- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- PY-CA :why no limit check for Quebec Tax Calculati...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

PY-CA :why no limit check for Quebec Tax Calculation in SAP

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 02-06-2022 9:01 AM

Hi Experts,

i found that there are differences between SAP system and Manual excel for Quebec tax calculation.

here is the formula published by QRA in document TP-1015.F-V(2022-01) (Page-11)

the problem is in SAP there is no "H", i don't know why.

I = Annual taxable income = P × (G – F – H) – J – J1 If the result is negative, enter 0.

where

P = Number of pay periods in the year

G = Gross remuneration subject to source deductions of income tax for the pay period. Do not include gratuities, retroactive pay or similar lump-sum payments

F = Total of the following amounts for the pay period

• the contribution to an RPP;

• the contribution to an RRSP;

• the contribution to a VRSP or to a PRPP; ......

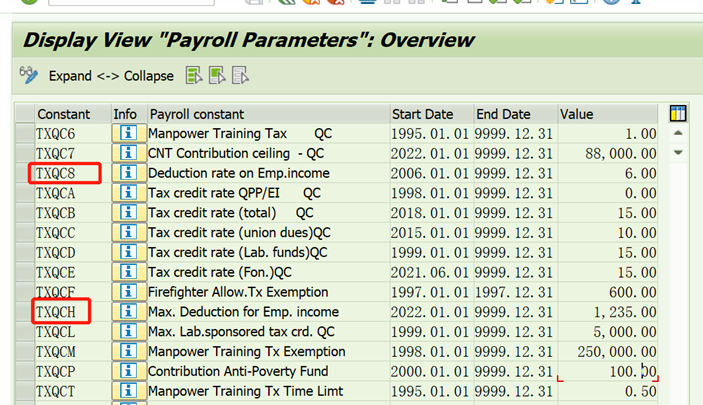

H = Deduction for employment income

= (0.06 × D), up to a maximum of $1,235 / P

D = Gross salary or wages subject to source deductions of income tax for the pay period. Do not include gratuities, retroactive pay or similar lump-sum payments. P = Number of pay periods in the year

......

the following picture is the one i searched online, obviously H exists

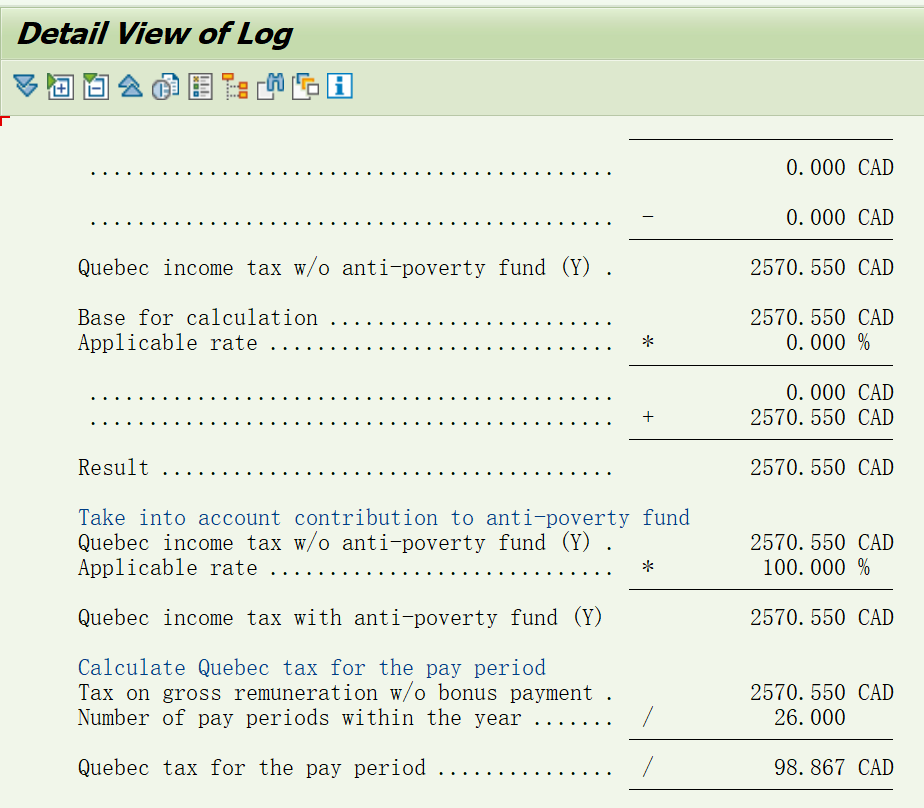

while in my system, there is no H existing

The constants TXQC8 and TXQCH are OK in V_T511K

i don't know how to trigger this....

Federal Tax is align with CRA but Quebec is different from the result from QRA because of the missing of this function.

Could anyone help me with this?

Thanks in Advance

QRA result is 91.74

H: =Min of 1280*6%=76.8 and 1235/26=47.5, so H=47.5

(1280-47.5)*26=32045 32045*15%=4806.75 4806.75-16143*15%=2385.3 2385.3/26=91.74

SAP result is 98.87

1280*26=33280 33280*15%=4992 4992-16143*15%=2570.55 2570.55/26=98.87

- SAP Managed Tags:

- HCM Payroll

Accepted Solutions (0)

Answers (3)

Answers (3)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Thank you very much Michael, it's ok now

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

You just need to set Cumulation 65 on wage types. I would start by setting all wage types that are accumulated in /152 (cumulation 52) to also accumulate in /165.

I hope this is helpful.

Serge

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

Do you have anything in /165 ? This is what triggers the calculation.

Regards,

Serge

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- How to check the calculation for "Actual Cost Rate Calculation - Cost Centers (KSII)"? in Enterprise Resource Planning Q&A

- TCODE CO43 - Overhead Calculation not displaying in Enterprise Resource Planning Q&A

- Purchase Order Accrual in S/4HANA - Part 2 in Enterprise Resource Planning Blogs by Members

- Service with Advanced Execution and Fixed Price Billing in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 104 | |

| 12 | |

| 11 | |

| 6 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.