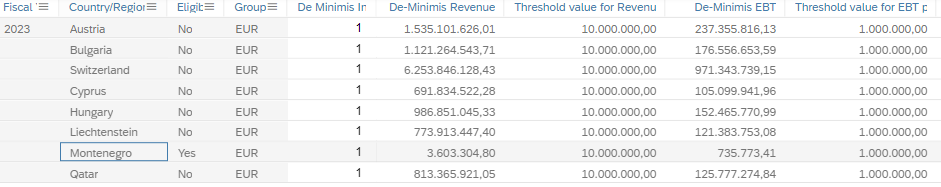

By triggering this executable function Excess Profit and Jurisdiction Top Up, all changes will be collected, and Results of the executable function written in Results model table over which we have editable query. This editable query gives end user possibility to check if jurisdiction is eligible to de minimis. De minimis exclusion applies for the companies with insignificant revenues below 10 mil EUR and EBT below 1 mil EUR. If both conditions are met, than those jurisdictions can go with De Minimis, which means they will pay their local taxes. In the system, by default it is set they will apply De Minimis in case they fulfill conditions.

Based on the picture below and organizational structure implemented, we can see that only Montenegro is Eligible for De Minimis and in the column De Minimis indicator it is stated by default 1. In case end user, from any reason they might have, do not want to go with De Minimis, they can simply switch to 0. Based on decision made in De Minimis we will recalculate everything and distribute top up tax amount in Calculation Results which is the last step prior the reporting part.

Conclusion

We came to the end of the second part of the blog post. We have covered logic behind very interested and popular topic.

Anyhow, in the upcoming blog post, that will be released in next couple of days, I will inform you how our solution is dealing with the versioning part and how we have visually presented results of the calculation.

Hope you all are excited, as I am.

Until next time,

Ana-Marija

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Business Trends

145 -

Business Trends

15 -

Event Information

35 -

Event Information

9 -

Expert Insights

8 -

Expert Insights

29 -

Life at SAP

48 -

Product Updates

521 -

Product Updates

63 -

Technology Updates

196 -

Technology Updates

10

- SAP Sustainability für Financial Services - Portfolio & Lösungen in Financial Management Blogs by SAP

- SAP Sustainability for Financial Services - Portfolio and Solutions in Financial Management Blogs by SAP

- Group Reporting Rule Based COI - TP calculation in Financial Management Q&A

- GRC Process Control: How CCM can be leveraged to monitor HANA Databases in Financial Management Q&A

- Manage dates-driven planning processes with SAP Analytics Cloud in Financial Management Blogs by SAP

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |