- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- NF-e Technical Note 2023.004 v1.10: New Fields Add...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hello, everybody

The Brazilian government has published the technical note 2023.004 v1.10-SEFAZ, which provides the inclusion and change of existing fields and validation rules for the Import Documents, ICMS Exempted and Payment Information groups for Electronic Nota Fiscal (NF-e). Click here for the Portuguese version.

In this blog post, we will cover the following topics available for SAP S/4HANA and SAP ERP:

- Updates related to the new and changed fields.

- Relevant SAP Notes for this legal requirement.

New fields added to the system

Import Document Group

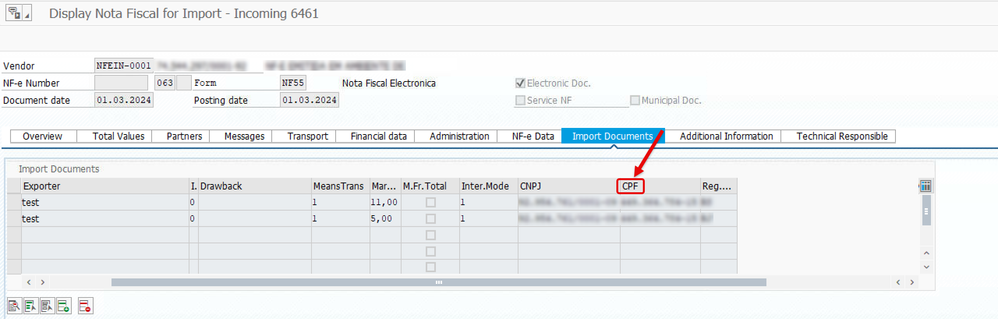

The new field CPF Number (CPF) has been added to the Nota Fiscal Data for Import Documents (J_1BNFIMPORT_DI) table.

ICMS Group

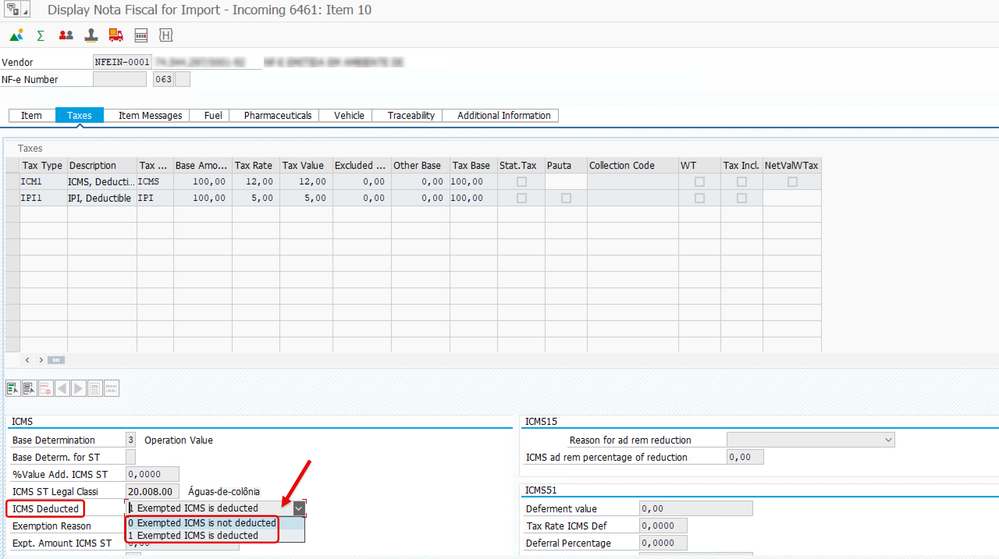

The new field Exempted ICMS value deduction from the nota fiscal total (INDDEDUZDESON) has been added to the existing table Nota Fiscal line items (J_1BNFLIN). This indicates whether the ICMS exempt value is deducted.

Payment Information Group

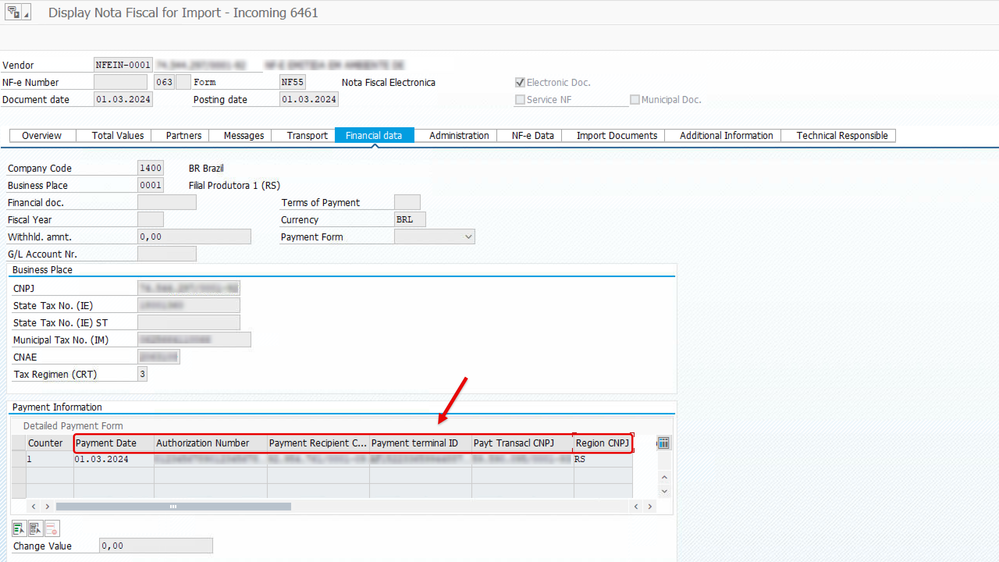

The new fields Payment Recipient CNPJ (CNPJRECEB), Payment terminal identifier (IDTERMPAG), Payment Date (DPAG), Payment Transactional CNPJ (CNPJPAG), and Region of the establishment's CNPJ where the payment is made (UFPAG) have been added to the existing Payment Information table (J_1BNFEPAYMENT).

Changes to existing fields in the system

The Authorization Number (C_AUT) field in the Payment Information table (J_1BNFEPAYMENT) now supports up to 128 characters.

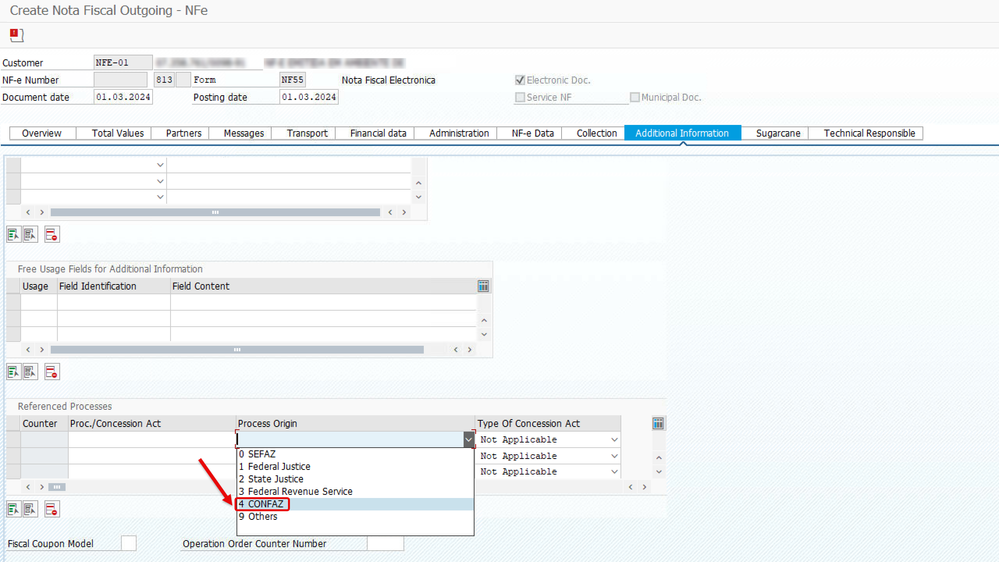

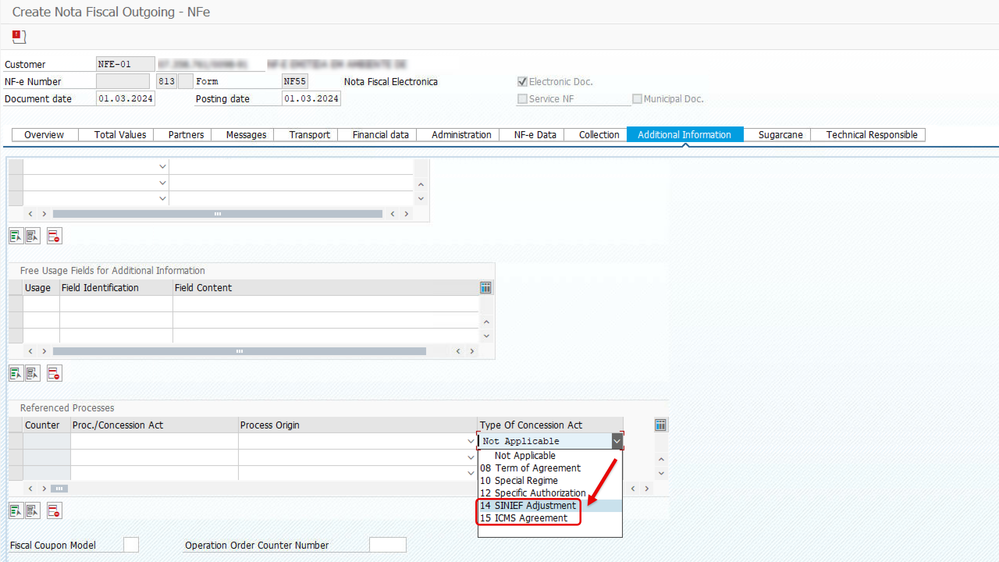

In the Additional Information: Referenced Processes (J_1BNFREFPROC) group, the following entry has been added in the value range of the Process Origin Indicator (INDPROC) field:

- 4-CONFAZ

New entries were also added to the value range of the Type of Concession Act (TPATO):

- 14-SINIEF Adjustment

- 15-ICMS Agreement

The changes mentioned in this blog post are available in the following system objects for SAP ERP, SAP S/4HANA:

- Nota Fiscal Writer Transactions (J1B*N)

- Payment Information table (J_1BNFEPAYMENT), under the Financial data tab

- Nota Fiscal Data for Import Documents (J_1BNFIMPORT_DI) table, under the Import Documents tab

- Nota Fiscal line items (J_1BNFLIN), under the Details tab

- Nota Fiscal System – Create Object from data (BAPI_J_1B_NF_CREATEFROMDATA) BAPI

- Nota Fiscal: List details of a Nota Fiscal (BAPI_J_1B_NF_READDATA) BAPI

- Additional Data for Nota Fiscal (J_1BNF_ADD_DATA) BAdI

Relevant SAP Notes for this legal requirement

You can install the following SAP Notes to update your solution:

- SAP Note 3423949: NT 2023.004 v1.1: Prerequisite objects for SAP Note 3423950

- SAP Note 3423950: NT 2023.004 v1.1: New Fields added to Nota Fiscal

Use the regulatory change manager tool to find if a solution is planned for a legal change. For the NF-e Technical Note 2023.004, check NF-e Technical Note 2023.004 version 1.10 - Payment information and others. Take a look at the SAP Knowledge Base Article 3421995 and the Regulatory Change Manager page to understand how to use this tool.

For more information, check the SAP Knowledge Base Article 2969814 - NF-e Technical Note 2023.004 Troubleshooting Guide.

Update - 01 April, 2024

You can implement these updates in the SAP Document and Reporting Compliance, outbound invoicing option for Brazil (LOD-LH-NFE component) and Nota Fiscal Eletrônica Outbound (FI-LOC-NFE-BR-OUT component) by following the instructions on the SAP Notes:

- SAP Note 3440649 – Outbound NF-e: Prerequisite Objects of SAP Note 3447619

- SAP Note 3447619 – Outbound NF-e: NF-e Technical Note 2019.001 v1.62 and 2023.004 v1.11

In the layout of the XML file, the indDeduzDeson field was added to indicate whether the Exempt ICMS (vICMSDeson) field should be subtracted from the Product Value (vProd field).

You can also implement the changes for the SAP Electronic Invoicing for Brazil (SAP NFE) solution by following the instructions on SAP Note 3426933 – NF-e NT2019.001 & NT2023.004.

Update - 05 April, 2024

Follow the steps on the SAP Notes below to implement the updates in the SAP Document and Reporting Compliance, inbound invoicing option for Brazil:

- SAP Note 3444168 – Incoming NF-e: Technical Note 2019.001 v1.62 and 2023.004 v1.11

- SAP Note 3441355 – eDocument Brazil Inbound NF-e: Prerequisite Objects for SAP Note 3447713

- SAP Note 3447713 – eDocument Brazil Inbound NF-e: Technical Note 2019.001 v1.62 and 2023.004 v1.11

Did you like this post? Give it a Like and share the content with your colleagues. Feel free to leave feedback, comment, or question in the space below. And don’t forget to follow the SAP S/4HANA Logistics for Brazil tag in the SAP Community to stay tuned for the latest news.

Regards,

Luize Boyen

- SAP Managed Tags:

- SAP S/4HANA Logistics for Brazil,

- SAP ERP,

- Localization

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

160 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

220 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- Post asset acquisition back to old fiscal year in Enterprise Resource Planning Q&A

- NOTIFICATION FOR FAILED MEASURING POINT VALUES in Enterprise Resource Planning Q&A

- Material has status: Technical Defect (delivery is not allowed) in Enterprise Resource Planning Q&A

- SAP S4HANA Cloud Public Edition Logistics FAQ in Enterprise Resource Planning Blogs by SAP

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 8 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |