- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by Members

- Retained Earnings Account

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Retained Earnings Account:

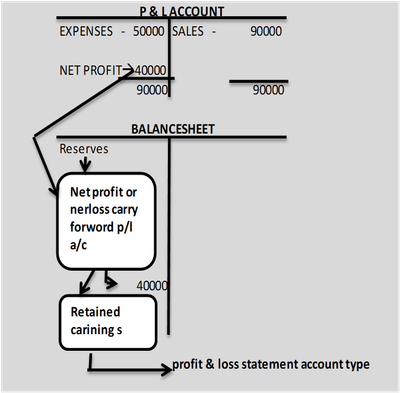

At the end of the fiscal year, We need to carry forward the balance of the p\L account to the retained earnings accounts( BS General Reserve Accounts).

The profit & loss statement account type it represents the retained earnings account.

The retained earnings account can also be called as net profit/net losses carry forward to be the part of the general reserves account.

The profit & loss statement account type can be defined similar to variant.

We can define more than one profit &loss statement account type per COA.

If we can define the more than one profit &loss statements account type for chart of account then we need to assign profit & loss statement account type in the G/L master for every profit &loss account.

If we define single profit &loss statement account type for COA , in this case all profit & loss accounts by default assign to the profit & loss statement account type.

Not required to assign manually in the G/L account.

The profit & loss account need to be defined for each COA wise.

Profit & loss statement account type can be defined maximum upto 2 digit code.

We can use more than one retained earnings GL account per Chart of Account if you are using the Account Approach to address the different Accounting Principles.

Examples:

X1 P&L statement Account Type for Common Accounts

X2 P&L statement Account Type for USGAP

X3 P&L statement Account Type for IFRSGAP

X4 P&L statement Account Type for IAS GAP

Note:

Not Required Multiple Retained earning accounts per Chart of Accounts if you are following Ledger Approach.

Why multiple retained earnings account required ?

We have two approaches to address the different accounting principle requirements

Approach1=======> Account Approach Approach2=========> Ledger Approach

Approach1=======> Account Approach:

We will open few additional GL accounts in addition to common GL accounts for specific to accounting principle wise for those areas need to treat differently

| IFRS | COMMON GL | USGAP |

| 25 GL accounts for specific to IFRS | 300 Common GL accounts | 22 GL accounts for specific to USGAP |

FS(Financial Statement) for IFRS =IFRS specific GL accounts + Common GL accounts

FS(Financial Statement) for USGAP =USGAP specific GL accounts + Common GL accounts

In Account approach , We will maintain more than one Retained earnings Accounts

In the above example ,

X1 ==> Retained earning accounts -common ==> Assigned to all common P&L GL accounts

X2 ==> Retained earning accounts -IFRS Accounts ==> Assigned to IFRS specific GL accounts

X3 ==> Retained earning accounts -USGAP Accounts ==> Assigned to USGAP specific GL accounts

Approach2=========> Ledger Approach:

Each Ledger represents the one set of Books

Ledger ==>L2===========> USGAP

Ledger ==>L1===========> IFRS

In the ledger approach , not required to maintain additional GL accounts for specific to accounting principle wise

Hence not required multiple retained earnings GL accounts ====> One retained earnings GL account is sufficient

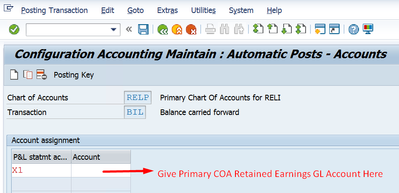

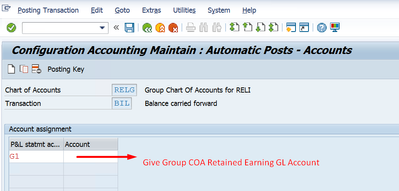

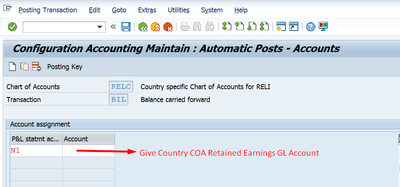

Create Retained Earnings Account:

Need to be Defined P&L statement account type per Each Chart of Account wise

Operational COA(RELP)

X1 P&L Statement A/ Type for Op COA ( RELP )

Grp COA (RELG)

G1 P&L Statement A/ Type for Grp COA ( RELG )

Country COA (RELC)

N1 P&L Statement A/ Type for Country COA ( RELC )

SPRO -> SAP Reference IMG -> Financial Accounting -> General Ledger Accounting -> Master Data -> G/L Accounts -> Preparations -> Define Retained Earnings Accounts (OB53)

Data was Saved in the Table of T030

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Assign Missing Authorization Objects

1 -

Bank Reconciliation Accounts

1 -

CLM

1 -

FIN-CS

1 -

FINANCE

2 -

GRIR

1 -

Group Reporting

1 -

Invoice Printing Lock

2 -

Mapping of Catalog & Group

1 -

Mapping with User Profile

1 -

matching concept and accounting treatment

1 -

Oil & Gas

1 -

Payment Batch Configurations

1 -

Public Cloud

1 -

Revenue Recognition

1 -

review booklet

1 -

SAP BRIM

1 -

SAP CI

1 -

SAP RAR

1 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP Treasury Hedge Accounting

1 -

Z Catalog

1 -

Z Group

1

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- DOCUMENT NUMBER GENERATION USING BAPI_ACC_DOCUMENT_POST. in Financial Management Q&A

- Period Based Encumbrance Tracking in PSM-FM in Financial Management Blogs by Members

- GRC Tuesdays: How To Calculate the ROI of an Integrated Risk and Control Platform to Justify Investment in Financial Management Blogs by SAP