- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Governance, Risk, and Compliance (GRC) with SAP S/...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hello and welcome to the release highlights for Governance, Risk, and Compliance (GRC) with SAP S/4HANA Cloud, public edition 2308. This blog contains selected highlights from SAP Financial Compliance Management, SAP Document and Reporting Compliance, and tax-related enhancements for Indirect Taxation Abroad (RITA) along with their business benefits and deep-dive system demos.

To get a quick overview of our SAP S/4HANA Cloud 2308 highlights for Governance, Risk, and Compliance, watch this 3-minute video:

This blog covers the following topics:

SAP Financial Compliance Management

SAP Document and Reporting Compliance

Registration for Indirect Taxation Abroad (RITA)

SAP Cloud Identity Access Governance

- Additional Workflow Options to Support Business Requirements

- Administrator View to Manage Privileged Access Management ID

- Mass Maintenance of Business Roles

SAP Financial Compliance Management

SAP Financial Compliance Management provides you with the tools to become compliant with internal controls, laws, and regulations that apply to your organization. The solution enables you to document your internal controls framework and manage potential risks to your organization, as well as develop and monitor checks put in place to ensure compliance.

If you are new to the topic of SAP Financial Compliance Management, I recommend that you first read my blog on Governance, Risk, and Compliance (GRC) with SAP S/4HANA Cloud 2102. There, you will find a quick introduction into the cloud GRC product. Please note that SAP Financial Compliance Management is not part of SAP S/4HANA Cloud, but is a separate product and requires an additional licence.

Please note that SAP Financial Compliance Management is integrated with SAP S/4HANA Cloud via scope item 'Financial Operation Monitoring with SAP Financial Compliance (3KY)' and requires a separate license.

More Information

- SAP Help Portal: SAP Financial Compliance Management

- SAP Process Navigator: Financial Operation Monitoring with SAP Financial Compliance (3KY)

Operational Dashboard

Compliance specialists now benefit from full transparency into the status quo of issue and remediation management provided by the ‘Issues Overview’ app. Thanks to the intuitive dashboard, they are guided by the system to those issues that require their attention and can directly drill-down to take immediate action.

Value Proposition

- Real-time insights and full transparency regarding issues and remediation

- Intuitive and easy-to-use graphical user interface with personalization options

- Reduce reaction time by guiding the users where to take action

- Easy-to-use dashboard

Capabilities

- Pre-defined cards to analyze most frequently used topics:

- Issues by conclusion

- Open issues by status

- Tasks by due date and priority

- Validation findings needing follow-ups

- Transferred issues to external case management systems by risk level

- Additional cards:

- Task processors

- Issue owners

- Quick links for direct access to related apps

Fig. 1: The operational dashboard in SAP Financial Compliance Management provides full transparency for compliance specialists regarding issue and remediation management

Back to Top

System Demo

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_h98chf4e

More Information

- SAP Help Portal: Issues Overview

SAP Document and Reporting Compliance

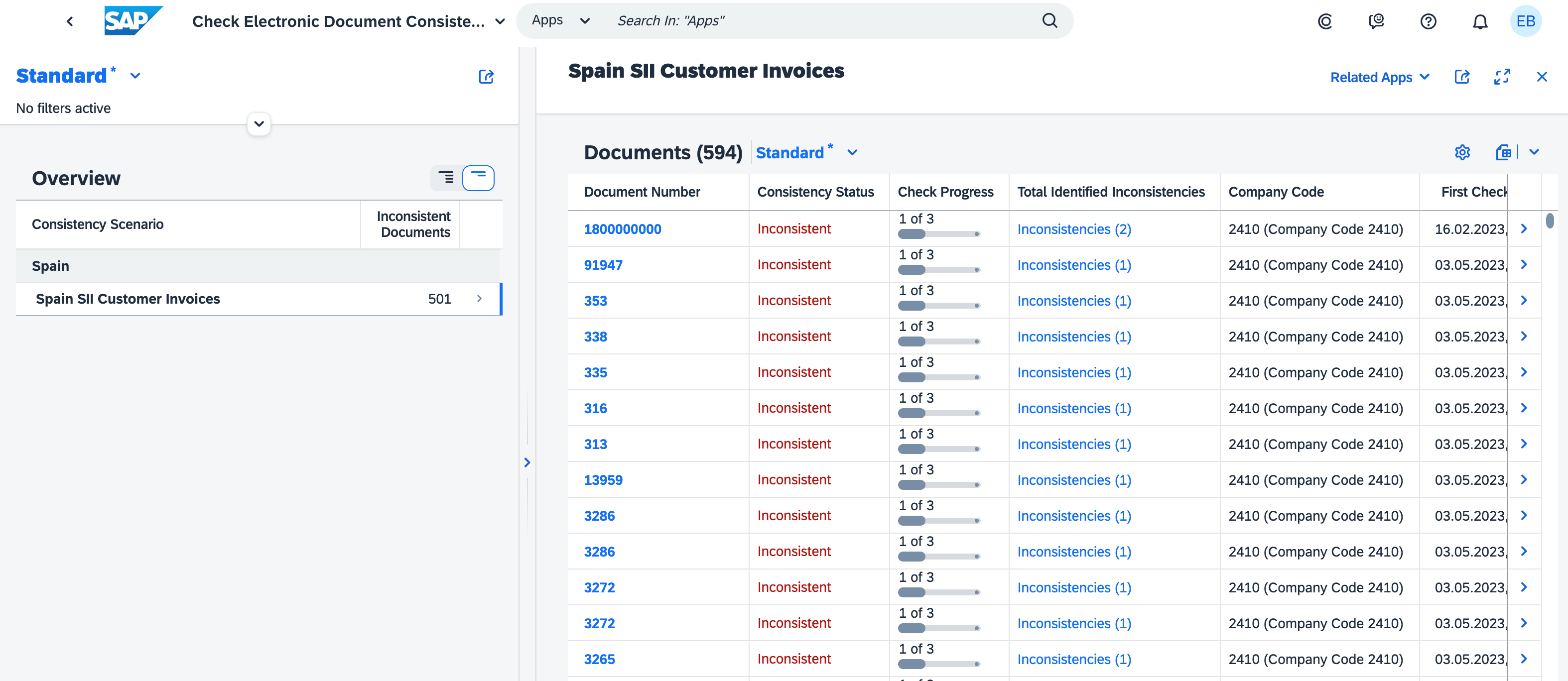

Electronic Document Consistency Check

Tax authorities have been continuously increasing the number and the complexity of legal mandates and, lately, they have been moving toward continuous transactions controls. These translate to business processes extended with an additional step that sends business documents to the tax authorities for registration / approval before business transactions can take place. And, as a result, tax authorities collect all data required to automatically verify returns upon submission or even prepare draft returns on behalf of tax payers.

SAP Document and Reporting Compliance allows you to automatically check the consistency of business transactions between SAP S/4HANA Cloud and tax authorities’ platforms to early identify discrepancies and allow enough time for corrections prior month-end. In addition, you can centrally review the findings and initiate corrections. This way, you can ensure traceability and minimize the risk of noncompliance at the time of returns submission.

Value Proposition

- Gain real-time insights into your compliance status

- Proactively identify inconsistencies of electronic documents and centrally review findings

- Streamline remediation of inconsistencies to ensure full consistency between electronic documents in the system of records and the data collected by tax authorities

- Minimize risk of non-compliance when tax authorities reconcile periodic tax returns to the records collected in real-time or near-real time in their platforms

Capabilities

- Automate consistency checks between the electronic documents in the system and the ones stored in the tax authority’s system or local platforms

- Centrally review inconsistencies

- Initiate corrections of inconsistencies

Fig. 2: With the consistency check for electronic documents, you can proactively check the consistency of business transactions between SAP S/4HANA Cloud and the data of the tax authorities

Fig. 3: With the consistency check for electronic documents, you can review inconsistencies and initiate corrections

Back to Top

System Demo

https://sapvideo.cfapps.eu10-004.hana.ondemand.com/?entry_id=1_tdmcs286

Video 2: System demo for electronic documents consistency checker

More Information

- SAP Help Portal: Check Electronic Document Consistency

Automated Error Notifications During Electronic Documents Processing

SAP Document and Reporting Compliance allows you to comply with local regulations, including automated creation and electronic exchange of business documents in the required format. The ’Manage Electronic Documents’ app allows you to review electronic documents and manage corrections across countries.

With the new release, you can proactively notify errors by sending emails to predefined mailboxes (e.g. support teams or individual users) or setting up automated notifications to specific users. From the notification or the document list (Logs tab or Error Tag), you can easily navigate to the ‘Error Analysis’ page, which provides a streamlined view by error type and assists you in troubleshooting errors, retriggering email notifications and initiating corrections. Another enhancement with electronic documents processing is the option to manually create electronic documents when, for example, automatic creation fails or electronic document needs to be recreated upon update of underlying business transaction.

Value Proposition

- Accelerate corrections by automatically notifying responsible person when errors occur and avoid late submission due to errors

- Maximize efficiency by prompting user actions when required and preventing unnecessary manual monitoring

- Increased usability

- Seamlessly handle special case electronic documents e.g. recreate e-documents previously deleted

Capabilities

- Set up automated error notifications for specific users by error category

- Review error by category, manually send email notification and initiate corrections

- Manually create electronic documents when automatic creation fails or original documents are deleted with new SAP Fiori app ‘Create Electronic Documents Manually - Special Cases’

Fig. 4: Thanks to the automated error notifications during electronic documents processing, you can proactively trigger error notifications during electronic documents processing

More Information

- SAP Help Portal: Error Analysis

- SAP Help Portal: Create Electronic Documents Manually - Special Cases

Fig. 5: With the new functionality, you can manually send e-mail notifications

Fig. 6: In addition, you can review errors and initiate corrections of your electronic documents

Back to Top

System Demo

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_1xkg8ufo

Video 3: System demo for automated error notifications during electronic documents processing

More Information

- SAP Help Portal: Setting Up Error Notifications

- SAP Help Portal: Create Electronic Documents Manually - Special Cases

Early Adopter: Intuitive Indirect Tax Operations with the Tax Register and SAP Document and Reporting Compliance

Please note: Currently in early adoption only. Available for early adopters as of mid of September 2023.

Value Proposition

- Open-item management of tax items

- Clear tax liabilities efficiently

- Visualize the lifecycle of each tax line such as the tax item posted out of business transactions, reported, cleared, or paid

- Visualize posted tax data based on tax-specific attributes with the new Fiori app ‘Display Tax Items’

Capabilities

- Settle your tax liabilities with the new Fiori app ‘Manage Tax Payable’

- Create tax authorities as business partners (new role)

- Post tax payments based on tax returns created with SAP Document and Reporting Compliance or post manual payments

- Cancel tax payments and re-open cleared items in case of any incorrect posting

* Native integration with SAP Document and Reporting Compliance

System Demo

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_b5fg2brg

Video 4: For early adopters: System demo for tax operations with tax register and SAP Document and Reporting Compliance

Registration for Indirect Taxation Abroad (RITA)

With growing international economic trends and digital economies, many countries over the world allow foreign companies to register for indirect taxes in the country / jurisdiction without setting a permanent establishment.

Registration for Indirect Taxation Abroad enables legal entities to step out of national / jurisdictional borders and extend business abroad.

RITA is the solution in SAP S/4HANA Cloud enabling a single legal entity to perform indirect tax calculation in multiple countries. Therefore, RITA is not intended for permanent establishments abroad.

With the 2308 release, we have two RITA-innovations related for tax.

More Information

- Blog: Registration for Indirect Taxation Abroad (RITA) in 2302 – A Pragmatic Approach

- For more information, please see SAP Early Adopter Care: SAP Registration for Indirect Taxation Abroad (RITA)

- Registration for Indirect Taxation Abroad with SAP S/4HANA Cloud 2202

Proposed Tax Posting

Intra-company stock transfers and customer consignments are common ways to manage inventory. Companies that carry out EU intra-community cross-border deliveries of goods between physical locations can be subject to specific tax and reporting regulations. In these cases, you can use the Create Proposed Tax Postings from Goods Movements job to generate a list of proposed tax postings for your goods movements transactions. You can then use the Manage Proposed Tax Postings app to review and accept these proposals, or amend them if necessary. You can also call up a pricing analysis in the Managed Proposed Tax Postings app to see more information about the pricing conditions that led the system to make the proposal for the tax posting.

Value Proposition

- Based on RITA

- For Intra-Company Intracommunity (EU) Cross-Border Transactions

- End-to-end process-oriented solution

Capabilities

- Create Proposed Tax Postings from Goods Movements

- Manage Proposed Tax Postings

- Pricing Analysis for Proposed Tax Postings

Fig. 7: With the proposed tax posting functionality, you can manage your proposed tax postings

More Information

- SAP Help Portal: Create Proposed Tax Postings from Goods Movements

- SAP Help Portal: Manage Proposed Tax Postings

Consignment Register - Sales View

If you as a supplier use a customer consignment process with intra-community simplification rules between two EU countries under the new European Council Directive 2006/112/EC Article 17a, you are legally required to track all movements of your consignment goods to and from the call-off stock.

Value Proposition

- Provide certain data to help you fulfill European Council Directive 2006/112/EC Article 243(3) and Article 54a, in case of movements to or from a "simplified" consignment stock/call-off stock.

Capabilities

- Keep track of the movements of your consignment stock with the following process types:

- Consignment fill-up (fill-up)

- Consignment issue (issue)

- Consignment pick-up (pick-up)

- Consignment return (return)

- Positive and Negative correction.

- Export your results to a spreadsheet

- Upload Data to Consignment Register

Fig. 8: With the Consignment Register - Sales View, you can keep track of the movements of your consignment stock

More Information

- SAP Help Portal: Consignment Register - Sales View

- SAP Help Portal: Upload Data to Consignment Register

SAP Cloud Identity Access Governance

Additional Workflow Options to Support Business Requirements

Additional workflow configuration options to support various business requirements:

- Auto Approval Stage for Auto Provisioning: You can now configure an auto approval stage and path and use this path in business framework for any initiator condition.

- Business Rule Framework for Configurable Workflow and Initiator Rules: This feature helps you to create routing rules, conditions, and path in Business Rule Framework. You can also configure initiators for paths.

- Dedicated Optional Risk Owner Stage: You can configure an optional Risk Owner Stage in a workflow path to route a request to better manage unmitigated risks.

Benefits

- Customize the workflow as per the process needs

- Automatically approve noncritical assignment requests

Capabilities

Improved workflow to enable additional customization:

- Optional auto-approval and risk-owner stage

- Administrator ability to cancel a request

More Information

- SAP Help Portal: What's New

- SAP Help Portal: Setting Up Workflow Service

Administrator View to Manage Privileged Access Management ID

The new Manage PAM session app allows the administrators to view all PAM IDs that exist, are in use and/or inactive. The app also lists additional information on session status, validity of the PAM ID, information on when the session was started and reasons for which the PAM IDs are required.

Benefits

- Increase administrator visibility into PAM ID assignments

- Obtain insights into the PAM IDs that are currently in use and the systems they're being used in

- Provide transparency into the PAM ID log review status

Capabilities

- New administrative view that will provide insight into the assignment and use of the privileged access management (PAM) ID to better manage the process

More Information

- SAP Help Portal: What's New

- SAP Help Portal: Manage PAM Session

Mass Maintenance of Business Roles

This feature provides capability to upload multiple new business roles and also update existing business roles attributes using the file upload. You can download the template for business roles.

Benefits

- Simplify the creation and maintenance of business roles

- Streamline the process for frequently updated attributes

- Boost transparency through an auditable process

- Import the “business roles” definition from a file

Maintain multiple attributes for one or more existing business roles at any given time

More Information

- SAP Help Portal: What's New

- SAP Help Portal: Business Role Mass Maintenance – File Upload

Here, you can find 20 replays and presentations as well as system demos for the topics listed in this blog post and many more as part of the SAP S/4HANA Cloud, public edition 2308 release. For more information on the SAP S/4HANA Cloud, Public Edition Early Release Series and how to sign up for it, check out this blog post.

Inside SAP S/4HANA Podcast

| As always, I would like to encourage you to subscribe to our podcast “Inside SAP S/4HANA”. This podcast leverages the unique knowledge and expertise of SAP S/4HANA product experts, partners and customers to address objects of interest by sharing product insights and project best practice. There is no customer success without product success and project success; we share all ingredients with you to get to the next level and make your SAP S/4HANA project a success. Subscribe now and benefit from the shared knowledge. |

openSAP microlearnings for SAP S/4HANA

Our openSAP microlearnings for SAP S/4HANA offer an exciting new learning opportunity. What began with a small batch of 20 videos, has now become a channel with more than 50 microlearnings that have generated over 20,000 views since then. Today we cover multiple lines of business such as finance, manufacturing, and supply chain, and key technology topics like Master Data Management, extensibility, SAP User Experience, and upgrade management. We are continuously adding new microlearnings to the SAP S/4HANA channel, so make sure you check them out.Your Voice Matters!

If you want to learn more and actively engage with SAP subject matter experts on SAP S/4HANA Cloud, public edition, join our SAP S/4HANA Cloud, public edition community–now fully integrated with SAP Community. The community brings together customers, partners, and SAP experts and has a clear mission: deliver an interactive community to engage with one another about best practices and product solutions. We invite you to explore the SAP S/4HANA Cloud, public edition community ‘one-stop shop’ as the central place for all resources, tools, content questions, answers and connect with experts to guide you through your journey to SAP S/4HANA Cloud, public edition.Other SAP S/4HANA Cloud and SAP S/4HANA Enablement Assets

SAP S/4HANA is the foundation of the intelligent enterprise and is an innovative, robust, and scalable ERP. We at Cloud ERP Product Success and Cloud Co-Innovation offer a service as versatile as our product itself. Check out the numerous offerings our Enablement team has created for you below:

More Information on SAP S/4HANA Cloud, Public Edition:

- GRC Collection Blog (roadmap, release highlights, microlearnings) here

- Customer Influence Review Round Q3/2023 – Results for SAP S/4HANA Cloud for Finance, public edition – here

- SAP S/4HANA Cloud, public edition release info here

- Latest SAP S/4HANA Cloud, public edition release blog posts here and previous release highlights here

- Product videos for SAP S/4HANA Cloud and SAP S/4HANA

- SAP S/4HANA PSCC Digital Enablement Wheel here

- SAP S/4HANA Cloud, Public Edition Early Release Series here

- SAP S/4HANA Cloud for User Experience and Cross Topics, Public Edition Continuous Influence Session here

- Inside SAP S/4HANA Podcast here

- openSAP microlearnings for SAP S/4HANA here

- Best practices for SAP S/4HANA Cloud, public edition here

- SAP S/4HANA Cloud, public edition community: here

- Feature Scope Description here

- What’s New here

- Help Portal Product Page here

Feel free to ask your questions on SAP Community here. Follow the SAP S/4HANA Cloud tag and the PSCC_Enablement tag to stay up to date with the latest blog posts.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

160 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

220 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

- Working with SAFe Epics in the SAP Activate Discover phase in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |