- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP Joint venture Accounting(JVA) - Basic Concepts

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

niranjani_02

Discoverer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-17-2023

3:01 PM

In this blog, I have provided an introduction to Joint venture Accounting and In Which phase they will be using this JVA in an oil and gas Industry and why?

An oil and gas industry is usually divided into three major sectors,

UPSTREAM:

The upstream sector includes searching for potential underground or underwater crude oil and natural fields, drilling exploratory wells, and subsequently operating the wells that recover and bring the crude oil or raw natural gas to the surface.

MIDSTREAM:

Midstream refers to anything required to transport and store crude oil and natural gas before they are refined and processed into fuels. Midstream also includes pipelines and all the infrastructure needed to move these resources long distances, such as pumping stations, tank trucks, rail tank cars and transcontinental tankers.

DOWN STREAM:

The final sector of the oil and natural gas industry is known as downstream. This includes everything involved in turning crude oil and natural gas into thousands of finished products we use every day like gasoline, diesel, kerosene.

PROCESS OF UPSTREAM:-

Upstream process starts with sending seismic waves which is nothing but a tool used to find oil and natural gas deep into the Earth's surface .

This technique allows for interpretation of what is underneath the ground or seabed (oil, gas, water, faults, folds etc) without having to actually drill.when we get any positive signal through waves, Exploration is carried out at that place where the probablity of getting crude oil is 50% and if oil is present means it will be moved to Production and Crude gathering is done by gathering crude oil along with natural gas in either gas storage or through pipelines.

The Risk involved during the process of Exploration is very high as the Probablity of getting crude oil is low and Investment is high,In order to reduce the risk involved and to minimise the profit and loss of that company,they will do partnership with the some other companies and share all the profit and loss involved,Here is where Joint venture came into Picture.

In simple "Joint Venture is a business arrangement where two or more parties pool their resources for the purpose of accomplishing a specific task".

JOINT VENTURE ACCOUNTING:-

IF LOSS =600M

1 ST COMPANY -200M

2ND COMPANY -200M

3RD COMAPNY -200M

The process of doing this accounting by sharing the profit and loss is called Joint venture Accounting.

JOINT VENTURE AGREEMENT(Operating Agreement):-

A JOA is a formal agreement that specifies the conditions for a joint operation. This covers the interests of the partners and their properties as wells as overheads and penalties.

It specifies the overhead rates.

Equity Share.

JOINT VENTURE:-

This is an association of Two or more partners, formed to share a venture's risks, costs and

revenues. Each partners share is proportional to their undivided interest in the venture.

EQUITY TYPE:-

The JOA has different stages such as

Engineering

Design

Construction

Production.

Different partners participate at each stage

JVA manages different stages by using Equity Types,An Equity type explains a particular association of partners.

TCODE:GJ57

EQUITY GROUP:-

An equity group represents an association of venture partners and their interests.An Equity group may consist of all or some of the venture partners.

For ex:if we are having 10 partners means 2 or more partners will form a group that is called as equity group.

JOINT VENTURE PARTNER:-

This is a partner mentioned in JOA with undivided intrest in a venture.

One partner called OPERATOR manages the operation.

The remaining non-operating partners share the expenses and revenues.

TCODE:GJ2B

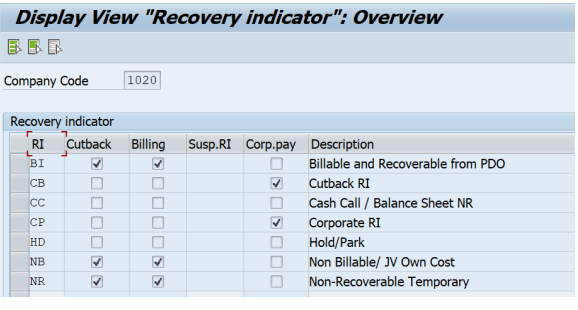

RECOVERY AND BILLING INDICATORS:-

We Assign recovery indicators to a cost object to indicate whether or not expenses posted using the cost object,are billable to JVA partners.

we assign billable costs to the appropriate partners.

we assign Non billable expenses to the operator.

Billing indicators are assigned to billable postings and identify the type of posting involved,including

cash call and normal expenditures.

TCODE:GJ21

USE:-

The JOA specifies the relationship between partners,joint ventures and rules for cost calculations.

Joint ventures,equity types and equity groups are assigned to JOA.

Joint venture partners are assigned to equity groups.

A joint venture can belong to only one JOA,However multiple ventures can belong to the same JOA.

TYPES OF JOINT VENTURES:-

Example:- there are 3 companiesSHELL-Main company which opens JVA

BP-Managing

HAVELON-Managing

TCODE:GJ24

OPERATED(NO TAX):-

Operated by the company managing SAP JVA.

Allows carried interest(CI) Or net profit interest(NPI),Partner and suspense processing.

You cannot add tax to this type of ventures.

Eg:-BP,HAVELON.

OPERATED(WITH TAX):-

Operated by the company running SAP JVA.

Neither CI/NPI Partners nor Suspense processing is allowed for this type of ventures.

You can assign Tax codes.

Cutback calculates tax charges to venture partners based on the tax setting for the company in the SAPJVA configuration.

Eg:Shell

NON OPERATED VENTURE:-

Company managing SAP JVA holds a non operated venture share.

This is billed by the operator for its share of venture expenses.

Eg:BP,HAVELON.

NON OPERATED ON BILLING:-

Company running SAP JVA sells part of its non operated share of the venture to its third parties.

Eg:-If BP have 200 USD share means they can sell 100 USD to the third parties on Billable.

CORPORATE VENTURE:-

Company running SAP JVA holds 100% interest.

Eg:- If the ventures are shared over a period of 5 years means after 5 years Shell will be set as a corporate venture.

PERIODIC PROCESSES:-

INTEGRATION:-

Please share your feedback and thoughts in comments and follow my Profile for more interesting content.

An oil and gas industry is usually divided into three major sectors,

UPSTREAM:

The upstream sector includes searching for potential underground or underwater crude oil and natural fields, drilling exploratory wells, and subsequently operating the wells that recover and bring the crude oil or raw natural gas to the surface.

MIDSTREAM:

Midstream refers to anything required to transport and store crude oil and natural gas before they are refined and processed into fuels. Midstream also includes pipelines and all the infrastructure needed to move these resources long distances, such as pumping stations, tank trucks, rail tank cars and transcontinental tankers.

DOWN STREAM:

The final sector of the oil and natural gas industry is known as downstream. This includes everything involved in turning crude oil and natural gas into thousands of finished products we use every day like gasoline, diesel, kerosene.

PROCESS OF UPSTREAM:-

Upstream includes Exploration ,Production and crude oil reserves,

Upstream process starts with sending seismic waves which is nothing but a tool used to find oil and natural gas deep into the Earth's surface .

This technique allows for interpretation of what is underneath the ground or seabed (oil, gas, water, faults, folds etc) without having to actually drill.when we get any positive signal through waves, Exploration is carried out at that place where the probablity of getting crude oil is 50% and if oil is present means it will be moved to Production and Crude gathering is done by gathering crude oil along with natural gas in either gas storage or through pipelines.

The Risk involved during the process of Exploration is very high as the Probablity of getting crude oil is low and Investment is high,In order to reduce the risk involved and to minimise the profit and loss of that company,they will do partnership with the some other companies and share all the profit and loss involved,Here is where Joint venture came into Picture.

In simple "Joint Venture is a business arrangement where two or more parties pool their resources for the purpose of accomplishing a specific task".

JOINT VENTURE ACCOUNTING:-

IF LOSS =600M

1 ST COMPANY -200M

2ND COMPANY -200M

3RD COMAPNY -200M

The process of doing this accounting by sharing the profit and loss is called Joint venture Accounting.

JOINT VENTURE AGREEMENT(Operating Agreement):-

A JOA is a formal agreement that specifies the conditions for a joint operation. This covers the interests of the partners and their properties as wells as overheads and penalties.

It specifies the overhead rates.

Equity Share.

JOINT VENTURE:-

This is an association of Two or more partners, formed to share a venture's risks, costs and

revenues. Each partners share is proportional to their undivided interest in the venture.

EQUITY TYPE:-

The JOA has different stages such as

Engineering

Design

Construction

Production.

Different partners participate at each stage

JVA manages different stages by using Equity Types,An Equity type explains a particular association of partners.

TCODE:GJ57

EQUITY GROUP:-

An equity group represents an association of venture partners and their interests.An Equity group may consist of all or some of the venture partners.

For ex:if we are having 10 partners means 2 or more partners will form a group that is called as equity group.

JOINT VENTURE PARTNER:-

This is a partner mentioned in JOA with undivided intrest in a venture.

One partner called OPERATOR manages the operation.

The remaining non-operating partners share the expenses and revenues.

TCODE:GJ2B

RECOVERY AND BILLING INDICATORS:-

We Assign recovery indicators to a cost object to indicate whether or not expenses posted using the cost object,are billable to JVA partners.

we assign billable costs to the appropriate partners.

we assign Non billable expenses to the operator.

Billing indicators are assigned to billable postings and identify the type of posting involved,including

cash call and normal expenditures.

TCODE:GJ21

USE:-

The JOA specifies the relationship between partners,joint ventures and rules for cost calculations.

Joint ventures,equity types and equity groups are assigned to JOA.

Joint venture partners are assigned to equity groups.

A joint venture can belong to only one JOA,However multiple ventures can belong to the same JOA.

TYPES OF JOINT VENTURES:-

Example:- there are 3 companiesSHELL-Main company which opens JVA

BP-Managing

HAVELON-Managing

TCODE:GJ24

OPERATED(NO TAX):-

Operated by the company managing SAP JVA.

Allows carried interest(CI) Or net profit interest(NPI),Partner and suspense processing.

You cannot add tax to this type of ventures.

Eg:-BP,HAVELON.

OPERATED(WITH TAX):-

Operated by the company running SAP JVA.

Neither CI/NPI Partners nor Suspense processing is allowed for this type of ventures.

You can assign Tax codes.

Cutback calculates tax charges to venture partners based on the tax setting for the company in the SAPJVA configuration.

Eg:Shell

NON OPERATED VENTURE:-

Company managing SAP JVA holds a non operated venture share.

This is billed by the operator for its share of venture expenses.

Eg:BP,HAVELON.

NON OPERATED ON BILLING:-

Company running SAP JVA sells part of its non operated share of the venture to its third parties.

Eg:-If BP have 200 USD share means they can sell 100 USD to the third parties on Billable.

CORPORATE VENTURE:-

Company running SAP JVA holds 100% interest.

Eg:- If the ventures are shared over a period of 5 years means after 5 years Shell will be set as a corporate venture.

PERIODIC PROCESSES:-

- Month end processing

- JVA Billing

- cutback

Cutback:-

A joint venture operating partner carries all operating cost throughout the accounting period .At the

end of accounting period ,the operators expenditures are shared by the non operating partners and the operator, according to the Equity share, this process is called cutback.

Eg :-If we have 100 USD ,This is how expense is shared and the net cost shows how much each partner owes to their operator.

INTEGRATION:-

- Financial Accounting

- Controlling

- Material Management

- Project system

Please share your feedback and thoughts in comments and follow my Profile for more interesting content.

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA Finance

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

- Working with SAFe Epics in the SAP Activate Discover phase in Enterprise Resource Planning Blogs by SAP

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- Innovate Faster: The Power Duo of SAP Activate and Scaled Agile Framework (SAFe) in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |