- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Finance in SAP S/4HANA Cloud, Public Edition 2308

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-27-2023

8:31 AM

Welcome back finance experts. I'm happy to share a number of new innovations highlights freshly dropped with our SAP S/4HANA Cloud, Public Edition, 2308 for finance:

Video 1: Release Highlight Video for Finance in SAP S/4HANA Cloud, Public Edition 2308

Here are the topics covered in the video:

Manage Journal Entries App - New Version

We deliver an optimized user experience in one of the most used apps in finance: the Manage Journal Entries app. After initial user research and intense usability testing with end users from multiple companies we are proud to present the new Manage Journal Entries App. It has an improved page structure for better overview and more efficient navigation between journal entries as well as to related apps. The change log provided within the app makes it easier to overview what changes were made and by whom. These and many more improvements boost the productivity of General Ledger accounts.

Value Proposition

The new version offers significantly enhanced usability based on user research, including:

Capabilities

Demo 1: Manage Journal Entries App - New Version

For more information, see: Manage Journal Entries (New Version) or our What’s New Video.

Automated Supervision of Closing Tasks with Account Balance Validation

During the financial close process, accountants need to validate data quality to ensure the accuracy, completeness and compliance of financial results. As part of this process, they need to validate account balances on various financial positions and other dimensions such as cost object, profit center or segment. They need to run preventive validations prior to closing tasks (for example, validity of assets balances to prevent incorrect depreciation runs), validations after closing tasks (for example, validate zero-balance accounts after settlement runs), milestone validations (for example, balance sheet account variances between current and previous periods are within a predefined threshold), and more.

SAP S/4HANA Cloud provides the new Fiori apps Manage Balance Validation Rules and Groups (F6386) and View Balance Validation Results (F6387) to enable maintenance and execution of validation rules. In addition, these are seamlessly integrated with SAP S/4HANA Cloud for Advanced Financial Closing to further increase automation and accelerate entity close by executing validations when the preceding steps are completed, initiating follow-up steps if no errors are found and triggering notifications for prompt actions in case of errors or threshold violations.

Value Proposition

Capabilities

Demo 2: Automated Supervision of Closing Tasks with Account Balance Validation

Demo 2.1: Balance Validation

For more information, see: Balance Validation

*SAP S/4HANA Cloud for Advanced Financial Closing is needed. Integration planned with SAP S/4HANA Cloud, Public Edition planned with 2308.1

Enhancements in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

With the new version of in-house banking, new features are included. Features included are among other things withholding taxes and the calculation of fees. The withholding taxes feature allows for the calculation of credit, debit and overdraft interests, since these may be subject to withholding taxes depending on local legal requirements. The calculation of fees allows for the calculation of transaction- or account maintenance-based fees.

Value Proposition

Capabilities

For more information, see: Withholding Tax | SAP Help Portal

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_ukn56h8z

Demo 3: Fees in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

For more information, see: Manage In-House Bank Fees | SAP Help Portal

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_mpzq4nur

Demo 4: Cross Bank Area Postings in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_k9sw083n

Demo 5: Cash Pooling in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

Here are the topics not covered in the video

BlackLine Integration

The SAP Solution Extensions by BlackLine provide additional automation for key tasks during the financial close, especially the account substantiation process. Account line items or balances are extracted to the BlackLine Cloud, and accountants can verify and/or certify that they are correct.

Value Proposition

Capabilities

For more information, see: SAP Process Navigator, Scope Items 6IL and 6IM

Ability to configure an additional depreciation area for assets and assets under construction

The new scope items 5HG and 5KF are available that provide an additional depreciation area on top of the custom-specific valuation of the asset.

Value Proposition

Capabilities

For more information, see: Additional Depreciation Area | SAP Help Portal

SAP Fiori App for Asset Accounting - Post Asset Retirement

The new SAP Fiori app 'Post Asset Retirement' (F7107) is available. You can use the app for asset retirements with revenue and for scrapping. The new app is intended to replace the two existing apps ‘Post Retirement (Non-Integrated) – Without Customer’ (ABAON) and ‘Post Retirement – By Scrapping’ (ABAVN).

Value Proposition

Capabilities

For more information, see: 'Post Asset Retirement' App | SAP Help Portal

Create Supplier Invoice - Advanced' (MIRO) App for Integrated Asset Acquisition Postings

The app ‘Create Supplier Invoice – Advanced’ (MIRO) provides specific features for integrated posted asset acquisitions. The MIRO app will replace the existing app ‘Post Acquisition (Integrated AP) - Without Purchase Order‘ (F-90).

Value Proposition

Capabilities

For more information, see: 'Create Supplier Invoice - Advanced' (MIRO) App for Integrated Asset Acquisition Postings | SAP Help Portal

Approval Workflows for Supplier Down Payment Requests

When a supplier requests a down payment, it is necessary for the cost center responsible, such as the AP manager, to check whether the down payment request details are complete and error-free. To ensure that down payments are made correctly to your suppliers and to optimize supplier down payment processes, you can implement an approval workflow in which authorized personnel can review and verify a supplier down payment request before it is paid.

SAP S/4HANA Cloud provides the following Fiori apps for setting up approval workflows for verifying supplier down payment requests:

Value Proposition

Capabilities

For more information, see: Approval Workflows for Supplier Down Payment Requests

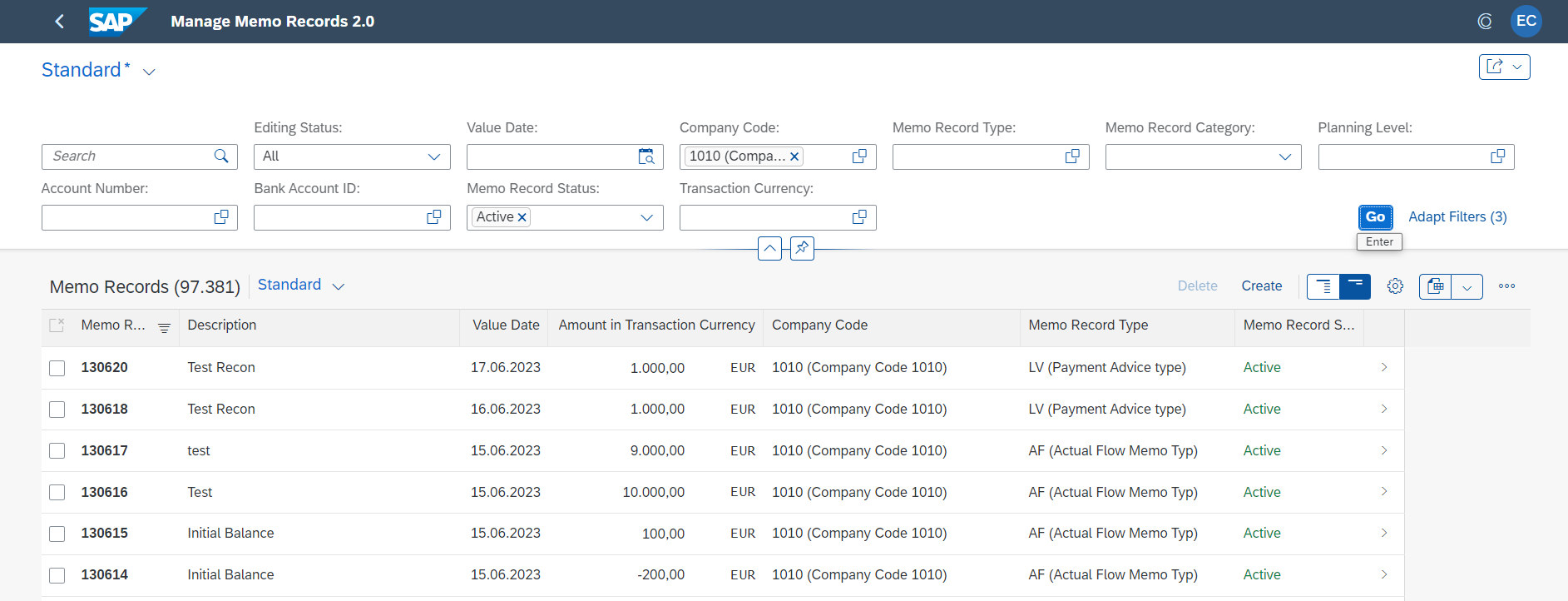

Managing Memo Records with Upload Capability

Memo Records 2.0 provides a more flexible and efficiently way for cash managers to manage memo records for both forecasted and actual cash flows. The memo record type has been reintroduced, and an important attribute, memo record category, has been introduced to enable different field status controls and lifecycle management. Additionally, mass import from spreadsheet is now supported, allowing for the processing of large numbers of memo records across systems. The memo records are displayed in the cash management apps to provide an up-to-date and more accurate view of your organization's cash position, such as Short-Term Cash Positioning, Cash Flow Analyzer, and Check Cash Flow Items.

Value Proposition

Capabilities

For more information, see: Manage Memo Records 2.0 and Import Memo Records 2.0.

Intraday Bank Statement Processing

With this feature, you can now post intraday bank statement items. That means, you don’t have to wait for your end-of-day bank statement to enter your system in order to post and clear items, but you can already start processing your payments during the day.

Value Proposition

Capabilities

For more information, see: Posting of Intraday Bank Statements and Overview on the Posting of Intraday Bank Statements.

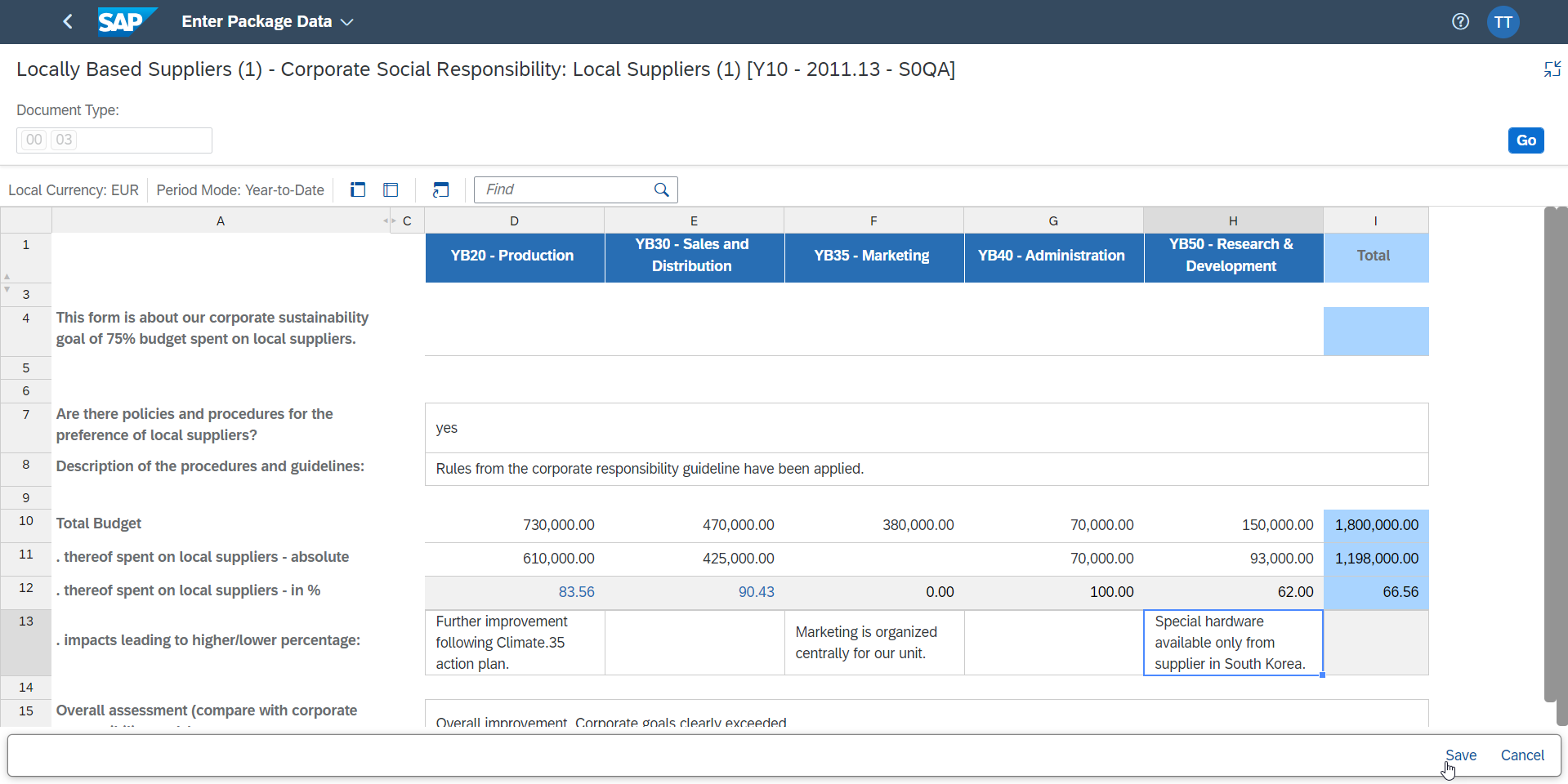

Relating questions and answers to numbers shown in a form (SAP Group Reporting Data Collection)

Notes to the annual statement, but also tax and sustainability reports require manual collection of explanatory notes. SAP Group Reporting Data Collection now enables customers to collect, analyse and summarize these via forms:

Value Proposition

Capabilities

For more information, see: User Guide for SAP GRDC

Group Reporting Extensibility: Customer-coded exchange rate determination in currency translation and enhancements for the Task API

Allows customers to write their own program logic in the following areas:

This requires to create and debug a BAdI Implementation in the SAP S/4HANA Cloud, public edition, ABAP Environment. Please read the great blog from dsada "Group Reporting: BAdI for Currency Transltion Deviating Rates" that guides you step-by-step thru an example implementation

Enabling Financial Accounting for U.S. Banks with Additional Posting Dimensions and Specific Chart of Accounts

Financial accounting for U.S. banks offers additional posting dimensions and a U.S.-specific chart of accounts to ensure a U.S. GAAP-compliant multidimensional accounting approach resulting in correct balance sheets and income statements for U.S. banks.

Value Proposition

Capabilities

For more information, see Accounting Enhancements for Banking.

Watch the Replays of Our SAP S/4HANA Cloud, Public Edition 2308 Early Release Series!

This July, we hosted a series of compelling live sessions from the heart of the SAP S/4HANA Engineering organization. Missed the live sessions? Watch our replays on demand!

Here, you can find the recording and a presentation for finance as well as 19 other topics as part of the SAP S/4HANA Cloud, public edition 2308 release. For more information on the SAP S/4HANA Cloud, Public Edition Early Release Series and how to sign up for it, check out this blog post.

Inside SAP S/4HANA Podcast

As always, I would like to encourage you to subscribe to our podcast “Inside SAP S/4HANA”. This podcast leverages the unique knowledge and expertise of SAP S/4HANA product experts, partners and customers to address objects of interest by sharing product insights and project best practice. There is no customer success without product success and project success; we share all ingredients with you to get to the next level and make your SAP S/4HANA project a success. Subscribe now and benefit from the shared knowledge!

openSAP microlearnings for SAP S/4HANA

Our openSAP microlearnings for SAP S/4HANA offer an exciting new learning opportunity. What began with a small batch of 20 videos, has now become a channel with more than 50 microlearnings that have generated over 20,000 views since then. Today we cover multiple lines of business such as finance, manufacturing, and supply chain, and key technology topics like Master Data Management, key user extensibility, SAP User Experience, and upgrade management. We are continuously adding new microlearnings to the SAP S/4HANA channel, so make sure you check them out.

Your Voice Matters!

If you want to learn more and actively engage with SAP subject matter experts on SAP S/4HANA Cloud, public edition, join our SAP S/4HANA Cloud, public edition community–now fully integrated with SAP Community. The community brings together customers, partners, and SAP experts and has a clear mission: deliver an interactive community to engage with one another about best practices and product solutions. We invite you to explore the SAP S/4HANA Cloud, public edition community ‘one-stop shop’ as the central place for all resources, tools, content questions, answers and connect with experts to guide you through your journey to SAP S/4HANA Cloud, public edition.

Other SAP S/4HANA Cloud and SAP S/4HANA Enablement Assets

SAP S/4HANA is the foundation of the intelligent enterprise and is an innovative, robust, and scalable ERP. We at Cloud ERP Product Success and Cloud Co-Innovation offer a service as versatile as our product itself. Check out the numerous offerings our Enablement team has created for you below:

Further Information:

Feel free to ask your questions on SAP Community here. Follow the SAP S/4HANA Cloud tag and the PSCC_Enablement tag to stay up to date with the latest blog posts.

Follow us via @Sap and #S4HANA, or myself via @HaukeUlrich and LinkedIn

- Accounting: Manage Journal Entries - New Version with amazing usability enhancements

- Entity Close: Automated Supervision of Closing Tasks with Account Balance Validation

- Entity Close: Blackline Integration

- Asset Accounting: Ability to configure an additional depreciation area for assets and assets under construction

- Asset Accounting: 'Create Supplier Invoice - Advanced' (MIRO) App for Integrated Asset Acquisition Postings

- Asset Accounting: SAP Fiori app for asset accounting - post asset retirement

- Workflow: Approval Workflows for Supplier Down Payment Requests

- Cash Management: Managing Memo Records with Upload Capability

- Bank Statement Processing: Intraday Bank Statement Processing

- Payment Factory: Enhancements in In-House Banking for Advanced Payment Management

- Group Reporting: Relating questions and answers to numbers shown in a form

- Group Reporting: Customer-coded Exchange Rate Determination in Currency Translation and Enhancements for the Task API

- Financial Services Industry: Enabling financial accounting for U.S. banks with additional posting dimensions and specific chart of accounts

Video 1: Release Highlight Video for Finance in SAP S/4HANA Cloud, Public Edition 2308

Here are the topics covered in the video:

Manage Journal Entries App - New Version

We deliver an optimized user experience in one of the most used apps in finance: the Manage Journal Entries app. After initial user research and intense usability testing with end users from multiple companies we are proud to present the new Manage Journal Entries App. It has an improved page structure for better overview and more efficient navigation between journal entries as well as to related apps. The change log provided within the app makes it easier to overview what changes were made and by whom. These and many more improvements boost the productivity of General Ledger accounts.

Value Proposition

The new version offers significantly enhanced usability based on user research, including:

- Direct access to more related apps and functions

- More fields to filter for and display

- Greater detail in the list of journal entries

- Clearer navigation between journal entries and line items

- The ability to display parked documents, workflow status, and related documents. You can also display predictive journal entries if you use predictive accounting.

Capabilities

- Display journal entries and their line items

- Create, copy, & edit journal entries

- Upload journal entries using templates

- Reverse journal entries individually or through mass reversals.

- View reversal logs and change logs

- See related documents, such as purchase orders or incoming invoices

- Display amounts in different currencies

- Display intercompany journal entries

- See an overview of the customer and supplier accounting document data

- Post notes and add attachments to journal entries

- Display predictive journal entries if you use predictive accounting

Demo 1: Manage Journal Entries App - New Version

For more information, see: Manage Journal Entries (New Version) or our What’s New Video.

Automated Supervision of Closing Tasks with Account Balance Validation

During the financial close process, accountants need to validate data quality to ensure the accuracy, completeness and compliance of financial results. As part of this process, they need to validate account balances on various financial positions and other dimensions such as cost object, profit center or segment. They need to run preventive validations prior to closing tasks (for example, validity of assets balances to prevent incorrect depreciation runs), validations after closing tasks (for example, validate zero-balance accounts after settlement runs), milestone validations (for example, balance sheet account variances between current and previous periods are within a predefined threshold), and more.

SAP S/4HANA Cloud provides the new Fiori apps Manage Balance Validation Rules and Groups (F6386) and View Balance Validation Results (F6387) to enable maintenance and execution of validation rules. In addition, these are seamlessly integrated with SAP S/4HANA Cloud for Advanced Financial Closing to further increase automation and accelerate entity close by executing validations when the preceding steps are completed, initiating follow-up steps if no errors are found and triggering notifications for prompt actions in case of errors or threshold violations.

Value Proposition

- Improve entity closing process governance with full visibility of validations.

- Reduce manual effort on closing tasks through automating manual validations.

- Accelerate the closing by automating error detection and notifying users for prompt actions.

- Higher financial statement quality via early data qualification.

Capabilities

- Define account balance validation rules and groups for validation tasks.

- Execute the validations and analyze the validation results to take required actions.

- Plan and orchestrate validation tasks as part of entity close*.

- Control closing process according to validation results*.

Demo 2: Automated Supervision of Closing Tasks with Account Balance Validation

Demo 2.1: Balance Validation

For more information, see: Balance Validation

*SAP S/4HANA Cloud for Advanced Financial Closing is needed. Integration planned with SAP S/4HANA Cloud, Public Edition planned with 2308.1

Enhancements in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

With the new version of in-house banking, new features are included. Features included are among other things withholding taxes and the calculation of fees. The withholding taxes feature allows for the calculation of credit, debit and overdraft interests, since these may be subject to withholding taxes depending on local legal requirements. The calculation of fees allows for the calculation of transaction- or account maintenance-based fees.

Value Proposition

- Fulfilment of legal requirement for calculation of withholding taxes.

- In house banking can pass on incurred expenses resulting from payments for example, foreign payments, domestic payments, and others to their account holders also known as subsidiaries.

Capabilities

- Withholding tax types and codes are determined in dependency of the country related to the in-house bank and the country where the subsidiary is located.

- Based on the calculated interests, withholding taxes are posted on the corresponding in-house bank account.

For more information, see: Withholding Tax | SAP Help Portal

- Fees can be assigned on bank-area level, group level and single account level.

- Fees can be maintained as fixed fees, interval or incremental fees.

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_ukn56h8z

Demo 3: Fees in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

For more information, see: Manage In-House Bank Fees | SAP Help Portal

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_mpzq4nur

Demo 4: Cross Bank Area Postings in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_k9sw083n

Demo 5: Cash Pooling in SAP S/4HANA Cloud for Advanced Payment Management, Public Edition

Here are the topics not covered in the video

BlackLine Integration

The SAP Solution Extensions by BlackLine provide additional automation for key tasks during the financial close, especially the account substantiation process. Account line items or balances are extracted to the BlackLine Cloud, and accountants can verify and/or certify that they are correct.

Value Proposition

- Eliminates labor-intensive, non-value adding activities

- Reduces the threat to the integrity of financial statements

- Reduce the risk of control failure

- Shortens cycle times

Figure 1: BlackLine Reconciliation

Figure 1: BlackLine Reconciliation

Capabilities

- Standardization of G/L balances and line items extraction

- Risk-based approach for auto-certification of certain balances

- Central storage of supporting documents and certifications for easy audit

For more information, see: SAP Process Navigator, Scope Items 6IL and 6IM

Ability to configure an additional depreciation area for assets and assets under construction

The new scope items 5HG and 5KF are available that provide an additional depreciation area on top of the custom-specific valuation of the asset.

Value Proposition

- Consistent customer-specific parallel valuation for the entire life of the asset

- Comparison of the asset’s values in an additional depreciation area also for future fiscal years and in different currencies using the asset valuation display in the ‘Manage Fixed Assets’ app

- Insights into asset values of the additional depreciation area using analytical apps. Immediate reflection of asset values in analytical reports

Capabilities

- Optional scope items that can be activated based on customer-specific requirements in addition to the standard Asset Accounting scope items

- Separate depreciation area to calculate asset values for further local or industry-specific depreciation and reporting rules in parallel

- Out-of-the-box use of preconfigured additional depreciation keys and easy configuration of depreciation terms such as useful life and maximum amount for low-value assets for fixed assets in this depreciation area

- Immediate reflection of asset values in analytical reports

Figure 2: Use Custom Specific Depreciation Area

Figure 2: Use Custom Specific Depreciation Area

For more information, see: Additional Depreciation Area | SAP Help Portal

SAP Fiori App for Asset Accounting - Post Asset Retirement

The new SAP Fiori app 'Post Asset Retirement' (F7107) is available. You can use the app for asset retirements with revenue and for scrapping. The new app is intended to replace the two existing apps ‘Post Retirement (Non-Integrated) – Without Customer’ (ABAON) and ‘Post Retirement – By Scrapping’ (ABAVN).

Value Proposition

- Revised and optimized SAP Fiori app for asset retirement postings

Capabilities

- Selection of all ledgers or individual ledgers or depreciation areas

- Representation of the types of postings using business transaction types

Figure 3: New Post Asset Retirement App

Figure 3: New Post Asset Retirement App

For more information, see: 'Post Asset Retirement' App | SAP Help Portal

Create Supplier Invoice - Advanced' (MIRO) App for Integrated Asset Acquisition Postings

The app ‘Create Supplier Invoice – Advanced’ (MIRO) provides specific features for integrated posted asset acquisitions. The MIRO app will replace the existing app ‘Post Acquisition (Integrated AP) - Without Purchase Order‘ (F-90).

Value Proposition

- Posting of asset acquisition and corresponding payable to a supplier in the same app

- One single app supporting both acquisition with and without purchase order for fixed assets

- Reduced data entry

Capabilities

- Integrated asset acquisition posting for all valuations in parallel

Figure 4: AP Integrated Asset Aquisition with 'Create Supplier Invoice - Advanced' App

Figure 4: AP Integrated Asset Aquisition with 'Create Supplier Invoice - Advanced' App

For more information, see: 'Create Supplier Invoice - Advanced' (MIRO) App for Integrated Asset Acquisition Postings | SAP Help Portal

Approval Workflows for Supplier Down Payment Requests

When a supplier requests a down payment, it is necessary for the cost center responsible, such as the AP manager, to check whether the down payment request details are complete and error-free. To ensure that down payments are made correctly to your suppliers and to optimize supplier down payment processes, you can implement an approval workflow in which authorized personnel can review and verify a supplier down payment request before it is paid.

SAP S/4HANA Cloud provides the following Fiori apps for setting up approval workflows for verifying supplier down payment requests:

- Manage Teams and Responsibilities - Supplier Down Payment Requests

- Manage Workflows - Supplier Down Payment Requests

- Verify Supplier Down Payment Requests

- Verify Supplier Down Payment Requests - Approver Inbox

- Verify Supplier Down Payment Requests - Approver Outbox

Value Proposition

- Optimize supplier down payment processes

- Require a second or third party from inside the company to review and verify a supplier down payment request before payment is made.

- Help mitigate manual errors and internal fraud.

Capabilities

- Enable approval workflows for supplier down payment requests based on user configurations.

- Allow requesters to create, display, edit, and submit supplier down payment requests for verification and approval.

- Allow designated approvers to view and process submitted supplier down payment requests. Approvers can choose to approve, reject, or send back a submitted request, and then the system changes the request status accordingly in the requester’s worklist.

Figure 5: Verify Supplier Down Payment Request Inbox

Figure 5: Verify Supplier Down Payment Request Inbox

For more information, see: Approval Workflows for Supplier Down Payment Requests

Managing Memo Records with Upload Capability

Memo Records 2.0 provides a more flexible and efficiently way for cash managers to manage memo records for both forecasted and actual cash flows. The memo record type has been reintroduced, and an important attribute, memo record category, has been introduced to enable different field status controls and lifecycle management. Additionally, mass import from spreadsheet is now supported, allowing for the processing of large numbers of memo records across systems. The memo records are displayed in the cash management apps to provide an up-to-date and more accurate view of your organization's cash position, such as Short-Term Cash Positioning, Cash Flow Analyzer, and Check Cash Flow Items.

Value Proposition

- Efficient handling of memo record creation via import jobs

- Dynamic field status control and lifecycle management based on predefined memo record categories and user-defined memo record types

- Flexible use of memo records in representing actual and forecasted cash flows

- Transparent data control with separate database table and source tracking

- Finer granularity in reporting with attributes such as source application and certainty level

Capabilities

- Create memo records manually or import memo records from a spreadsheet

- Manage different types of memo records for both forecasted and actual cash flows

- Implement dynamic field status controls based on user-defined memo record types and predefined memo record categories

Figure 6: New Manage Memo Record App

Figure 6: New Manage Memo Record App

For more information, see: Manage Memo Records 2.0 and Import Memo Records 2.0.

Intraday Bank Statement Processing

With this feature, you can now post intraday bank statement items. That means, you don’t have to wait for your end-of-day bank statement to enter your system in order to post and clear items, but you can already start processing your payments during the day.

Value Proposition

- Quick update of your bank transfers and cash flow by posting your bank statement items immediately and clearing the open items in your system as soon as you receive an intraday bank statement

- Avoid duplicate postings of items referring to the same bank transfer by identifying them automatically via the account servicer reference (related items) and by assigning them to specific processing categories

Capabilities

- Posting of intraday bank statements in the CAMT.052 format (together with end-of-day bank statements in the CAMT.053 format)

- Automated identification of items referring to the same bank transfer in case of multiple intraday bank statements (related items)

Figure 7: Intraday Bank Statement Processing

Figure 7: Intraday Bank Statement Processing

For more information, see: Posting of Intraday Bank Statements and Overview on the Posting of Intraday Bank Statements.

Relating questions and answers to numbers shown in a form (SAP Group Reporting Data Collection)

Notes to the annual statement, but also tax and sustainability reports require manual collection of explanatory notes. SAP Group Reporting Data Collection now enables customers to collect, analyse and summarize these via forms:

Value Proposition

- Form designers can ask questions within a form that optionally refer to numbers, such as:

- How do you explain the deviation >5%?

- List contracts, projects, etc.

- Share an assessment of key figures

Capabilities

- Questions and answers:

- Ask a question with answers for each item in a list

- Expand number of answers with the dimensionality of the form

- Relate to numbers or sets of numbers shown in the form

- Combine with visual controls including number-based conditions (for example, explain why a threshold of 5% between numbers A and B is exceeded)

Figure 8: Explanatory Notes in Group Reporting Data Collection

Figure 8: Explanatory Notes in Group Reporting Data Collection

For more information, see: User Guide for SAP GRDC

Group Reporting Extensibility: Customer-coded exchange rate determination in currency translation and enhancements for the Task API

Allows customers to write their own program logic in the following areas:

- Use custom code to determine alternative exchange rates for the specific translation in the currency translation task

- Provide more options in the Task API (continuation of previous release development):

- Run asynchronous task actions for data monitor tasks in group reporting such update or test run

- Retrieve configuration settings on the task definition

- Provide information to construct a task log URL

This requires to create and debug a BAdI Implementation in the SAP S/4HANA Cloud, public edition, ABAP Environment. Please read the great blog from dsada "Group Reporting: BAdI for Currency Transltion Deviating Rates" that guides you step-by-step thru an example implementation

Enabling Financial Accounting for U.S. Banks with Additional Posting Dimensions and Specific Chart of Accounts

Financial accounting for U.S. banks offers additional posting dimensions and a U.S.-specific chart of accounts to ensure a U.S. GAAP-compliant multidimensional accounting approach resulting in correct balance sheets and income statements for U.S. banks.

Value Proposition

- Enable a multidimensional accounting approach for U.S. banks based on reporting dimensions instead of additional accounts

- Easy-to-use as banking-specific enhancements are directly and seamlessly integrated into the core financial processes

- Help ensure the accuracy of the balance sheets and income statements of U.S. banks

Capabilities

- Enable balance sheets and income statements for banks operating in the U.S. based on U.S. GAAP:

- Addition of new accounts to the default chart of accounts YCOA that are relevant only for banks

- New field status groups to control the visibility and editability of these fields and dimensions

- Banking-specific accounts each taken into account in a financial statement version tailored to the requirements of banks

- Enable new additional accounting dimensions in general ledger line items and analytical reports needed for banks: product group, branch, data source, customer country/region, customer group, customer industry

- Support flexible hierarchies for the dimension product group for analytics and reporting

- Enable balance carryforwards for balance sheet and P&L accounts including the dimensions product group, customer group, country/region of customer, and trading partner

Figure 9: Financial Statement Version for Banking

Figure 9: Financial Statement Version for Banking

For more information, see Accounting Enhancements for Banking.

Watch the Replays of Our SAP S/4HANA Cloud, Public Edition 2308 Early Release Series!

This July, we hosted a series of compelling live sessions from the heart of the SAP S/4HANA Engineering organization. Missed the live sessions? Watch our replays on demand!

Here, you can find the recording and a presentation for finance as well as 19 other topics as part of the SAP S/4HANA Cloud, public edition 2308 release. For more information on the SAP S/4HANA Cloud, Public Edition Early Release Series and how to sign up for it, check out this blog post.

Inside SAP S/4HANA Podcast

As always, I would like to encourage you to subscribe to our podcast “Inside SAP S/4HANA”. This podcast leverages the unique knowledge and expertise of SAP S/4HANA product experts, partners and customers to address objects of interest by sharing product insights and project best practice. There is no customer success without product success and project success; we share all ingredients with you to get to the next level and make your SAP S/4HANA project a success. Subscribe now and benefit from the shared knowledge!

openSAP microlearnings for SAP S/4HANA

Our openSAP microlearnings for SAP S/4HANA offer an exciting new learning opportunity. What began with a small batch of 20 videos, has now become a channel with more than 50 microlearnings that have generated over 20,000 views since then. Today we cover multiple lines of business such as finance, manufacturing, and supply chain, and key technology topics like Master Data Management, key user extensibility, SAP User Experience, and upgrade management. We are continuously adding new microlearnings to the SAP S/4HANA channel, so make sure you check them out.

Your Voice Matters!

If you want to learn more and actively engage with SAP subject matter experts on SAP S/4HANA Cloud, public edition, join our SAP S/4HANA Cloud, public edition community–now fully integrated with SAP Community. The community brings together customers, partners, and SAP experts and has a clear mission: deliver an interactive community to engage with one another about best practices and product solutions. We invite you to explore the SAP S/4HANA Cloud, public edition community ‘one-stop shop’ as the central place for all resources, tools, content questions, answers and connect with experts to guide you through your journey to SAP S/4HANA Cloud, public edition.

Other SAP S/4HANA Cloud and SAP S/4HANA Enablement Assets

SAP S/4HANA is the foundation of the intelligent enterprise and is an innovative, robust, and scalable ERP. We at Cloud ERP Product Success and Cloud Co-Innovation offer a service as versatile as our product itself. Check out the numerous offerings our Enablement team has created for you below:

Further Information:

- Collection blog for finance here

- What's new with SAP S/4HANA Cloud 2308 and SAP S/4HANA 2023 in Finance from SAP Solution Management here

- Customer Influence Review Round Q3/2023 – Results for SAP S/4HANA Cloud for Finance, public edition - here

- SAP S/4HANA Cloud, public edition release info here

- Latest SAP S/4HANA Cloud, public edition release blog posts here and previous release highlights here

- Product videos for SAP S/4HANA Cloud and SAP S/4HANA

- SAP S/4HANA PSCC Digital Enablement Wheel here

- SAP S/4HANA Cloud, Public Edition Early Release Series here

- Inside SAP S/4HANA Podcast here

- openSAP microlearnings for SAP S/4HANA here

- Best practices for SAP S/4HANA Cloud, public edition here

- SAP S/4HANA Cloud, public edition community: here

- Feature Scope Description here

- What’s New here

- Help Portal Product Page here

Feel free to ask your questions on SAP Community here. Follow the SAP S/4HANA Cloud tag and the PSCC_Enablement tag to stay up to date with the latest blog posts.

Follow us via @Sap and #S4HANA, or myself via @HaukeUlrich and LinkedIn

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA Public Cloud

Labels:

5 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

160 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

220 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- SAP S4HANA Cloud Public Edition Logistics FAQ in Enterprise Resource Planning Blogs by SAP

- Demand Planning using historical sales data when just gone live with S/4HANA Cloud Public Edition in Enterprise Resource Planning Q&A

- Stock Ageing Report just gone live of SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Q&A

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

- Restriction on number of consolidation units in SAP Group Reporting Public Cloud edition. in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 8 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |