- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- Interest and Penalty Simulation and Recalculation ...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Interest Calculation

Tax authorities may have to calculate and post credit/debit interests on payables/receivables. SAP PSCD provides the Interest Calculation feature to support the requirement.

The calculation of interest is scheduled on a recurrent basis (yearly, monthly, weekly, and sometimes even daily) and interest documents are then posted (manually or in mass activity) according to the rules set in customizing.

This approach has two drawbacks:

- the number of generated interest documents can be quite high when receivables are due for some months/years and when the interest calculation takes place on a monthly/weekly basis. As a consequence, the account balance of a taxpayer is saturated with interest documents.

- the due interest amount is only correct at the time when the last interest calculation run is executed. Should a taxpayer pay a couple of days later, additional interest must be calculated on the two extra days.

As an alternative solution, It is possible in SAP PSCD to avoid the generation of the interest documents and have the estimation of the interest due displayed in:

- The account balance (transaction code FPL9)

- The business partner overview (transaction code FMCACOV)

- The taxpayer overview in SAP TRM (TPOV)

- The penalty and interest simulation report (transaction code FPI7)

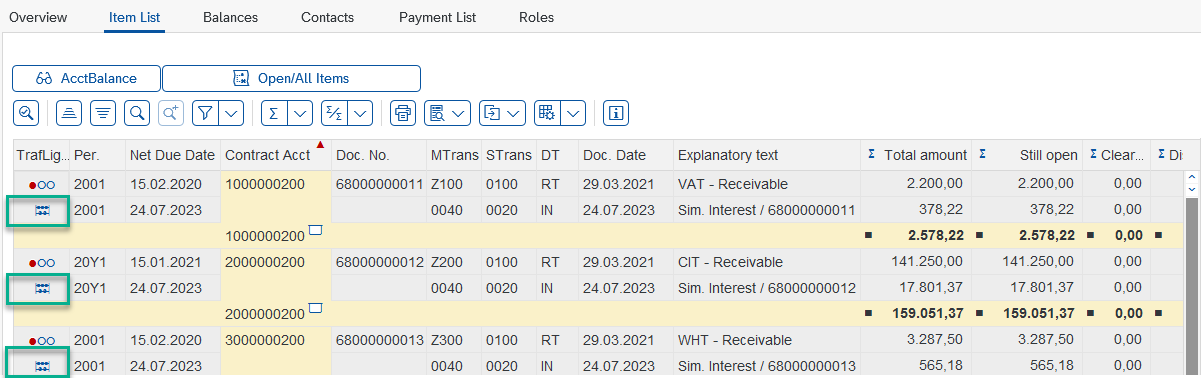

Displaying the estimated interest in the Business Partner Overview

Please note that the simulated interest is NOT a document, it's only an additional row in the balance display. The reference to the original document can be found in the field "Explanatory Text".

The simulation uses the current CPU date as a reference.

To use this functionality, it is required to activate two business functions in the SAP Swith Framework:

Then the function module FMCA_EVENT_1211_INT_SIMULATED must be set in event 1211 -Account Balance: Change Hit List and Totals.

The tax authority can execute the interest calculation in real mode once in a while, and have the general ledger accounting updated accordingly. The simulated interest documents only show the amounts of interest that have not been calculated and posted on the account yet.

The Penalty and Interest Simulation Report (transaction code FPI7) is pretty useful:

- This report simulates the interest and penalty per document on a business partner. Some further selection fields are available: contract account, contract object, period key, and form bundle number.

- The interest and penalty simulation can be calculated until a certain date in the future so that the exact due amount can be communicated to the taxpayer if he/she pays at a certain date

The report provides first a list of records on the open receivables.

Penalty and Interest Simulation Report - List of records

It also provides the following interest- and penalty-related details:

- Amount paid

- Amount not paid

- Interest posted

- Penalty posted

- Interest paid

- Penalty paid

- Simulated interest

- Due penalty

- Total interest

- Total penalty

- Total due

Penalty and Interest Simulation Report - Interest- and penalty-related details

Furthermore, it is possible to simulate the penalties in the report via the enhancement spot FKK_SIM_INT_PENALTIES in transaction code SE20.

Interest Recalculation (predated payments)

Let's assume now the situation below where a payment made beginning of January is found in clarification end of June, related to a receivable that was to be paid by mid-February, and for which penalty and interest charges have been calculated and posted.

Interest and Penalty Recalculation - Process Flow

The challenge is that the penalty and the interest charges must be re-assessed and possibly reversed.

To support this requirement, it's possible to use the Penalty and Interest Clarification Case (PICC). Initially provided to SAP TRM customers, it has been extended to SAP PSCD customers with SAP note 3078183 - PSCD-CC: 256910 Interest simulation without TRM prerequisite (PSCD)

Several SAP Objects are available:

- Package

- FKK_SIM_INT - Simulation and Recalculation of Interest

- Transactions

- FPI10 - Penalty and Interest Clarification Cases

- FPI10A - Penalty and Interest Case Run

- Events

- 0152 - P&I Clarification Case Settings I, to prohibit automatic processing for some steps

- 0153 - P&I Clarification Case Settings II for postprocessing, to enhance the automatic processing after the steps have been completed

- The possible steps are

- Reverse interest

- Reverse collection steps

- Reset clearings

- Reassess form bundles

- 1759 - Mass Activity: Penalty and Interest Clarification Cases - This is the main routine for the automatic processing of the clarification Cases

- Function Module

- FKK_PI_CLARIFICATION_EVENT_20

The purpose of function module FKK_PI_CLARIFICATION_EVENT_20 is to generate P&I clarification cases. The function module must be added as an installation-specific function module in event 0020 (transaction FQEVENTS).

Setting FKK_PI_CLARIFICATION_EVENT_20 as an installation-specific function module

The logic is the following: when a payment is made (clearing or payment on account), the system checks if penalty and interest charges have been posted after the value date of the payment. If that is the case, the system generates a P&I clarification case.

The P&I clarification case provides a framework to

- Reverse interest

- Reverse collection steps

- Reset clearings

- Reassess form bundles

Once a P&I clarification case has been created, it can be

- Process manually by an agent (transaction FPI10)

- Process manually by an administrator (transaction FPI10 - Administrator mode)

- Process in a mass activity (transaction FPI10A)

PICC Creation Process Flow

Let's now create an example and check the feature: let's assume that the corporate income tax return of a taxpayer has been assessed, with a receivable due on 15.01.2021.

CIT Assessment - Receivable is due - Initial view

Let's now run a dunning cycle that generates interest, dunning charges, and a dunning notice.

The application log of the dunning cycle shows the creation of the interest and the collection charges

The interest calculation has been triggered at the time of the dunning by collection strategies. It could have been triggered by the interest calculation mass activity.

The business partner overview is updated accordingly

Business Partner Overview after Dunning Cycle

Now let's make a payment with a value date of 13.01.2021, which is two days before the due date. In this example, we use the cash desk to process the incoming payment.

Processing the Payment in the Cash Desk

Please make sure to have the "Value Date'" field set as "Shown" in the field status group in the field Status Variant.

In transaction FPI10, the administrator mode shows the P&I Clarification Case.

PICC has been created

It's then now possible for the tax agent to process the Penalty and Interest Clarification Case and take action on the steps that must be reversed/recalculated/reassessed.

Processing the PICC Manually

And that is the end of this blog about Interest and Penalty Simulation and Recalculation (predated payments) in SAP TRM/PSCD.

- SAP Managed Tags:

- Public Sector,

- SAP Public Sector Collection and Disbursement

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Business Trends

145 -

Business Trends

15 -

Event Information

35 -

Event Information

9 -

Expert Insights

8 -

Expert Insights

29 -

Life at SAP

48 -

Product Updates

521 -

Product Updates

63 -

Technology Updates

196 -

Technology Updates

10

- Payment Batch Configurations SAP BCM - S4HANA in Financial Management Blogs by Members

- Treasury and Risk Management - Leading Digital Treasury in Financial Management Blogs by Members

- Handling Bank Statement Processes In SAP in Financial Management Blogs by Members

- IFRS16 – Lease standard SAP Solution through Real Estate Management in Financial Management Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |