- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Value of Stock (BSX) in Goods Receipt for Purchase...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-26-2023

9:17 PM

You would like to understand the value posted to the Stock Account (BSX) on Goods received for a Purchase Order when the stock was negative before posting.

First of all, let’s take into account the concept of negative stocks:

Negative stocks are allowed when the goods issue needs to be done urgently. Just due to organizational reasons goods issues are entered before the corresponding goods receipts.

Once the goods receipts have been posted, the book inventory balance must again correspond to the physical stock, that is, the book inventory balance may no longer be negative.

Negative stocks are always a sign that physical movements must be entered into the system at a later stage.

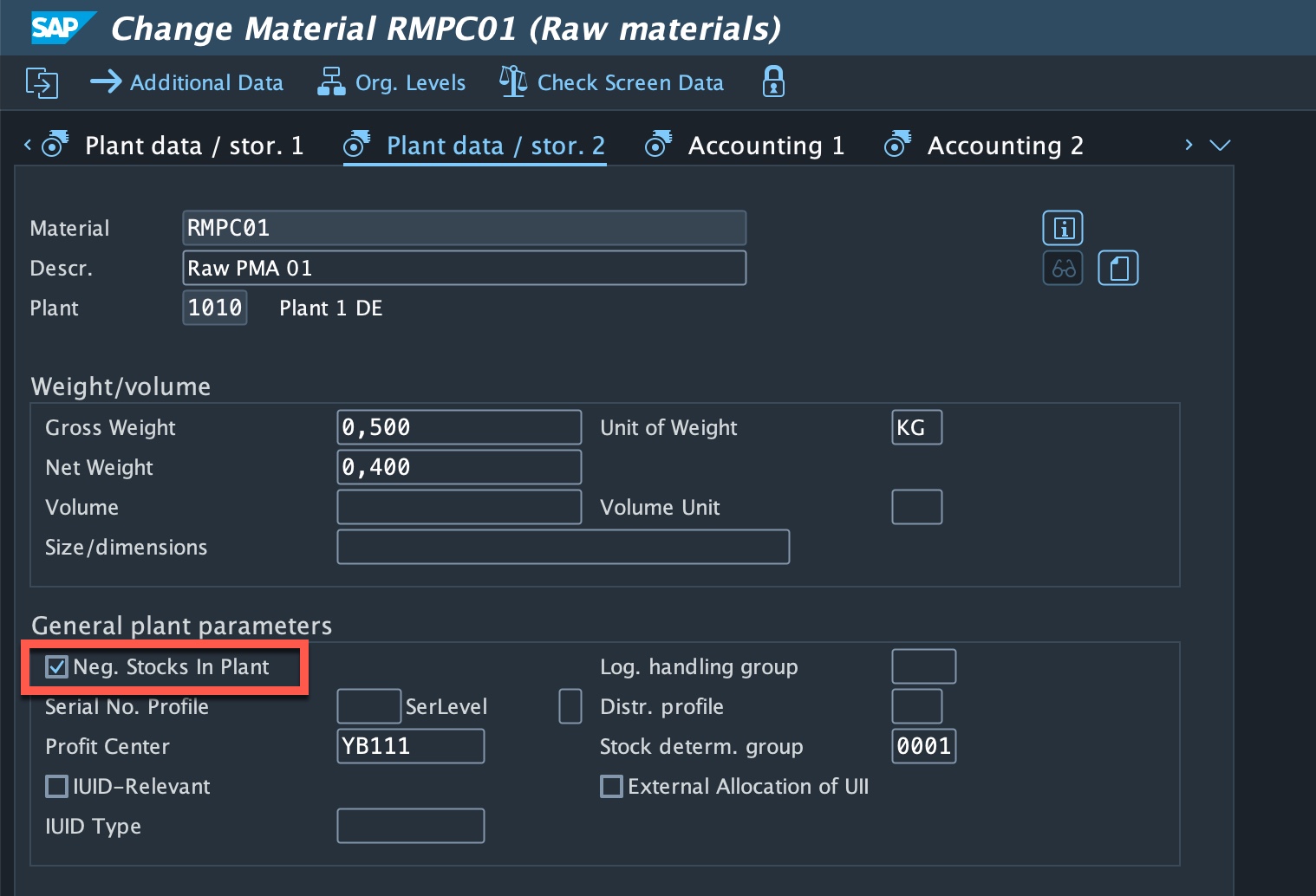

So that negative stocks are allowed, the 'Negative stocks' indicator should be marked into the material master data via MM01/MM02 transactions on the General Plant Data 2 view at the ‘General Plant Parameters’ screen.

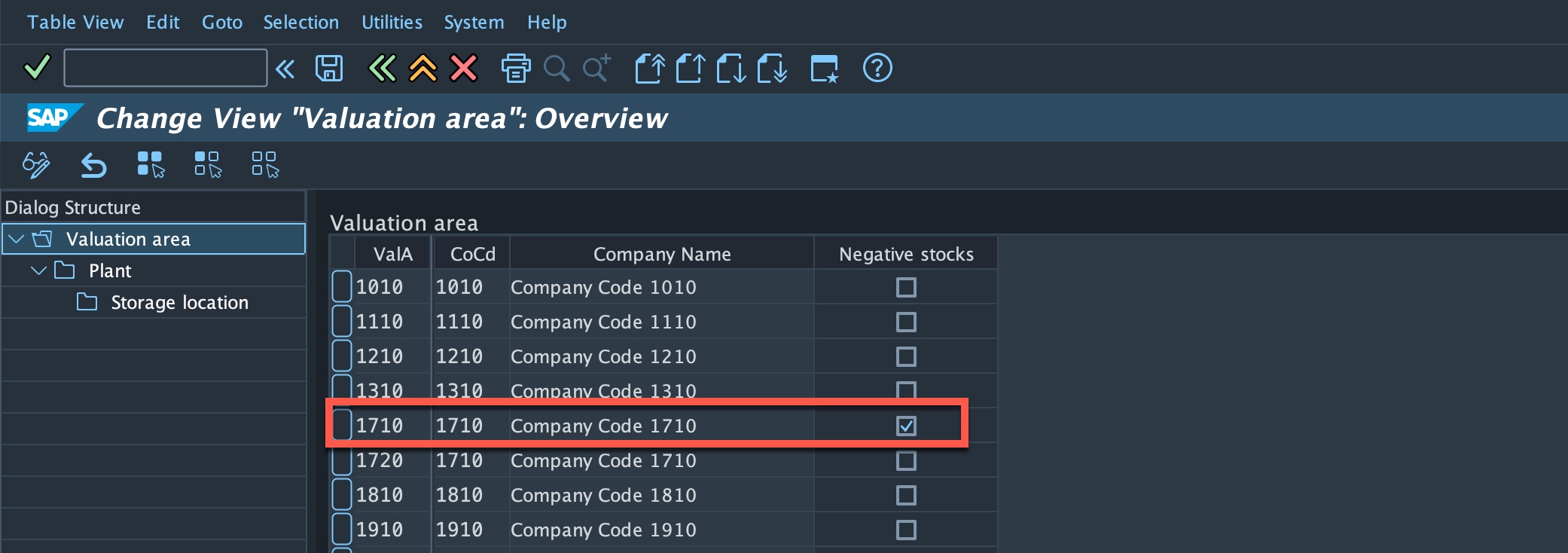

You have also to allow negative stocks by Plant. Trx.: OMJ1

Example: Goods Receipt Valuation when allowing negative stocks

Imagine that you are notified you have negative stocks in MMBE transaction and a corresponding negative value in MM03.

For example, you have -10 kg valuated at -700 USD (Moving Average Price of 140 USD/kg)

It's created a Purchase Order in the ME21N transaction for 20 kg.

After that, it's posted a Goods Receipt for the Purchase Order in MIGO transaction for 20 kg.

Checked the stock position after posting the GR in the MMBE transaction.

Goods receipt was done by 20 kg. So we have -10 kg + 20 kg = 10 kg.

Calculating the GR value (WRX)

Data (for example):

PO qty = 20 kg

PO Net price: 150 USD

PO price unit: 1 kg

GR qty: 20 kg

Formulas:

PO Net Value = PO qty x (PO Net price / PO price unit)

GR value = GR qty x (PO net value / PO qty)

Calculation:

PO Net Value = PO qty x (PO Net price / PO price unit)

PO Net Value = 20 kg x (150 USD / 1 kg) = 1500 USD.

GR value = GR qty x (PO net value / PO qty)

GR value = 20 kg x (1500 USD / 20 kg) = 1500 USD.

Calculating the stock account value

Data (for example):

-10 kg valuated at -700 USD (Moving Average Price of 140 USD/kg)

Process:

The first 10 kg in the reception will clear the negative stock. After receiving the first 10 kg, the stock will be zero. Since the stock will be zero, the value needs to be cleared also. The first 10 kg are valuated at 700 USD in order to clear the stock value.

Then, the remaining 10 kg are valuated according to the value given externally by the purchase order:

10 kg x 1500 USD / 20kg = 750 USD.

The total value posted to stock is:

BSX = 700 USD + 750 USD = 1450 USD.

Calculating the price difference value

PRD = WRX - BSX

PRD = 1500 USD - 1450 USD = 50 USD.

Now Check the FI document via ME23N (PO history), MB03 (via material document) or in the FB03 directly.

With this example above you can see that the stock account would be debited on 1450 USD, the clearing account would be credited on 1500 USD and, as a consequence, the price difference account would be debited on 50 USD.

Related SAP Notes:

2574448 - Stock posting (BSX) valuation - Guided Answers - SAP ERP & SAP S/4 HANA

212286 - Overview Note: Valuation for goods movements

518485 - FAQ: Valuation of goods movements

518368 - FAQ: Valuation for purchase order

Thank you for your time, I hope this post is helpful.

First of all, let’s take into account the concept of negative stocks:

Negative stocks are allowed when the goods issue needs to be done urgently. Just due to organizational reasons goods issues are entered before the corresponding goods receipts.

Once the goods receipts have been posted, the book inventory balance must again correspond to the physical stock, that is, the book inventory balance may no longer be negative.

Negative stocks are always a sign that physical movements must be entered into the system at a later stage.

So that negative stocks are allowed, the 'Negative stocks' indicator should be marked into the material master data via MM01/MM02 transactions on the General Plant Data 2 view at the ‘General Plant Parameters’ screen.

You have also to allow negative stocks by Plant. Trx.: OMJ1

Example: Goods Receipt Valuation when allowing negative stocks

Imagine that you are notified you have negative stocks in MMBE transaction and a corresponding negative value in MM03.

For example, you have -10 kg valuated at -700 USD (Moving Average Price of 140 USD/kg)

It's created a Purchase Order in the ME21N transaction for 20 kg.

After that, it's posted a Goods Receipt for the Purchase Order in MIGO transaction for 20 kg.

Checked the stock position after posting the GR in the MMBE transaction.

Goods receipt was done by 20 kg. So we have -10 kg + 20 kg = 10 kg.

Calculating the GR value (WRX)

Data (for example):

PO qty = 20 kg

PO Net price: 150 USD

PO price unit: 1 kg

GR qty: 20 kg

Formulas:

PO Net Value = PO qty x (PO Net price / PO price unit)

GR value = GR qty x (PO net value / PO qty)

Calculation:

PO Net Value = PO qty x (PO Net price / PO price unit)

PO Net Value = 20 kg x (150 USD / 1 kg) = 1500 USD.

GR value = GR qty x (PO net value / PO qty)

GR value = 20 kg x (1500 USD / 20 kg) = 1500 USD.

Calculating the stock account value

Data (for example):

-10 kg valuated at -700 USD (Moving Average Price of 140 USD/kg)

Process:

The first 10 kg in the reception will clear the negative stock. After receiving the first 10 kg, the stock will be zero. Since the stock will be zero, the value needs to be cleared also. The first 10 kg are valuated at 700 USD in order to clear the stock value.

Then, the remaining 10 kg are valuated according to the value given externally by the purchase order:

10 kg x 1500 USD / 20kg = 750 USD.

The total value posted to stock is:

BSX = 700 USD + 750 USD = 1450 USD.

Calculating the price difference value

PRD = WRX - BSX

PRD = 1500 USD - 1450 USD = 50 USD.

Now Check the FI document via ME23N (PO history), MB03 (via material document) or in the FB03 directly.

With this example above you can see that the stock account would be debited on 1450 USD, the clearing account would be credited on 1500 USD and, as a consequence, the price difference account would be debited on 50 USD.

Related SAP Notes:

2574448 - Stock posting (BSX) valuation - Guided Answers - SAP ERP & SAP S/4 HANA

212286 - Overview Note: Valuation for goods movements

518485 - FAQ: Valuation of goods movements

518368 - FAQ: Valuation for purchase order

Thank you for your time, I hope this post is helpful.

- SAP Managed Tags:

- SAP ERP,

- SAP S/4HANA

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

159 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

219 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- SAP S4HANA Cloud Public Edition Logistics FAQ in Enterprise Resource Planning Blogs by SAP

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Output Type SPED trigger Inbound Delivery after PGI for Inter-Company STO's Outbound delivery in Enterprise Resource Planning Blogs by Members

- Manage Workflows For Supplier Invoices - if certain amount is reached in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |