- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- VAT Changes as of January 1st, 2024 in Switzerland

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Employee

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-02-2023

4:21 PM

The objective of this blog post is to give you a guidance how to proceed with the setup of the SAP Business One for the existing customers in order to reflect the upcoming legislation changes in the system.

The changes in VAT rates follow a vote on September 25, 2022, that accepted an amendment to the AHV Act and the federal decree on the supplementary financing of the AHV.

If we compare current status with the expected, it looks like this:

It can be assumed that the Tax Authorities approach will be identical to the VAT changes from January 1st, 2018. Special attention must be paid to applying the correct tax rate (old / new) when issuing invoices in the year 2023 and if these invoices are partially or fully relevant to the year 2024. Such an example could be invoice partial payment, invoice down payment, invoices for periodic services, but conversely also to subsequent pay reductions and returns received in 2024, which relate to the 2023 service period.

Tax Codes

In order to fulfill the tax authorities requirement, you need to perform these steps in the system:

1. New Temporary Tax Codes

During the transition phase of the tax increase, the situation will arise where services for 2024 will already be invoiced in 2023. It will also happen that services provided in 2023 will be offset in 2024. To do this, temporary tax codes must be added to the system as follows:

Add temporary tax codes to the “Tax Groups – Setup” table

Path: Administration -> Setup -> Financials -> Tax -> Tax Groups

Each temporary tax code is a copy of its currently valid tax code. The difference is in the “Tax Definition – Setup”.

List of Codes for which the temporary codes should be added (this setup might differ based on business needs):

Add temporary tax codes to the “Tax Groups – Setup” table. The setup of temporary codes is a duplicate of the original codes. The tax definition is different. Please, follow the instructions from the text below.

2. Temporary Tax Codes Definition

In the transition phase of the tax increase, the situation will work like this: In the year 2023 services for 2024 will already be invoiced. It will also happen that services provided in 2023 will be charged in 2024. To do this, temporary control codes must be opened as follows:

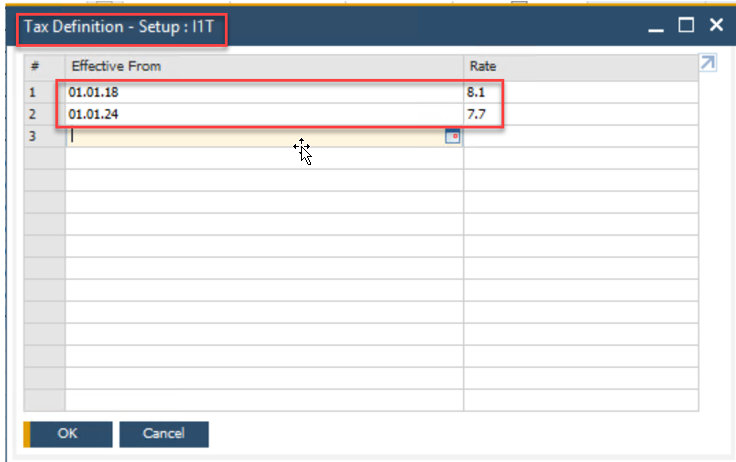

For example, in case of Code I1 (Vorsteuer Import Dienstleistungen) with currently valid tax rate 7.7%, you need to add a temporary tax code, e.g. I1T and setup the definition in “Tax Definition – Setup”

Path: Administration -> Setup -> Financials -> Tax -> Tax Groups (Click on Tax Definition button for a particular I1T temporary tax code added to the Tax Groups – Setup table.)

Example of the definition setup for such a temporary tax code where the tax rate will change from 7,7% to 8.1% as of January 1st, 2024.

Example of the definition setup for such a temporary tax code where tax rate will change from 2.5% to 2.6% as of January 1st, 2024.

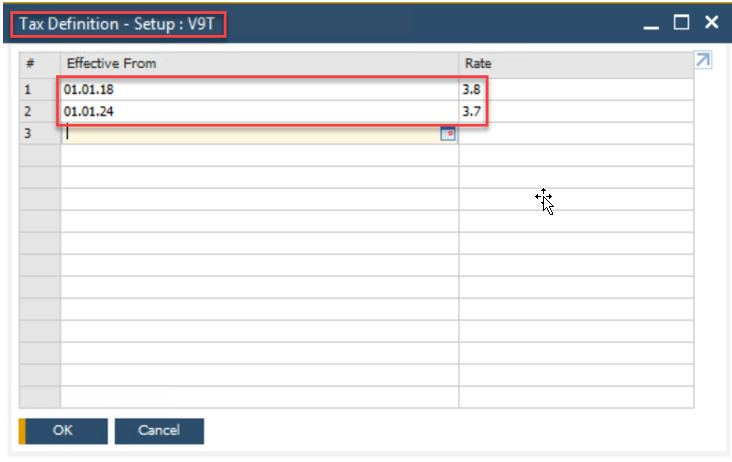

Example of the definition setup for such a temporary tax code where tax rate will change from 3.7% to 3.8% as of January 1st, 2024.

The original code is already defined. Temporary codes can already exist in your databases following the legal changes from the year 2018. In such a case it is possible re-activate them and change the definition for the actual VAT Rate increase.

The reversal of the tax rates means that for the document date from 2023 the new VAT rate 8.1% will apply for services that will be provided in 2024 and for the document date from 2024 and the service provided in 2023 the VAT rate relevant for the year 2023 (7,7%) will apply.

3. Original Tax Codes Definition

Changes are required in case of these Tax Codes:

I1, V1, V2, V3, V5, A1, E1 - please, follow the setup according to the Screenshot No.1

V6, V8, A2, E2 - please, follow the setup according to the Screenshot No.2

V9 - please, follow the setup according to the Screenshot No.3

Path: Administration -> Setup -> Financials -> Tax -> Tax Groups (Click on Tax Definition button for a particular Tax Code)

Screenshot No.1

Screenshot No.2

Screenshot No.3

4. Tax Declaration Boxes and BAS Code Definition Adjustment

The following must be taken into account: The decisive factor for how the individual services are to be declared in the billing is the time or period in which the service was provided. Services provided until December 31, 2023 are subject to the previous tax rates. Services provided from January 1, 2024 are subject to the new tax rates. Since the tax rates applicable until the end of 2017 are no longer shown in the available statements, sales from services before January 1, 2018 must be reported to the Tax Authorities in writing outside of the statement.

VAT Form as of January 1st, 2024

Currently there is no separate VAT Form for the transition period from July 1st, 2023 to December 31st, 2023.

https://www.estv.admin.ch/estv/de/home/mehrwertsteuer/mwst-abrechnen/mwst-formulare.html

https://www.estv.admin.ch/dam/estv/de/dokumente/mwst/formulare/abrechnung-2024/4470-eff.pdf.download...

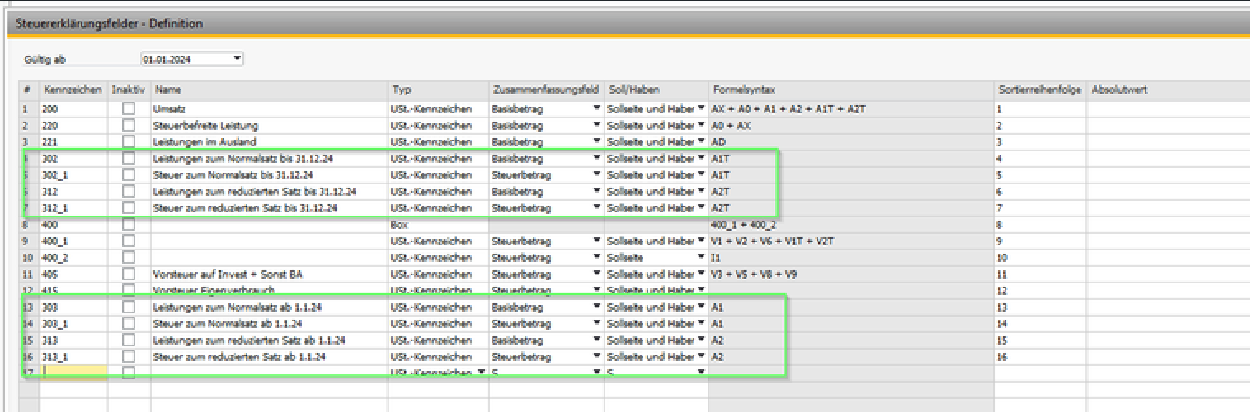

In SAP Business One, the boxes in Tax Declaration Boxes – Setup must be updated according to the VAT Form 2024 changes:

Open the existing definition.

Path: Administration -> Setup -> Financials -> Tax -> Tax Declaration Boxes

These are examples how the "Tax Declaration Boxes - Setup" should be adjusted from the 3rd quarter of 2023 and from January 1st, 2024. This setup might differ based on business needs.

Path: Administration -> Setup -> Financials -> Tax -> Tax Declaration Boxes

From the 3rd quarter of 2023

As of January 1st, 2024

5. Invoicing - recommendations

Special attention must be paid to applying the correct tax rate (old/new) when issuing invoices during 2023 (transition period) in order to ensure correct processing of VAT.

The tax rate determination is dependent on the date of the service provisioning. On A/R Invoice you have to split it into two lines, one is for the service until 31.12.2023 (A1) and second is for service provided from 1.1.2024 (A1T) for invoices in 2023. In 2024 it will change to until 31.12.20123 to A1T, and from 1.1.2024 to A1.

The date of the tax declaration is the document date of invoice or any down payment. Deliveries and services without invoice will be declared on the date of payment.

On A/R Invoice the items should be split.

In the print layout both tax codes should be printed.

For the new companies created in the SAP Business One in 2024 the updated tax rates and adjusted Tax Declaration Boxes and BAS Code Definition will be available with the SP2402 release.

In this blog post you could learn how to proceed with the setup of Tax Codes, Tax Declaration Boxes plus learn about invoicing during the transition period while the new VAT Tax rates will be valid as of January 1st, 2024.

I would like to invite you to provide feedback or ask clarifying questions regarding the topic in the comment section.

The tax authorities in Switzerland have announced that as of January 1, 2024, the following VAT (value-added tax) rates will apply in Switzerland:

- Standard rate: 8.1%

- Reduced rate: 2.6%

- Special rate for accommodation: 3.8%

The changes in VAT rates follow a vote on September 25, 2022, that accepted an amendment to the AHV Act and the federal decree on the supplementary financing of the AHV.

If we compare current status with the expected, it looks like this:

| Standard Rate | Reduced Rate | Special Rate for Accommodation Services | |

| Current VAT Rates (as of 1.1.2018) | 7.7% | 2.5% | 3.7% |

| Applicable VAT Rates as of January 1st, 2024 | 8.1% | 2,6% | 3.8% |

It can be assumed that the Tax Authorities approach will be identical to the VAT changes from January 1st, 2018. Special attention must be paid to applying the correct tax rate (old / new) when issuing invoices in the year 2023 and if these invoices are partially or fully relevant to the year 2024. Such an example could be invoice partial payment, invoice down payment, invoices for periodic services, but conversely also to subsequent pay reductions and returns received in 2024, which relate to the 2023 service period.

Tax Codes

In order to fulfill the tax authorities requirement, you need to perform these steps in the system:

- Add new temporary tax code for each currently valid tax codes where since 1.1.2024 a new tax rate should apply

- Add definition for each temporary tax code added to the system

- Change the definition of original tax codes

- Update VAT Declaration Boxes and BAS Code Definition

- Invoicing - recommendations

1. New Temporary Tax Codes

During the transition phase of the tax increase, the situation will arise where services for 2024 will already be invoiced in 2023. It will also happen that services provided in 2023 will be offset in 2024. To do this, temporary tax codes must be added to the system as follows:

Add temporary tax codes to the “Tax Groups – Setup” table

Path: Administration -> Setup -> Financials -> Tax -> Tax Groups

Each temporary tax code is a copy of its currently valid tax code. The difference is in the “Tax Definition – Setup”.

List of Codes for which the temporary codes should be added (this setup might differ based on business needs):

| Code | Category | Name | Temporary code | |

| I1 | Input Tax | Vorsteuer Import Dienstleistungen | -> | I1T |

| V1 | Input Tax | Vorsteuer Materialaufwand | -> | V1T |

| V2 | Input Tax | Vorsteuer Dienstleistungen | -> | V2T |

| V3 | Input Tax | Vorsteuer Invest./Betriebsaufwendung | -> | V3T |

| V5 | Input Tax | Vorsteuer Betriebsaufwendung 50 % Abzug | -> | V5T |

| V6 | Input Tax | Vorsteuer Materialaufwand | -> | V6T |

| V8 | Input Tax | Vorsteuer Invest./Betriebsaufwand | -> | V8T |

| V9 | Input Tax | Vorsteur Sondersatz Beherbergungsaufwand | -> | V9T |

| A1 | Output Tax | Mehrwertsteuer 7,7% | -> | A1T |

| A2 | Output Tax | Mehrwertsteuer 2,5% | -> | A2T |

| E1 | Output Tax | Mehrwertsteuer 7,7% Eigenverbrauch | -> | E1T |

| E2 | Output Tax | Mehrwertsteuer 2,5% Eigenverbrauch | -> | E2T |

Add temporary tax codes to the “Tax Groups – Setup” table. The setup of temporary codes is a duplicate of the original codes. The tax definition is different. Please, follow the instructions from the text below.

2. Temporary Tax Codes Definition

In the transition phase of the tax increase, the situation will work like this: In the year 2023 services for 2024 will already be invoiced. It will also happen that services provided in 2023 will be charged in 2024. To do this, temporary control codes must be opened as follows:

For example, in case of Code I1 (Vorsteuer Import Dienstleistungen) with currently valid tax rate 7.7%, you need to add a temporary tax code, e.g. I1T and setup the definition in “Tax Definition – Setup”

Path: Administration -> Setup -> Financials -> Tax -> Tax Groups (Click on Tax Definition button for a particular I1T temporary tax code added to the Tax Groups – Setup table.)

Example of the definition setup for such a temporary tax code where the tax rate will change from 7,7% to 8.1% as of January 1st, 2024.

Tax Definition Setup for I1T

Example of the definition setup for such a temporary tax code where tax rate will change from 2.5% to 2.6% as of January 1st, 2024.

Tax Definition Setup for V6T

Example of the definition setup for such a temporary tax code where tax rate will change from 3.7% to 3.8% as of January 1st, 2024.

Tax Definition Setup for V9T

The original code is already defined. Temporary codes can already exist in your databases following the legal changes from the year 2018. In such a case it is possible re-activate them and change the definition for the actual VAT Rate increase.

The reversal of the tax rates means that for the document date from 2023 the new VAT rate 8.1% will apply for services that will be provided in 2024 and for the document date from 2024 and the service provided in 2023 the VAT rate relevant for the year 2023 (7,7%) will apply.

3. Original Tax Codes Definition

Changes are required in case of these Tax Codes:

I1, V1, V2, V3, V5, A1, E1 - please, follow the setup according to the Screenshot No.1

V6, V8, A2, E2 - please, follow the setup according to the Screenshot No.2

V9 - please, follow the setup according to the Screenshot No.3

Path: Administration -> Setup -> Financials -> Tax -> Tax Groups (Click on Tax Definition button for a particular Tax Code)

Screenshot No.1

Screenshot No.2

Screenshot No.3

4. Tax Declaration Boxes and BAS Code Definition Adjustment

The following must be taken into account: The decisive factor for how the individual services are to be declared in the billing is the time or period in which the service was provided. Services provided until December 31, 2023 are subject to the previous tax rates. Services provided from January 1, 2024 are subject to the new tax rates. Since the tax rates applicable until the end of 2017 are no longer shown in the available statements, sales from services before January 1, 2018 must be reported to the Tax Authorities in writing outside of the statement.

VAT Form as of January 1st, 2024

Currently there is no separate VAT Form for the transition period from July 1st, 2023 to December 31st, 2023.

https://www.estv.admin.ch/estv/de/home/mehrwertsteuer/mwst-abrechnen/mwst-formulare.html

https://www.estv.admin.ch/dam/estv/de/dokumente/mwst/formulare/abrechnung-2024/4470-eff.pdf.download...

In SAP Business One, the boxes in Tax Declaration Boxes – Setup must be updated according to the VAT Form 2024 changes:

Open the existing definition.

Path: Administration -> Setup -> Financials -> Tax -> Tax Declaration Boxes

These are examples how the "Tax Declaration Boxes - Setup" should be adjusted from the 3rd quarter of 2023 and from January 1st, 2024. This setup might differ based on business needs.

Path: Administration -> Setup -> Financials -> Tax -> Tax Declaration Boxes

From the 3rd quarter of 2023

As of January 1st, 2024

5. Invoicing - recommendations

Special attention must be paid to applying the correct tax rate (old/new) when issuing invoices during 2023 (transition period) in order to ensure correct processing of VAT.

The tax rate determination is dependent on the date of the service provisioning. On A/R Invoice you have to split it into two lines, one is for the service until 31.12.2023 (A1) and second is for service provided from 1.1.2024 (A1T) for invoices in 2023. In 2024 it will change to until 31.12.20123 to A1T, and from 1.1.2024 to A1.

The date of the tax declaration is the document date of invoice or any down payment. Deliveries and services without invoice will be declared on the date of payment.

On A/R Invoice the items should be split.

A/R Invoice

In the print layout both tax codes should be printed.

Print layout

For the new companies created in the SAP Business One in 2024 the updated tax rates and adjusted Tax Declaration Boxes and BAS Code Definition will be available with the SP2402 release.

In this blog post you could learn how to proceed with the setup of Tax Codes, Tax Declaration Boxes plus learn about invoicing during the transition period while the new VAT Tax rates will be valid as of January 1st, 2024.

I would like to invite you to provide feedback or ask clarifying questions regarding the topic in the comment section.

- SAP Managed Tags:

- SAP Business One,

- SAP Business One, version for SAP HANA,

- FIN (Finance)

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

159 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

219 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- A direct consumption PO with Account Assignment category K in Enterprise Resource Planning Q&A

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- Revolutionizing Taxation: Navigating VAT in the Digital Age (ViDA) in Enterprise Resource Planning Blogs by SAP

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Has the template file of the Migration Object "Supplier" changed? in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |