- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- How to activate Invoice Receipt Date in document h...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

MarekTurczynski

Contributor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

06-16-2020

8:10 AM

Many of the customers use OCR solutions like VIM where incoming invoice data is stored including the date of invoice receipt. However hardly anybody knows that the same date can be stored in non-OCR scenario - this is because the field Invoice Receipt Date is not visible in any of FI/ LIV transactions by default settings. Only visible fields are:

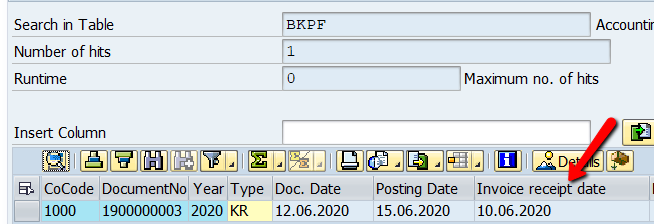

However if you look in to BKPF table then you will spot the receipt date available in form of REINDAT field:

The question is how to make it visible?

As you know the fields in document header are controlled in different places, mainly by coding - there is no field status variant available like it is for posting lines.

Same applies to REINDAT field - it was activated for usage of Czech companies due to VAT Ledger requirements by note:

2193486 - FAQ /regular update/ for Legal Change CZ VAT Ledger Statement for 2016

which listed following notes to be implemented:

These notes are prerequisities to see and be able to activate the field.

You could stop reading here and say - how should we use a Czech-specific funtion if we do not have a company there? The settings may seem to be activable for Czech companies only but in reality any company can use it - it works for everyone (according to principle: it is not a bug it is a feature).

Once the notes are available in your system you should be able to access following path:

Or simply call view IDFIVATV_DEF via SM30.

Even if your company is not from Czech Republic, you can enter your company code and just mark the field:

All the other fields can remain as they are. The test company 1000 is defined in country PL.

After you have saved the settings the field is available in FB01/ FB60/ MIRO FB02 for your company code:

The field is also available in document change view (FB02).

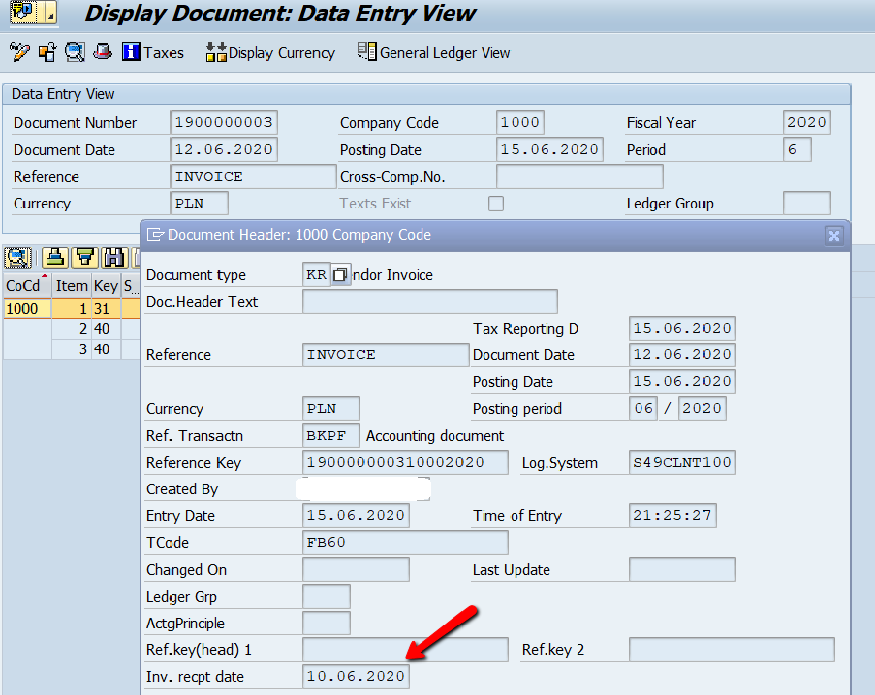

After posting document is posted you can see the field available in table and in FB03 view:

FB03:

If you have stored the day of invoice receipt in a non-standard field or reserved a standard header field for that - you can release it for other usage and switch easily to standard solution. The good message is that because it is included in BKPF it can be also made available for dynamic selections in various reports.

Thank you for reading!

Marek Turczyński

- Posting Date

- Document Date

- Translation Date

- VAT Date (if activated in company code)

However if you look in to BKPF table then you will spot the receipt date available in form of REINDAT field:

The question is how to make it visible?

Prerequisites

As you know the fields in document header are controlled in different places, mainly by coding - there is no field status variant available like it is for posting lines.

Same applies to REINDAT field - it was activated for usage of Czech companies due to VAT Ledger requirements by note:

2193486 - FAQ /regular update/ for Legal Change CZ VAT Ledger Statement for 2016

which listed following notes to be implemented:

- 2219418 Country-specific VAT implementations: UDO

- 2172952 - Enhancing the structure BAPIVBRKOUT

- 2213503 - Country-specific VAT implementations

- 2241853 - RFUMSV00(CZ): Combining entries for input tax

- 2237363 = Country-specific VAT implementations: UDO 2

- 2221947 = Country-specific VAT implementations 2

- 2231165 - Country-specific VAT implementations 3

- 2250498 = Country-specific VAT implementations: UDO 3 (Only for DE - optional, but it can't be implemented after 2255858 note!)

- 2255858 = Country-specific VAT implementations: UDO 4

- 2244343 = Country-specific VAT implementations 4

- 2259658 = Country-specific VAT implementations: UDO 5

- 2258535 = Country-specific VAT implementations 5

- 2240873 - Country-specific VAT implementations. The field REINDAT

- 2263523 - FB09: Feld BKPF-REINDAT ist nicht änderbar

- 2256603 - Country-specific VAT implementations. The field REINDAT (the transaction FB01)

- 2283397 - Country-specific VAT implementations. The field REINDAT (the transaction FB01)

These notes are prerequisities to see and be able to activate the field.

You could stop reading here and say - how should we use a Czech-specific funtion if we do not have a company there? The settings may seem to be activable for Czech companies only but in reality any company can use it - it works for everyone (according to principle: it is not a bug it is a feature).

How to activate the field in customizing

Once the notes are available in your system you should be able to access following path:

| IMG Activity | Financial Accounting (New) --> General Ledger Accounting (New) --> Periodic Processing --> Report --> Statutory Reporting: Czech Republic --> Value-Added Tax Ledger |

| Transaction | Define Settings for VAT Ledger |

Or simply call view IDFIVATV_DEF via SM30.

Even if your company is not from Czech Republic, you can enter your company code and just mark the field:

All the other fields can remain as they are. The test company 1000 is defined in country PL.

After you have saved the settings the field is available in FB01/ FB60/ MIRO FB02 for your company code:

FB60 Invoice Receipt date field visible

MIRO Invoice Receipt date field visible

The field is also available in document change view (FB02).

After posting document is posted you can see the field available in table and in FB03 view:

FB03:

If you have stored the day of invoice receipt in a non-standard field or reserved a standard header field for that - you can release it for other usage and switch easily to standard solution. The good message is that because it is included in BKPF it can be also made available for dynamic selections in various reports.

Thank you for reading!

Marek Turczyński

- SAP Managed Tags:

- SAP S/4HANA Finance,

- FIN (Finance),

- FIN Accounts Receivable and Payable,

- FIN General Ledger

7 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

API and Integration

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

2 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Employee Central Integration (Inc. EC APIs)

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

POSTMAN

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP CI

1 -

SAP Cloud ALM

1 -

SAP CPI

1 -

SAP CPI (Cloud Platform Integration)

1 -

SAP Data Quality Management

1 -

SAP ERP

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Subscription Billing with Convergent Invoicing and Contract-Based Revenue Recognition in Enterprise Resource Planning Blogs by SAP

- SAP Activate Realize and Deploy phase activities in the context of Scaled Agile Framework in Enterprise Resource Planning Blogs by SAP

- Profit Center Transfer via Stock Transfer Order in Enterprise Resource Planning Q&A

- Why YCOA? The value of the standard Chart of Accounts in S/4HANA Cloud Public Edition. in Enterprise Resource Planning Blogs by SAP

- Line loop on Grid excluding first four lines in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |