- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Multiple Valuation Approaches -SAP S/4HANA

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member69

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

09-07-2020

5:31 PM

A transfer prices arises for accounting purposes, when one entity purchases goods from another entity within same group of companies. When two unrelated companies trade with each other, the price at which they undertake their transaction is simply known as “Price”. But when supply of goods and services is made to another related company, the price is called “transfer Price”

What you will understand from this blog Post?

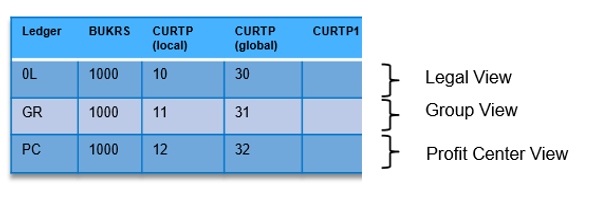

A Multinational company operating in three countries have a requirement to determine the actual cost of goods manufactured for the group and does not include any intercompany profit and at the same time for legal reporting purpose require to include intercompany profit. This blog explained about how we can valuate inventory for different reporting purposes. In SAP S/4HANA Multiple valuation approaches /transfer prices functionality can manage up to three valuation approaches. This blog post covers two valuation approaches or views a) Legal View b) Group View

What is Multiple Valuation approach

Multiple valuation approach is the ability to value inventory in more than one valuation method.

This Approach required for:

Legal view

The legal view is the view of the individual enterprise that represents the transfers of goods and services between independent companies according to the legal reporting requirements

Group view

In the group view, the exchanged goods and services within affiliated companies determines the cost of good manufactured without including any intercompany profits.

Profit center view

In the profit center view, the exchanges of goods and services between profit centers are valuated using internal prices. In order to determine the profitability of those profit center and helpful for management to take pricing decision accordingly.

Business case:

In our example “Best Run” is a holding company with three legal entities the system represents the company codes LT02 located in Germany ,Company LT01 located in India and the company code LT03 located in US

The entity LT02 uses EUR as its local currency,LT01 uses INR as its local currency and LT03 uses USD as its local currency and all the three company code assign to the Controlling area “Best Run” LTP1 which uses the group currency EUR .The controlling area is assigned to an Operating concern called “Best Run” LTP1 with Accounting Based COPA ,its Currency EUR.

This session provides an configuration setting required for multiple valuation with in S/4 HANA environment

1.Creating a Currency and Valuation Profile:

The currency and valuation profile determine which valuations the system stores in which currency. Using standard, we can store up to three different valuation views in up to two different currency

To create valuation profile, follow the below steps:

Transaction 8KEM or follow the IMG menu Path Controlling --> General Controlling -->Multiple Valuation Approaches/Transfer Prices -->Basic settings -->Maintain Currency and Valuation Profile

2. Assigning Currency and Valuation profile to Controlling area:

Assignment of the currency and valuation Profiles enable you to create actual version in CO for different valuation views. To assign the valuation profile to the controlling area, follow these steps:

Transaction 8KEQ or follow the IMG menu Path Controlling-->General Controlling -->Multiple Valuation Approaches/Transfer Prices --> Basic settings --> Assign currency and valuation profile to controlling area

The multiple valuation approaches are stored in CO version in Controlling. If you use multiple valuation, the system used actual Version 0 for legal valuation and data of the parallel valuation stored in the delta version.

To create a delate version in CO, follow these steps

IMG menu path: Controlling -->General Controlling -->Organization -->Maintain version

4. Currency and Ledger settings in the Universal Journal

In the universal journal, multiple valuation approaches are managed in same way as parallel FI currencies. In SAP S/4HANA two options available to store multiple valuation.

Multiple Valuation-Single Ledger

Multiple Valuation-Multiple Ledger

Customizing settings in Finance: IMG menu path Financial accounting-->Financial accounting Global settings -->Ledgers-->Define settings for ledger and Currency types (transaction FINSC_ledger)

In case of multiple valuation ledger approach Valuation view is blank. In our Example we are using Multiple valuation- Single Ledger

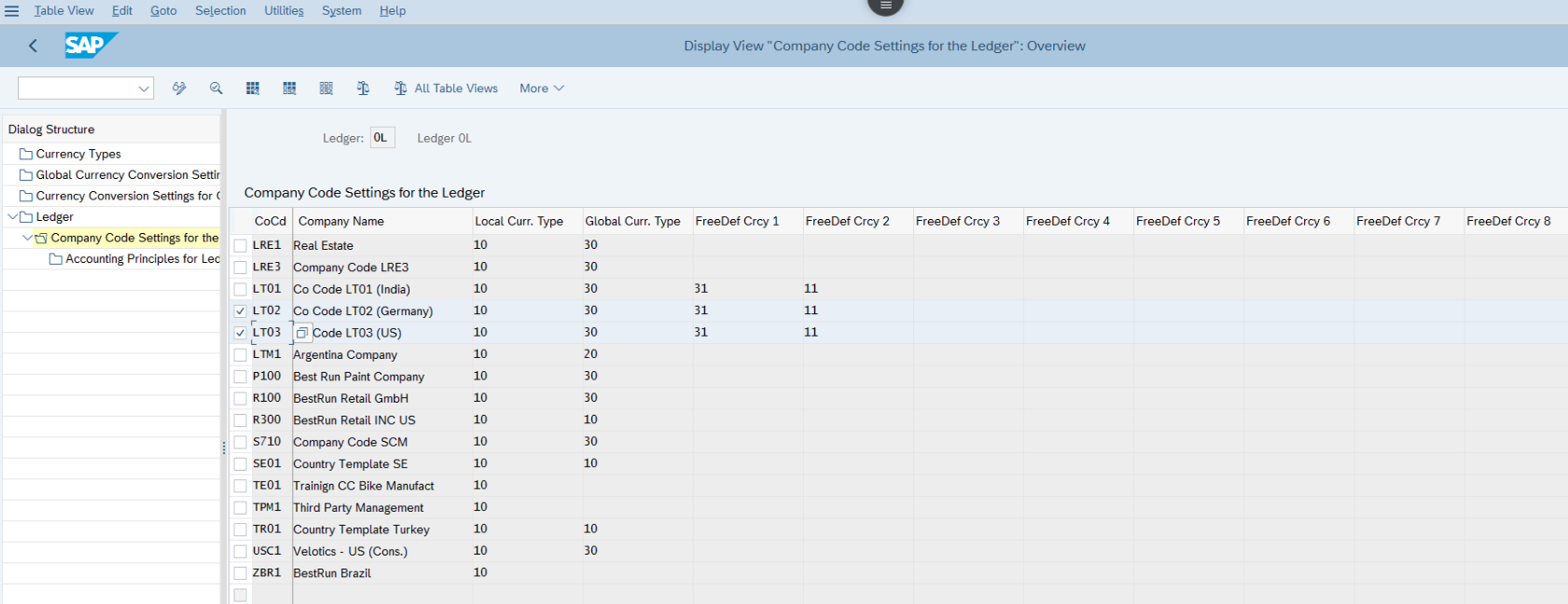

For activating group valuation, both currency types 11 and 31 need to be maintained in the new currency customizing. In ACDOCA, the currency types in the company code currency and global currency must exit for group valuation. Although only one currency type is maintained for a valuation approach in the currency and valuation profile both currency types of a valuation are necessary for updating data in Controlling (Refer SAP note-2882025)

Company code settings for the ledger LT02 and LT03

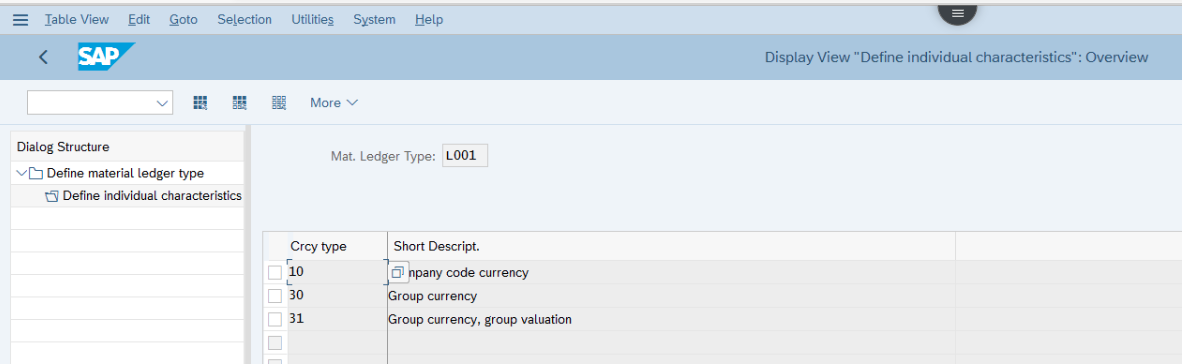

5. Assigning Currency type to Material ledger

Material ledger is used for a multi-currency and or multi- valuation of inventory. In SAP S/4HANA ML must be active. The valuated inventory accountings are stored in Universal journal (ACDOCA). The currency types assigned to Material ledger types only in the currency maintained in the Currency and Valuation profile. If you use group valuation only one currency per valuation is allowed.

IMG Menu path Controlling--> Product Cost Controlling-->Actual costing/Material ledger-->Assign Currency types and Define Material ledger type.

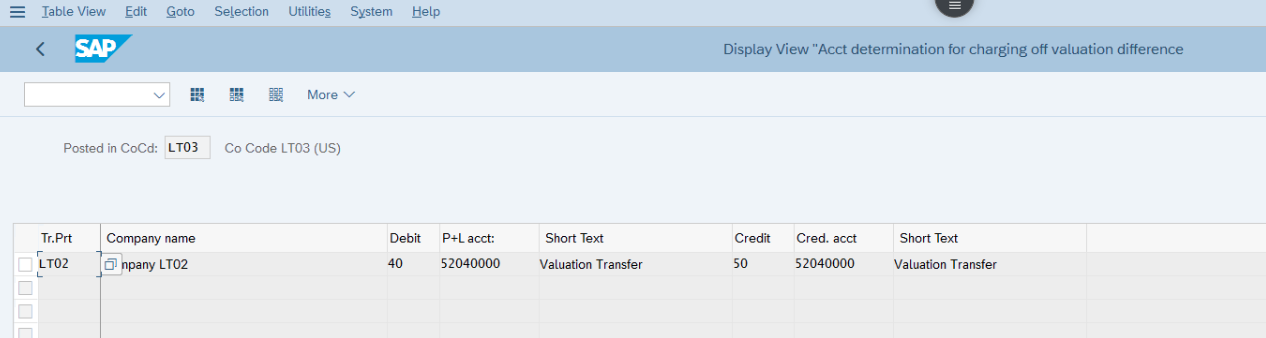

6. Determining the valuation approach for Clearing Account

When you use multiple valuation approaches/transfer prices, payables and receivables are only posted using legal valuation because that represents the amount in which the payment is made. If, however, you want to record other valuation approaches in the valuation clearing account, you need to post the difference to accounts for intercompany profits so that this amount appears in the group report.

Use Transaction 8KEN, or follow the IMG menu path Controlling -->General Controlling -->Multiple Valuation Approaches/Transfer Prices --> Level of Detail --> Define Valuation Clearing Account

7. Standard cost Estimate settings for valuation approach (Optional Activity)

Product cost planning provide the possibility of determining standard cost according to different valuation approach (Legal and Group).To update the standard cost of the material for each valuation, additional costing variant required in product cost planning for Legal Valuation and Group Valuation .

First create the costing types to create the costing variant. The costing type determines what valuation approach is assigned to the costing variant.

Transaction OKKI Or IMG menu path Controlling -->Product Cost controlling --> Product Cost Planning -->Material Cost Estimate with Quantity Structure -->Costing Variant: Components -->Define Costing Types.

The product cost variant contains all the control parameters of costing.

Transaction OKKN or follow the IMG menu path Controlling --> Product Cost controlling -->Product Cost Planning -->Material Cost Estimate with Quantity Structure --> Define Costing Variants.

Costing Type GR used for Group Valuation

Costing Type L1 used for Legal Valuation

Product Costing Variant for Legal valuation LT01

Product Costing Variant for Group valuation LT02

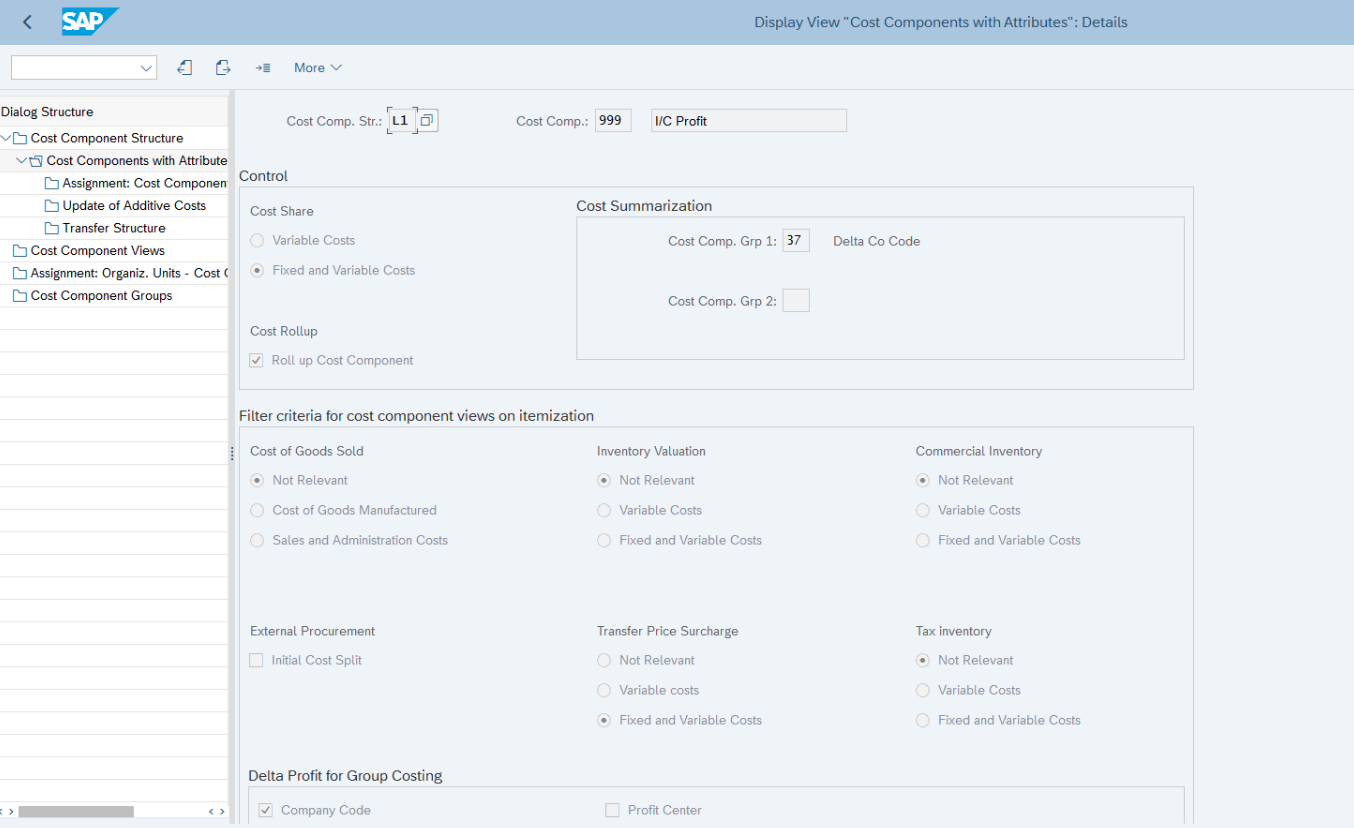

8. Cost Component structure settings for Group valuation (Optional Activity)

Additionally, a configuration in the cost component structure allows you to display the intercompany profit across all levels of the entire value chain. This enables you to compare actual costs with actual revenue by eliminating the internal profits between company codes from the same group.

To identify the markup in the intercompany process, you have to create a new cost component in your cost component structure. You configure the cost component structure

Transaction OKTZ or by following the IMG menu path Controlling -->Product Cost Controlling -->Product Cost Planning --> Basic Settings for Material Costing --> Define Cost Component Structure

9. Splitting of Cost of Goods Sold in Parallel Valuation View (Optional Activity)

By activating this function, the cost of goods sold amount are split into different accounts in accordance with the cost components.

By implementing the account-based split in Cost Splitting profile, it will split the cost when the source account is posted.

As of Release1809, the cost posted during the revaluation of material consumption (CKMLCP) can be split based on the actual costing. For this you must set the “Split Revaluated Consumption with Actual Cost Component Split”

As of Release 1909, The COGS split document, the fixed portion is updated in the controlling area currency for the legal valuation, group valuation in table ACDOCA.

Refer SAP note -2399030

Customizing option for COGS Split performed in IMG menu Financial accounting (New)-->General ledger Accounting (New)-->Periodic Processing-->Integration->Material management -->Define Accounts for splitting the cost of Goods Sold

10. Activating Multiple Valuation

Activating the currency and valuation profile is the final mandatory step in customizing. The currency and valuation profile must only be activated after all above necessary steps are completed. The activation can be by following the Transaction 8KEP or IMG menu path Controlling-->General Controlling -->Multiple Valuation approaches /Transfer Prices -->Activation --> Multiple Valuation Approaches: Check/Execute Activation

Select the option Check activation before activation, the system checks whether the valuation approaches defined in the currency and valuation profile are consistent with the settings in the individual applications.

Scenario:

Based on the above-mentioned customizing settings let understand the accounting postings in Universal Journal. The entity LT02 has plant LT02 located in Germany and Company code LT03 has plant LT03 located in US. LT02 plant transfer Finished goods to selling plant, LT03. Whereas LT02 receive finished goods from LT01 is a manufacturing Plant. To avoid operating at a breakeven /loss ,entity LT02 add intercompany margin in the intercompany sales.

In these case all the plants are activated actual costing and actual cost component split in SAP S/4HANA.

.

This session provides an intercompany transaction postings and integrated accounting documents (From LT02 to LT03). Based on the above-mentioned customizing settings

I . Standard Cost Estimate:

The released standard cost estimate can be viewed in material master for finished goods. The price determination of the material ML-FG-P300 in plant LT03 and LT02is 3. The special procurement type F& L2 (Stock transfer from LT02) maintained for this material

II .Cost Component Split in Standard Price

Let us analysis the I/C profit for transfer price in cost component view in both valuation legal and Group valuation

In Legal Valuation:

Intercompany profit will be zero

In Group Valuation:

In Group view system calculates the delta profit between company code which we called as Intercompany margin.

IC margin = Procurement Costs -COGM_in_group_valuation (Refer Sap Note-2160974 for calculation)

III. Purchase Order

Let’s create an intercompany purchase order in company code LT03 and LT02 as supplier -Company code located in Germany.

In the above purchase order material- ML-FG-P300 procured from company code LT02, for a PO quantity 1 EA

Pricing Element Condition in Purchase order Contains:

Finished material procured from company code LT02 for a price of 125.40 EUR and Intercompany mark value is 21.60 EUR per quantity

IV. Accounting Document:

In this step, lets analyses the intercompany accounting document posting in both company code LT02 and Lt03 against purchased order created in above step.

Once you posted goods receipt, you can see the three documents posted for intercompany posting ,2 document posted in sending company code LT02 and one document posted in receiving company code LT03

Before analyzing the accounting document in entity LT02, let understand the Standard price of the material ML-FG-P300 in plant LT02. For legal valuation at 125.40 EUR and in Group Valuation at 104.49 EUR

Legal Valuation:

Group Valuation:

a ) Below document posted in company code LT02 for cost of goods sold at standard price

b) Another document posted in company code LT02 for COGS Split in Group Valuation.

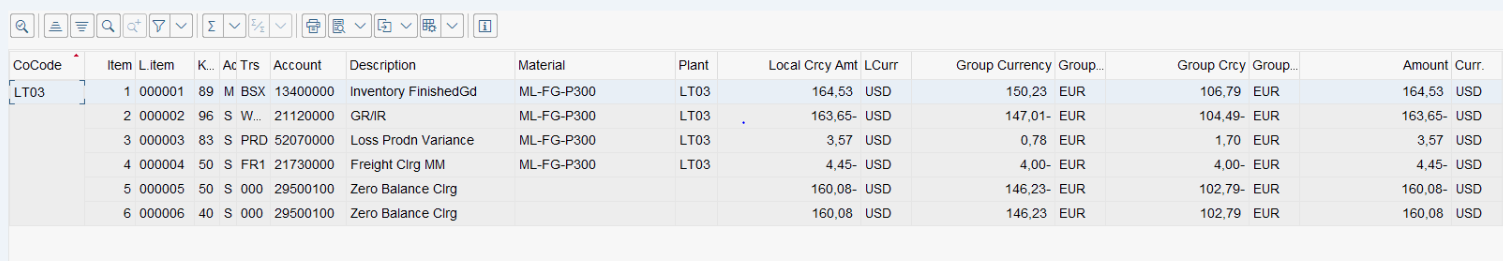

c) Third Accounting Document posted in Company code LT03, lets understand how intercompany profit calculated in legal valuation and eliminated in Group View

In the above document I/C profit value is added only in Legal view both in local and Group Currency

V. Intercompany Invoice Posting:

We are using parallel valuation approaches, receivables and payables are posted only in the legal valuation view because the payment is made with this amount. However, if different valuations are posted for the offsetting account, the difference must be posted in valuation approach clearing accounts to be used in consolidated financial statement reporting.

Entity LT02 post a sales invoice to company code LT03

Once Goods receipts posted against Intercompany Purchase order, next step to post Vendor invoice posting in company code LT03.

The difference in value between two valuation approach has been posted in Gl account – “Valuation Transfer” with value of EUR 42.51 only in group view in Gl clearing account 52040000. Gl account is determined based on the above settings mentioned in 8KEN.

In addition to above accounting entry Valuation transfer GL get posted even at the time of price difference settlement posting during actual costing run.

VI. Actual Costing Run:

Calculate and post the actual costing run across the company code by using actual costing run CKMLCP. The actual costing run allocates the price difference from raw material to semi-Finished to Finished goods. In case of stock transfer from one pant to another both plants should be included in same costing run to settle the price difference from sending plant to receiving plant. The actual costing run determines all the material having price determination 3.Activating Actual Costing is not mandatory in SAPS/4HANA it depends on business requirement .

Let’s examine in Material Price Analysis -CKM3 what happens in the Legal and Group valuation view. When the goods receipt is performed in the receiving company code, an inter-company is calculated in the legal view and show in Inter company profit component created in OKTZ.

Legal Valuation View Receiving Plant LT03:

Group Valuation View in Receiving Plant LT03:

Legal Valuation View in Sending Plant LT02:

Group Valuation View in Sending Plant LT02:

Before concluding let’s simulate the all the accounting entry posted to understand the P&L balance in Legal and Group View. This accounting document get stored in Universal Journal table and can be analysed in COPA line item report KE24 in each valuation view.

Summary

When you divide up your company as a Profit center by manufacturing ,sales depot for same classification of material and we do more number of inter profit center transaction ,then there is a requirement to use the option of transfer price for inter profit transfer in this case activating profit center views will provide the inventory valuation at profit center level. The additional configuration steps for profit center views are - Automatic Account determination, Determining Accounts for Internal Goods Movement, Transfer price Pricing procedure (8KEA).

Limitation on the Multiple valuation approaches :

Thanks

Sudharsan R

What you will understand from this blog Post?

A Multinational company operating in three countries have a requirement to determine the actual cost of goods manufactured for the group and does not include any intercompany profit and at the same time for legal reporting purpose require to include intercompany profit. This blog explained about how we can valuate inventory for different reporting purposes. In SAP S/4HANA Multiple valuation approaches /transfer prices functionality can manage up to three valuation approaches. This blog post covers two valuation approaches or views a) Legal View b) Group View

- Introduction to Multiple Valuation approach

- Business Case

- Configuration Settings required for Multiple Valuation approach

- Scenario explained for business transaction

- Summary and Limitation in Multiple Valuation approach

What is Multiple Valuation approach

Multiple valuation approach is the ability to value inventory in more than one valuation method.

This Approach required for:

Legal view

The legal view is the view of the individual enterprise that represents the transfers of goods and services between independent companies according to the legal reporting requirements

Group view

In the group view, the exchanged goods and services within affiliated companies determines the cost of good manufactured without including any intercompany profits.

Profit center view

In the profit center view, the exchanges of goods and services between profit centers are valuated using internal prices. In order to determine the profitability of those profit center and helpful for management to take pricing decision accordingly.

Business case:

In our example “Best Run” is a holding company with three legal entities the system represents the company codes LT02 located in Germany ,Company LT01 located in India and the company code LT03 located in US

The entity LT02 uses EUR as its local currency,LT01 uses INR as its local currency and LT03 uses USD as its local currency and all the three company code assign to the Controlling area “Best Run” LTP1 which uses the group currency EUR .The controlling area is assigned to an Operating concern called “Best Run” LTP1 with Accounting Based COPA ,its Currency EUR.

This session provides an configuration setting required for multiple valuation with in S/4 HANA environment

1.Creating a Currency and Valuation Profile:

The currency and valuation profile determine which valuations the system stores in which currency. Using standard, we can store up to three different valuation views in up to two different currency

To create valuation profile, follow the below steps:

Transaction 8KEM or follow the IMG menu Path Controlling --> General Controlling -->Multiple Valuation Approaches/Transfer Prices -->Basic settings -->Maintain Currency and Valuation Profile

2. Assigning Currency and Valuation profile to Controlling area:

Assignment of the currency and valuation Profiles enable you to create actual version in CO for different valuation views. To assign the valuation profile to the controlling area, follow these steps:

Transaction 8KEQ or follow the IMG menu Path Controlling-->General Controlling -->Multiple Valuation Approaches/Transfer Prices --> Basic settings --> Assign currency and valuation profile to controlling area

3. Creating Versions for valuations

The multiple valuation approaches are stored in CO version in Controlling. If you use multiple valuation, the system used actual Version 0 for legal valuation and data of the parallel valuation stored in the delta version.

To create a delate version in CO, follow these steps

IMG menu path: Controlling -->General Controlling -->Organization -->Maintain version

4. Currency and Ledger settings in the Universal Journal

In the universal journal, multiple valuation approaches are managed in same way as parallel FI currencies. In SAP S/4HANA two options available to store multiple valuation.

- Multi-Valuation ledger (Mixed ledger)

- Separate Valuation ledger (Single- Valuation ledger)

Multiple Valuation-Single Ledger

Multiple Valuation-Multiple Ledger

Customizing settings in Finance: IMG menu path Financial accounting-->Financial accounting Global settings -->Ledgers-->Define settings for ledger and Currency types (transaction FINSC_ledger)

In case of multiple valuation ledger approach Valuation view is blank. In our Example we are using Multiple valuation- Single Ledger

For activating group valuation, both currency types 11 and 31 need to be maintained in the new currency customizing. In ACDOCA, the currency types in the company code currency and global currency must exit for group valuation. Although only one currency type is maintained for a valuation approach in the currency and valuation profile both currency types of a valuation are necessary for updating data in Controlling (Refer SAP note-2882025)

Company code settings for the ledger LT02 and LT03

5. Assigning Currency type to Material ledger

Material ledger is used for a multi-currency and or multi- valuation of inventory. In SAP S/4HANA ML must be active. The valuated inventory accountings are stored in Universal journal (ACDOCA). The currency types assigned to Material ledger types only in the currency maintained in the Currency and Valuation profile. If you use group valuation only one currency per valuation is allowed.

IMG Menu path Controlling--> Product Cost Controlling-->Actual costing/Material ledger-->Assign Currency types and Define Material ledger type.

6. Determining the valuation approach for Clearing Account

When you use multiple valuation approaches/transfer prices, payables and receivables are only posted using legal valuation because that represents the amount in which the payment is made. If, however, you want to record other valuation approaches in the valuation clearing account, you need to post the difference to accounts for intercompany profits so that this amount appears in the group report.

Use Transaction 8KEN, or follow the IMG menu path Controlling -->General Controlling -->Multiple Valuation Approaches/Transfer Prices --> Level of Detail --> Define Valuation Clearing Account

7. Standard cost Estimate settings for valuation approach (Optional Activity)

Product cost planning provide the possibility of determining standard cost according to different valuation approach (Legal and Group).To update the standard cost of the material for each valuation, additional costing variant required in product cost planning for Legal Valuation and Group Valuation .

First create the costing types to create the costing variant. The costing type determines what valuation approach is assigned to the costing variant.

Transaction OKKI Or IMG menu path Controlling -->Product Cost controlling --> Product Cost Planning -->Material Cost Estimate with Quantity Structure -->Costing Variant: Components -->Define Costing Types.

The product cost variant contains all the control parameters of costing.

Transaction OKKN or follow the IMG menu path Controlling --> Product Cost controlling -->Product Cost Planning -->Material Cost Estimate with Quantity Structure --> Define Costing Variants.

Costing Type GR used for Group Valuation

Costing Type L1 used for Legal Valuation

Product Costing Variant for Legal valuation LT01

Product Costing Variant for Group valuation LT02

8. Cost Component structure settings for Group valuation (Optional Activity)

Additionally, a configuration in the cost component structure allows you to display the intercompany profit across all levels of the entire value chain. This enables you to compare actual costs with actual revenue by eliminating the internal profits between company codes from the same group.

To identify the markup in the intercompany process, you have to create a new cost component in your cost component structure. You configure the cost component structure

Transaction OKTZ or by following the IMG menu path Controlling -->Product Cost Controlling -->Product Cost Planning --> Basic Settings for Material Costing --> Define Cost Component Structure

9. Splitting of Cost of Goods Sold in Parallel Valuation View (Optional Activity)

By activating this function, the cost of goods sold amount are split into different accounts in accordance with the cost components.

By implementing the account-based split in Cost Splitting profile, it will split the cost when the source account is posted.

As of Release1809, the cost posted during the revaluation of material consumption (CKMLCP) can be split based on the actual costing. For this you must set the “Split Revaluated Consumption with Actual Cost Component Split”

As of Release 1909, The COGS split document, the fixed portion is updated in the controlling area currency for the legal valuation, group valuation in table ACDOCA.

Refer SAP note -2399030

Customizing option for COGS Split performed in IMG menu Financial accounting (New)-->General ledger Accounting (New)-->Periodic Processing-->Integration->Material management -->Define Accounts for splitting the cost of Goods Sold

10. Activating Multiple Valuation

Activating the currency and valuation profile is the final mandatory step in customizing. The currency and valuation profile must only be activated after all above necessary steps are completed. The activation can be by following the Transaction 8KEP or IMG menu path Controlling-->General Controlling -->Multiple Valuation approaches /Transfer Prices -->Activation --> Multiple Valuation Approaches: Check/Execute Activation

Select the option Check activation before activation, the system checks whether the valuation approaches defined in the currency and valuation profile are consistent with the settings in the individual applications.

Scenario:

Based on the above-mentioned customizing settings let understand the accounting postings in Universal Journal. The entity LT02 has plant LT02 located in Germany and Company code LT03 has plant LT03 located in US. LT02 plant transfer Finished goods to selling plant, LT03. Whereas LT02 receive finished goods from LT01 is a manufacturing Plant. To avoid operating at a breakeven /loss ,entity LT02 add intercompany margin in the intercompany sales.

In these case all the plants are activated actual costing and actual cost component split in SAP S/4HANA.

.

This session provides an intercompany transaction postings and integrated accounting documents (From LT02 to LT03). Based on the above-mentioned customizing settings

I . Standard Cost Estimate:

The released standard cost estimate can be viewed in material master for finished goods. The price determination of the material ML-FG-P300 in plant LT03 and LT02is 3. The special procurement type F& L2 (Stock transfer from LT02) maintained for this material

II .Cost Component Split in Standard Price

Let us analysis the I/C profit for transfer price in cost component view in both valuation legal and Group valuation

In Legal Valuation:

Intercompany profit will be zero

In Group Valuation:

In Group view system calculates the delta profit between company code which we called as Intercompany margin.

IC margin = Procurement Costs -COGM_in_group_valuation (Refer Sap Note-2160974 for calculation)

III. Purchase Order

Let’s create an intercompany purchase order in company code LT03 and LT02 as supplier -Company code located in Germany.

In the above purchase order material- ML-FG-P300 procured from company code LT02, for a PO quantity 1 EA

Pricing Element Condition in Purchase order Contains:

Finished material procured from company code LT02 for a price of 125.40 EUR and Intercompany mark value is 21.60 EUR per quantity

IV. Accounting Document:

In this step, lets analyses the intercompany accounting document posting in both company code LT02 and Lt03 against purchased order created in above step.

Once you posted goods receipt, you can see the three documents posted for intercompany posting ,2 document posted in sending company code LT02 and one document posted in receiving company code LT03

Before analyzing the accounting document in entity LT02, let understand the Standard price of the material ML-FG-P300 in plant LT02. For legal valuation at 125.40 EUR and in Group Valuation at 104.49 EUR

Legal Valuation:

Group Valuation:

a ) Below document posted in company code LT02 for cost of goods sold at standard price

b) Another document posted in company code LT02 for COGS Split in Group Valuation.

c) Third Accounting Document posted in Company code LT03, lets understand how intercompany profit calculated in legal valuation and eliminated in Group View

In the above document I/C profit value is added only in Legal view both in local and Group Currency

V. Intercompany Invoice Posting:

We are using parallel valuation approaches, receivables and payables are posted only in the legal valuation view because the payment is made with this amount. However, if different valuations are posted for the offsetting account, the difference must be posted in valuation approach clearing accounts to be used in consolidated financial statement reporting.

Entity LT02 post a sales invoice to company code LT03

Once Goods receipts posted against Intercompany Purchase order, next step to post Vendor invoice posting in company code LT03.

The difference in value between two valuation approach has been posted in Gl account – “Valuation Transfer” with value of EUR 42.51 only in group view in Gl clearing account 52040000. Gl account is determined based on the above settings mentioned in 8KEN.

In addition to above accounting entry Valuation transfer GL get posted even at the time of price difference settlement posting during actual costing run.

VI. Actual Costing Run:

Calculate and post the actual costing run across the company code by using actual costing run CKMLCP. The actual costing run allocates the price difference from raw material to semi-Finished to Finished goods. In case of stock transfer from one pant to another both plants should be included in same costing run to settle the price difference from sending plant to receiving plant. The actual costing run determines all the material having price determination 3.Activating Actual Costing is not mandatory in SAPS/4HANA it depends on business requirement .

Let’s examine in Material Price Analysis -CKM3 what happens in the Legal and Group valuation view. When the goods receipt is performed in the receiving company code, an inter-company is calculated in the legal view and show in Inter company profit component created in OKTZ.

Legal Valuation View Receiving Plant LT03:

Group Valuation View in Receiving Plant LT03:

Legal Valuation View in Sending Plant LT02:

Group Valuation View in Sending Plant LT02:

Before concluding let’s simulate the all the accounting entry posted to understand the P&L balance in Legal and Group View. This accounting document get stored in Universal Journal table and can be analysed in COPA line item report KE24 in each valuation view.

Summary

By reading this blog post, you would have understood the concepts and configuration steps of multiple valuation approaches/transfer prices by using Legal and Group valuation .The management requirement also met with the valuating inventory at multiple level by including with and without intercompany profit.

When you divide up your company as a Profit center by manufacturing ,sales depot for same classification of material and we do more number of inter profit center transaction ,then there is a requirement to use the option of transfer price for inter profit transfer in this case activating profit center views will provide the inventory valuation at profit center level. The additional configuration steps for profit center views are - Automatic Account determination, Determining Accounts for Internal Goods Movement, Transfer price Pricing procedure (8KEA).

Limitation on the Multiple valuation approaches :

- You can only perform group costing within a single controlling area

- Multiple valuation approaches cannot be used for the purposes of make-to-order production for unvaluated customer sales order stock.

- A deactivation of multiple valuation approaches/transfer prices in SAP S/4HANA is currently impossible. !

- Multiple valuations approach /transfer prices are not supported in RAR (FI-RA). The corresponding currencies must be deactivated in customizing for RAR.

- A maximum of three currency fields are available for the operational inventory valuation of the materials

- The subsequent implementation of multiple valuation approaches in a productive SAP S/4HANA system is not yet supported. Therefore, if multiple valuation approaches are required in your group, the current recommendation is to introduce the multiple valuations in the ERP system and then migrate to SAP S/4HANA.

Thanks

Sudharsan R

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance,

- FIN Controlling

Labels:

35 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

25 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

25 -

Expert Insights

114 -

Expert Insights

167 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

240 -

Roadmap and Strategy

1 -

Technology Updates

1,501 -

Technology Updates

89

Related Content

- SAP S/4HANA Data Migration and Master Data Management Best Practices with SAP BTP in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Sales in Enterprise Resource Planning Blogs by SAP

- SAP Activate methodology Prepare and Explore phases in the context of SAFe. in Enterprise Resource Planning Blogs by SAP

- Preparing for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 17 | |

| 5 | |

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 |