- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- QR-Bill in SAP S/4HANA Cloud

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-18-2020

7:05 PM

The QR-bill is replacing the existing multiplicity of payment slips in Switzerland and so is helping to increase efficiency and simplify payment traffic, at the same time offering a way of dealing with the challenges presented by digitalization and regulation. The new bills contain all the payment information in a QR code and can simply be scanned digitally.

The QR-bill replaces the current orange and red Swiss ISR (Inpayment Slip with Reference Number) starting on June 30, 2020.

This blog post helps you understand the individual functionalities and solutions regarding the QR-bill. To help you understand the QR-bill solution, this blog is divided into two parts:

Enabling QR-Bill Functionality

QR-Bill Reference

QR-bill can be in three different versions:

- QR-IBAN with QR reference

The QR-IBAN is comparable to the International Bank Account Number (IBAN) that identifies the supplier's international bank account number that is used during a payment transaction. The QR-IBAN contains the QR-IID (bank identification) in positions 5-9, using a number range from 30000 through 31999. QR-IBAN must be used for payments with a structured reference. The formal structure of this IBAN corresponds to the rules defined in ISO 13616.

The QR reference type is a 27-digit reference. This reference type follows the same rules as the former ISR reference. Position 27 contains a check digit according to modulo 10 recursive. It can be used with a QR-IBAN (IID 30000-31999) only.

- Standard IBAN without a reference

If you choose this reference type, no reference will be created. You can use this reference type with a standard IBAN, not with a QR-IBAN.

- Standard IBAN with ISO creditor reference

The ISO creditor reference type is a maximum 25-digit reference generated according to ISO 11649. The reference starts with 'RF', then followed by 2 check digits, and then maximum 21 characters - altogether maximum 25 characters. You can use this reference type with a standard IBAN, not with a QR-IBAN. ISO 11649 reference can be used internationally.

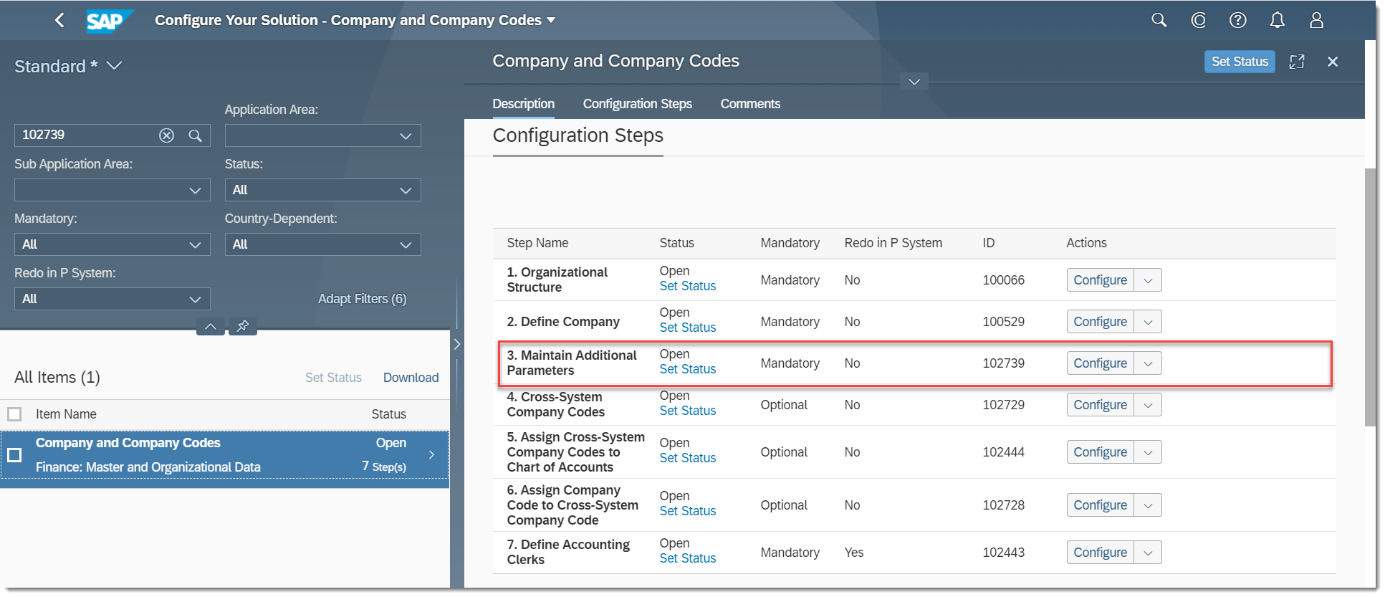

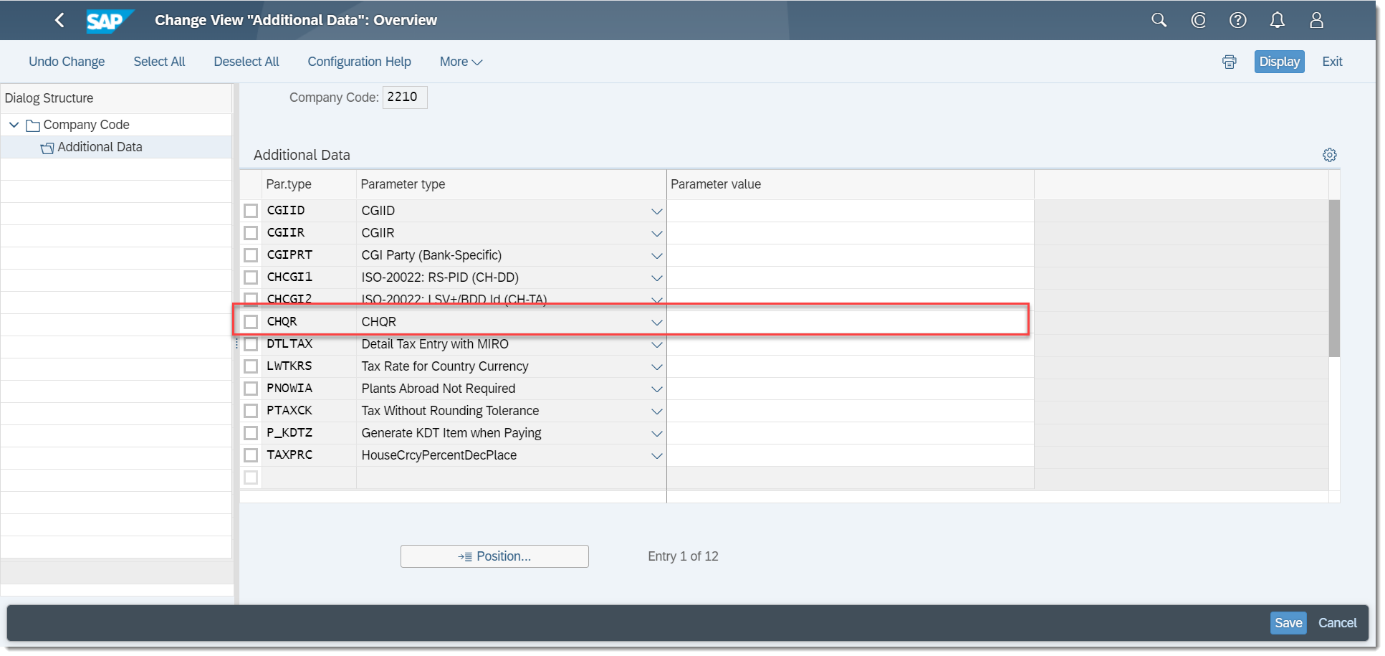

Configuration of Parameter Types

To enable the QR-bill functionality, follow the guideline below.

Log in with a user assigned to business role ’SAP_BR_BPC_EXPERT’ to the Fiori Launchpad (FLP). Call the Manage Your Solution app, select the local version (Switzerland or Liechtenstein) and call the Configure Your Solution app. Search for the Maintain Additional Parameters configuration step. There are two new parameter types available: CHQR. For these parameter types, enter parameter values as follows:

| «empty» | ISR number only |

| B | Both, ISR number and QR-IBAN Note: this option will be used in the transition period when both ISR Number and QR-IBAN will be allowed |

| Q | QR-IBAN only |

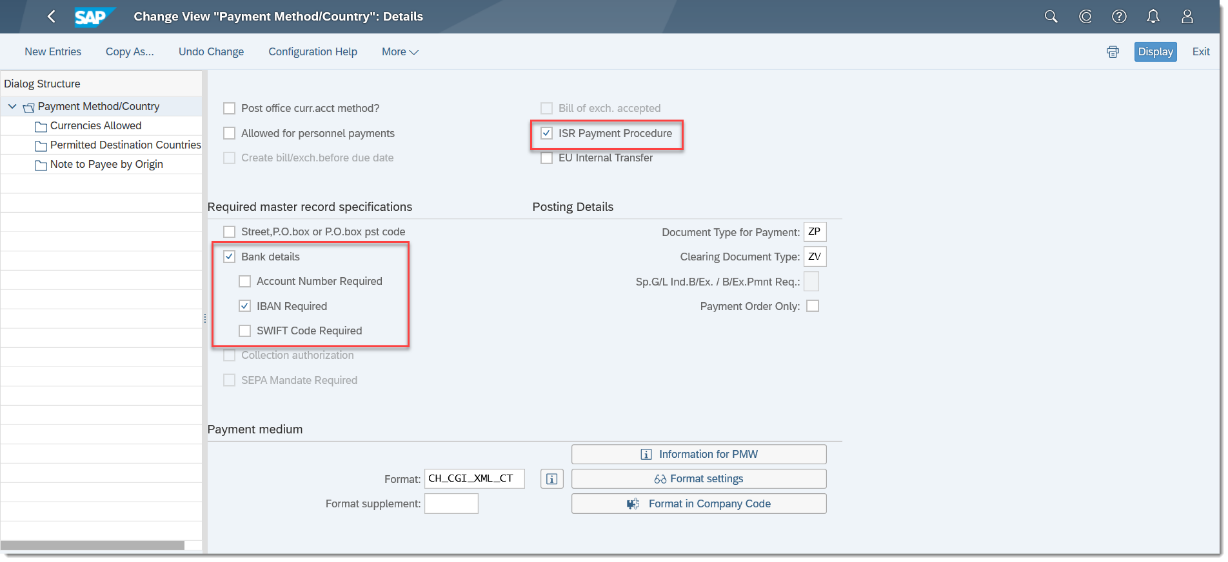

Configuration of Payment Method

Logon as ‘SAP_BR_BPC_EXPERT’, create a payment method for the ISR outgoing payment procedure with QR-IBAN in the Set Up Payment Methods per Country for Payment Transactions app.

Ensure that the followings are set:

- You have selected the ISR Payment Procedurecheckbox in the Payment Method Classification group box.

- You have selected the Bank Detailsand the IBAN Required checkboxes in the Required Master Record Specifications group box.

- You have maintained business partner master data with this newly created payment method.

Activating the Fast Entry Functionality

For the ISR Solution:

Fast entry functionality helps the user to quickly find the supplier a specific ISR number during document posting. The ISR number is assigned to the business partner master data.

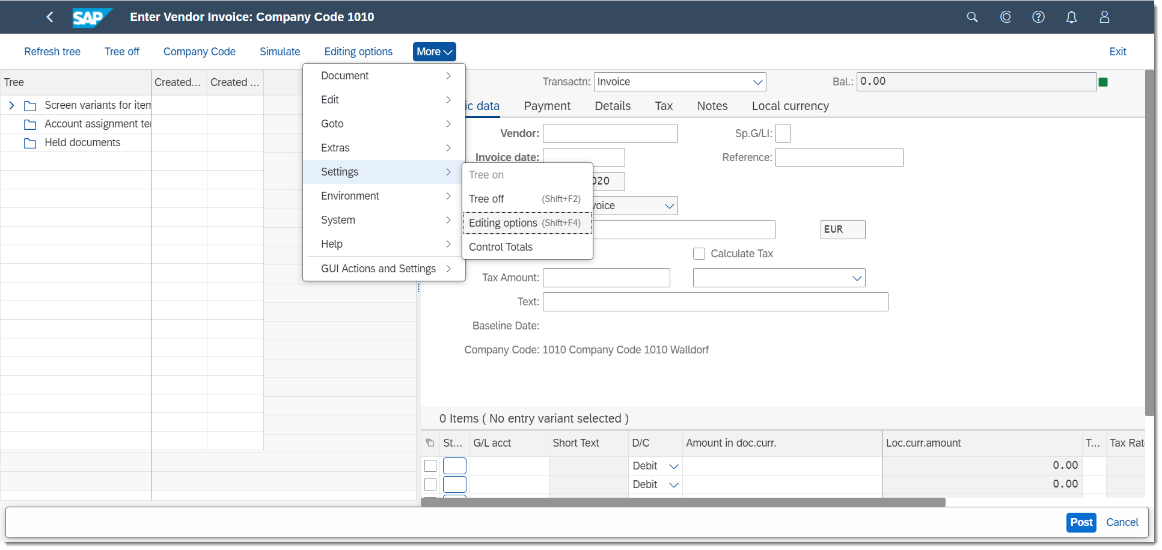

The fast entry functionality can be activated in the Create Incoming Invoices app, choosing More > Settings > Editing options. Select the following checkboxes:

- Fast Entry with ISR Number/QR-IBAN

- ISR Entry with Control Display

After the activation, when you enter an ISR number in the document, the app searches for the supplier having the same ISR number in their master data and display the list so that you can select the relevant one in the Create Incoming Invoices app.

For the QR-Bill Solution:

The QR-IBAN number is entered as a regular bank connection in the business partner master data. More than one QR-IBAN can be entered for one supplier. The fast entry functionality can be activated the same way as described above.

After the activation, when you enter a QR-IBAN in the supplier invoice, the system searches for the suppliers as follows:

- The app searches for all entries with the QR-IBAN in the IBANdatabase table (technical name: TIBAN).

- The app takes BANKS, BANKL, and BANKN values from each TIBAN entry and searches for the supplier bank connections (LFBK).

Note: If the app does not find any supplier with the QR-IBAN you entered, a warning message is displayed, and you need to enter the supplier number manually.

Invoice Management

Posting invoices with QR-IBAN

Log on as ‘SAP_BR_AP_ACCOUNTANT’. Invoices can be created and posted in the Create Incoming Invoices app.

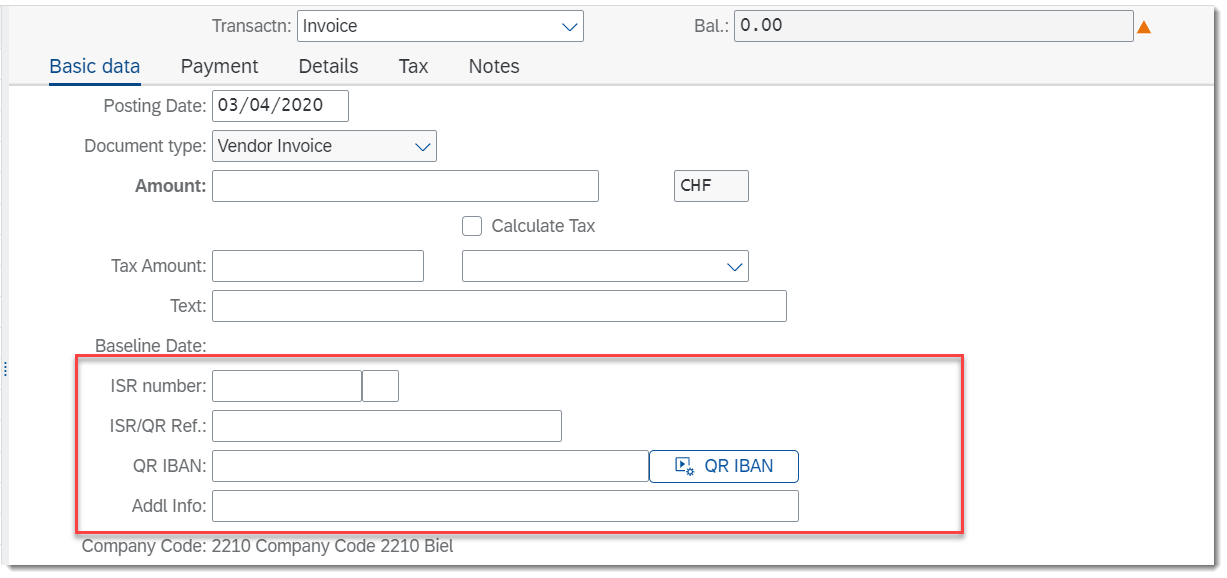

If you use only the ISR solution, enter the ISR number and the ISR reference number in the relevant fields. If you have chosen to use only the QR-bill or both the QR-bill and the ISR solutions, enter the QR-IBAN and the ISR/QR reference number in the relevant fields. These values are then displayed in the line item details.

ISR subscriber number visible

Transition period: both ISR subscriber number and QR-IBAN visible

Only QR-IBAN visible

Validations during document posting

When you enter a QR-IBAN, you must also enter the QR reference and when you enter the QR reference, you must also enter the QR-IBAN. The provided QR reference must be valid. The provided QR-IBAN must be of countries CH or LI and must be of proper IID. It is not possible to enter both ISR Number and QR-IBAN.

Alternative payee data

When the journal entry is posted with QR-IBAN, supplier address and bank data is automatically copied into the Alternative payee data screen.

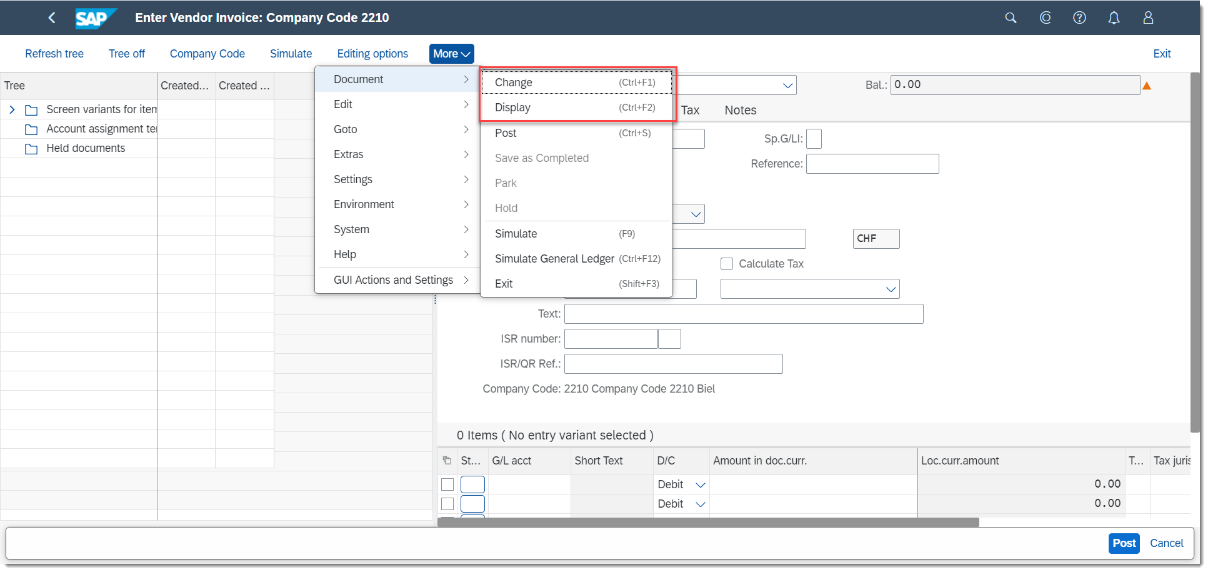

You can change or display the alternative payee data in the Create Incoming Invoices app, choosing More > Document > Change / Display.

Additional Information in QR-Bill

In the payment part, two elements «Unstructured message» (Ustrd) and «Billing information» (StrdBkginf) are available as additional information. The number of characters in the two fields together must not exceed 140 characters:

Unstructured messages can be used to give the payment purpose or for additional textual information about payments with a structured reference. Unstructured references are printed on the payment part under the heading «Additional information».

Billing information contains coded information of the biller for the bill recipient. The data is not forwarded with the payment, but it is printed on the payment part. The coding of the element always begins with delimiter «//».

Field Addl Info is available in the financial transactions. By double-clicking this field, the content is split into Structured and Unstructured Info fields. When you save the entries , the content of these two fields are concatenated.

Manage Journal Entries

You can display the entered data in the Manage Journal Entries app. Search for the journal entry number, click it, choose Manage Journal Entries, and then click the relevant line item. The QR-bill data, that is, the IBAN (it can be either a QR-IBAN or a standard IBAN), the reference, and the additional information) is displayed in the Country/Region-Specific Data section on the screen.

Manage Supplier Down Payment Requests

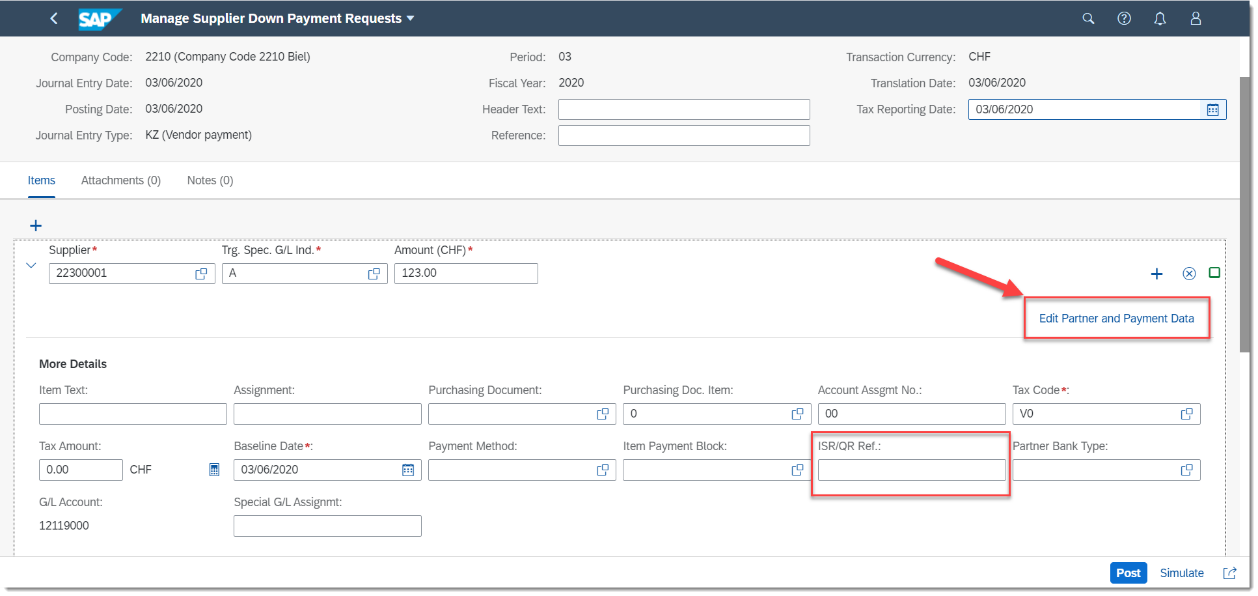

The Manage Supplier Down Payment Request app has been enhanced to be able to process the QR-bill solution. Based on the parameter type setting in the Maintain Additional Parameters configuration step, the app shows different fields when a new down payment request is created.

Parameter value «empty» (ISR Subscriber Number only)

For this value, the app shows fields ISR number and ISR/QR Ref.

Parameter value B (ISR number and QR-IBAN)

For this value, the app shows fields ISR number and ISR/QR Ref.

There is also a new button to edit partner and payment data. This button opens a new window where you can enter IBAN and Additional Information.

When IBAN is entered in this field, you also need to fill in the field Partner Bank Type in the previous view. It is not possible to enter both ISR Number and QR-IBAN.

Parameter value Q (QR-IBAN only)

For this value, the app shows field ISR/QR Ref. You must specify the IBAN in Edit Partner and Payment Data. When IBAN is entered in this field, you also need to fill in the field Partner Bank Type in the previous view.

Receivables Management

QR-bill slip is generated during the outgoing invoice processing and sent to the corresponding business partner to pay it. The electronically readable Swiss QR-code contains all payment-relevant data.

After the business partner has paid the QR-bill, the bank sends a camt.053 or a camt.054 file to the business partner who created the QR-bill. The paid item in the camt.054 file contains a unique reference that is used to search for and clear the corresponding line item in the system.

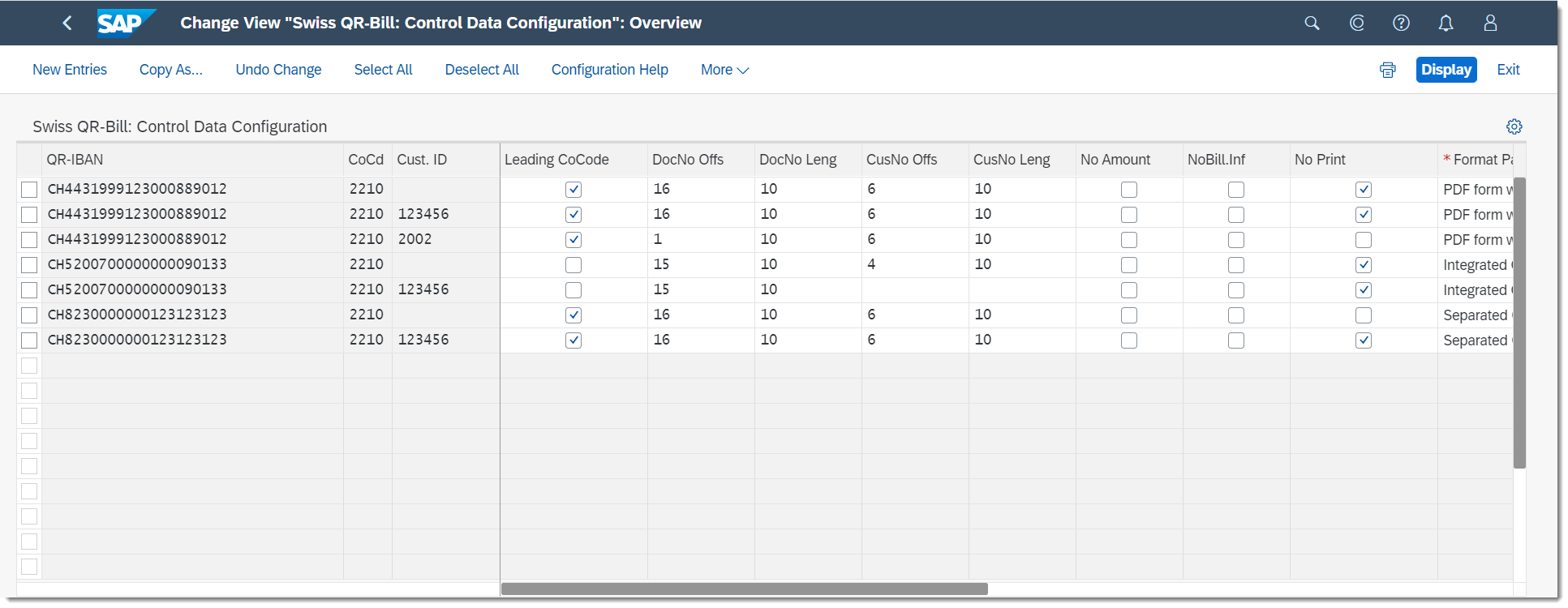

Configuration of Control Data

You can define rules for generating the reference number of QR-bills and make additional settings for the creation of outgoing invoices. When you read an electronic bank statement file, the rules defined for the reference number are used to de-compose the reference number into document number and customer number to enable the search algorithm to find the open items that were created during the posting of the SD invoice.

You can define control data for the following settings regarding the QR-bill:

- You can map data for the generation of the reference number of QR-bills.

- You can set whether you want the payment amount or the billing information to be printed on the QR-bill, or if you want to print the QR-bill.

- You can define how you want the payment data to be added to the invoice.

Log on with ‘SAP_BR_BPC_EXPERT’. Call the Manage Your Solution app, select the local version (Switzerland or Liechtenstein) and call the Configure Your Solution app. Search for the Define Control Data for QR-Bill configuration step and choose Configure.

This view contains keys and common data:

- QR-IBAN/IBAN

- Document and Customer number length and offset in QRR and SCOR Reference

- Parameters relevant to QR-bill form layout

In the last four columns of this view, it is possible to control data for Sales and Distribution and data for Finance. In the SOrg. column, sales organization can be assigned. In the Acct Mod. column, you can control the account determination if you want to post the amount to a bank subaccount. You can also choose an application indicator (Application Ind.) as a selection characteristic for importing bank statements. You can also decide if you want a dunning notice to be printed for a QR-bill (Print Dunning Notice).

Printing Customizations

Generic parameters for printing:

| No amount | No amount will be printed in the QR-bill |

| NoBill.Inf | The structured billing information will not be printed |

| No Print | QR-bill is not printed for this table line |

| Format Par | Select the format to be printed |

| QR Prov. | Provider of the tags for structured billing information |

| Ref. Type | Reference Type QRR is used for the replacement of ISR payments with QR-IBAN Reference Type SCOR is used for ISO 11649 Creditor Reference |

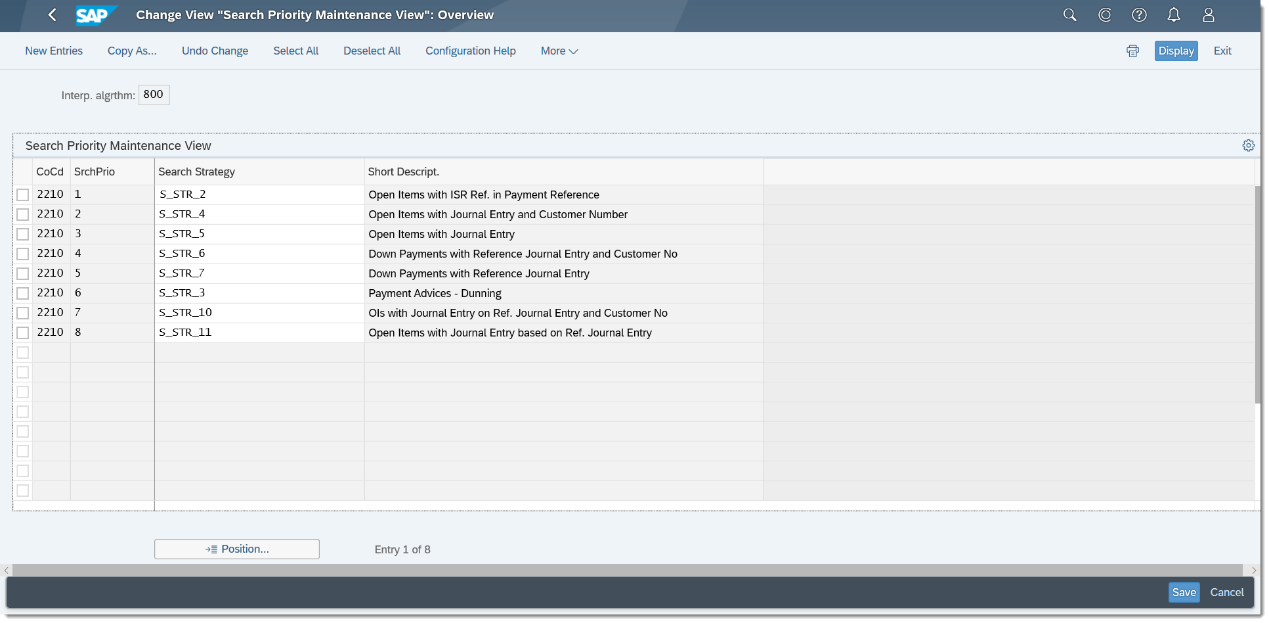

Configuration of Search Priorities

After the data in the bank statement has been imported, the system searches for the open items in the system and matches them to the imported payment data for further processing, which is posting and clearing activities. Optimize the search for these open items by defining search strategies and setting the priority order of the search strategies in the Define Search Priorities configuration step. You can use the predefined search strategies, or you can create your own search strategy.

Process Bank Statement

You can import the data from the CAMT.053 (version 4) and the CAMT.054 (version 4) bank statements that contain all the incoming payment data, including the ones according to the QR procedure, following the standard process as described in Electronic Bank Statement: Application.

During the import process, the system calls the FIEB_800_ALGORITHM function module that contains a predefined interpretation algorithm. This algorithm applies the search strategies in the priority order for matching open items. The search strategy defines the rule of how the system searches for open items.

The open items are cleared based on the QRR/SCOR references that contain the customer and the document numbers when the CAMT.054 file is uploaded.

See more information regarding QR-bill on SAP Help Portal.

Read more about Payment Formats and Bank Statements in SAP S/4HANA Cloud here.

Do you have any further comments regarding this topic? Do not hesitate to share them in the comment section below. You are also welcome to ask any questions about SAP S4/HANA Finance in the Community Q&A section.

Labels:

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

160 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

220 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Add Header Text in Basic Date of Supplier Invoice in Enterprise Resource Planning Q&A

- Get Delivery Header Text in S4HANA Cloud custom CDS view in Enterprise Resource Planning Q&A

- SAP S4HANA Cloud Public Edition Logistics FAQ in Enterprise Resource Planning Blogs by SAP

- CDS view Required - S4Hana Public Cloud MD04 - stock functionality (released) in Enterprise Resource Planning Q&A

- How to find field technical details in S4HANA Cloud solution in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |