- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Foreign Currency Revaluation Using Delta Logic and...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

PasupuletiVenu

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-17-2023

7:14 PM

Overview

In this blog post, I intend to provide an overview of FCV using delta logic and reversal after settlement, including step by step instructions (Configuration & End user steps). This will aid in comprehending how the FCV works when delta logic is enabled, ultimately, benefiting the organization by preventing the impact on the Profit and loss statement.

Introduction

Accounting standards IAS 21 mandate that the foreign currency revaluation to be carried out as a part of period-end closing when preparing the financial statement to present the true value of foreign currency open items or foreign currency assets/liabilities at closing date in presentation currency.

Due to fluctuating exchange rates between currencies, this adjustment takes into account, the changing value of payables, receivables and assets. In order to produce valued account balances in presentation currency and the corresponding impact on the financial result, the valuation process generates postings for valuation difference.

Business scenario

Case:1 (Regular process “FCV unrealized Gain loss & Reversals")

When we execute FCV system will generate two accounting documents. One for the actual valuation at the end of the month and the other is for the reversal on the following day. I.e., the first day of the following month, depending on the selection screen parameters, but sometimes the next period is not open for the reversal so system will generate only one document in FCV run. You may have to open the period and keep it running by using batch input.

Case: 2 (Delta Logic)

Let’s assume that Business is obliged not to generate a reversal entry on the first day of following month and reversal needs to happen after clearing the invoice or in the year end the reversal entry will be posted in the next year P&L / Schedule 6 (balance sheet).

This we can achieve by using the “Delta logic” & “Reversal After settlement date” functionality.

Points to be considered or noted:

Once delta logic is enabled, System will compare the exchange rate from the most recent revaluation cycle and the current revaluation cycle to identify differences for posting.

A. FCV Configuration:

SPRO - FINANCIAL ACCOUNTING - GENERAL LEDGER ACCOUTING - PERIODIC PROCESSING - VALUATE

Let’s Activate Delta and Reversal after settlement date.

SPRO - FINANCIAL ACCOUNTING - GENERAL LEDGER ACCOUTING - PERIODIC PROCESSING - VALUATE - Activate Delta

B. End user Process:

Exchange rate at the time of posting the invoice.

2. Post sample Invoice:

3. Maintain Exchange Rates: OB08

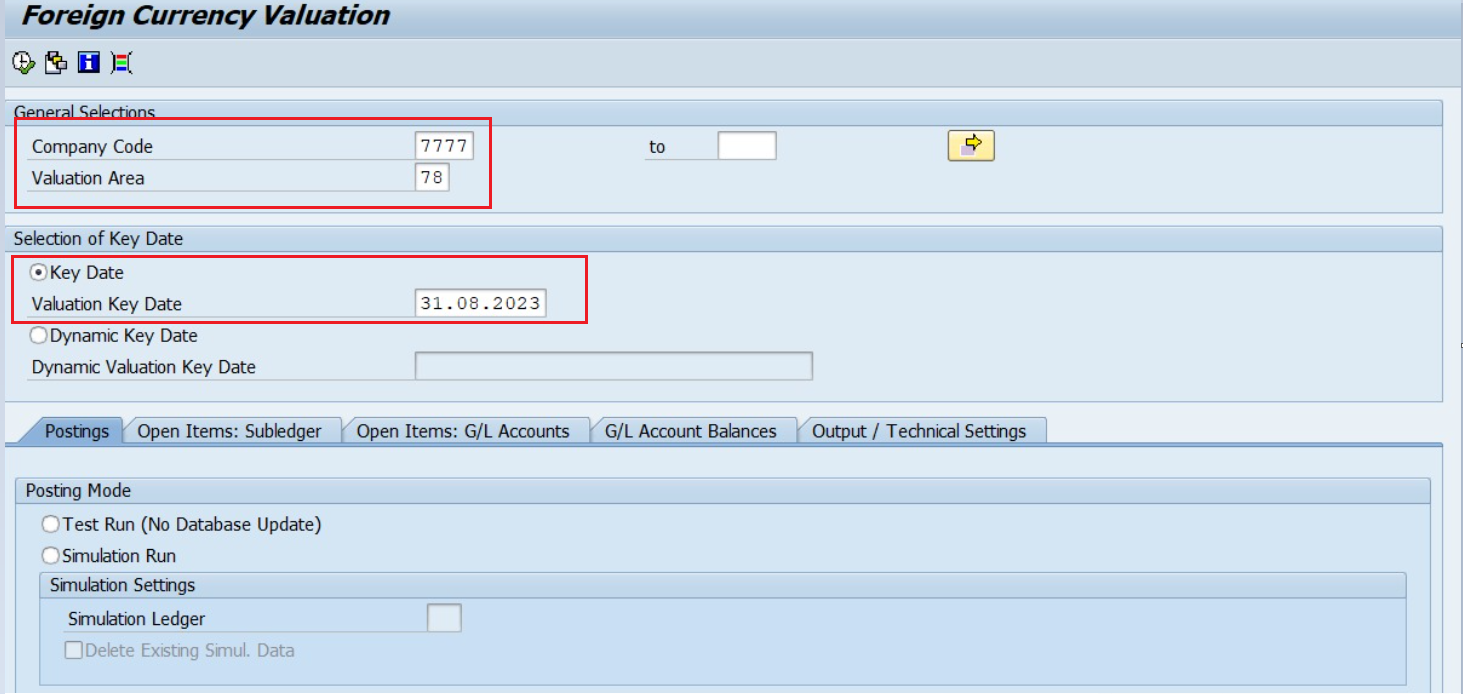

4. Execute Foreign Currency Revaluation: FAGL_FCV

From S4 HANA, SAP has provided a new transaction code for FC Valuation FAGL_FCV. Old T. code FAGL_FC_VAL is obsolete.

Input parameters:

If you select Determine Automatically under posting parameters, system will derive the Document date and posting date automatically based on the valuation key date.

If you select Valuate Vendors, system will perform the FCV only for Vendors. If we select both Valuate Vendors/ Customer system perform FCV for both customers and Vendors in single run.

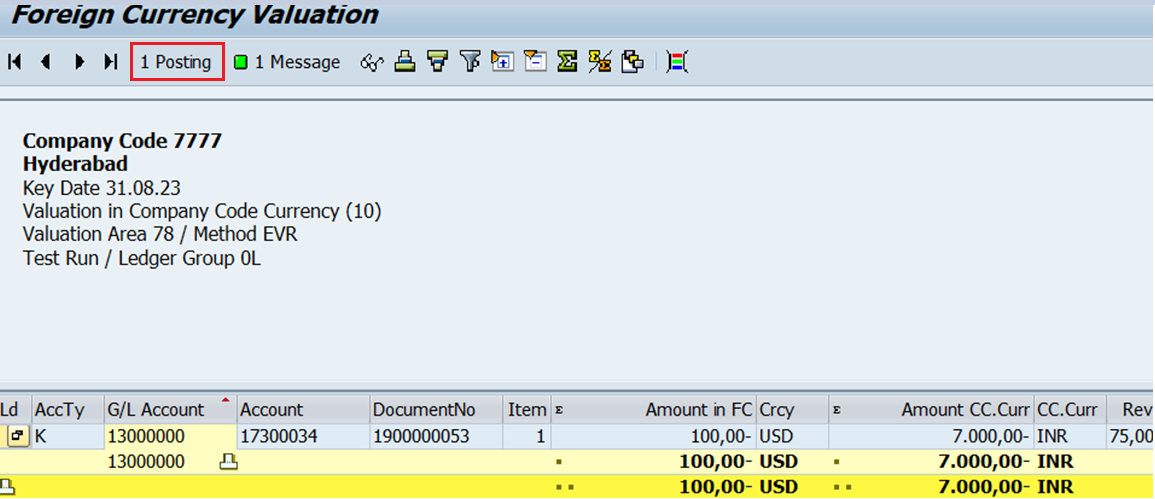

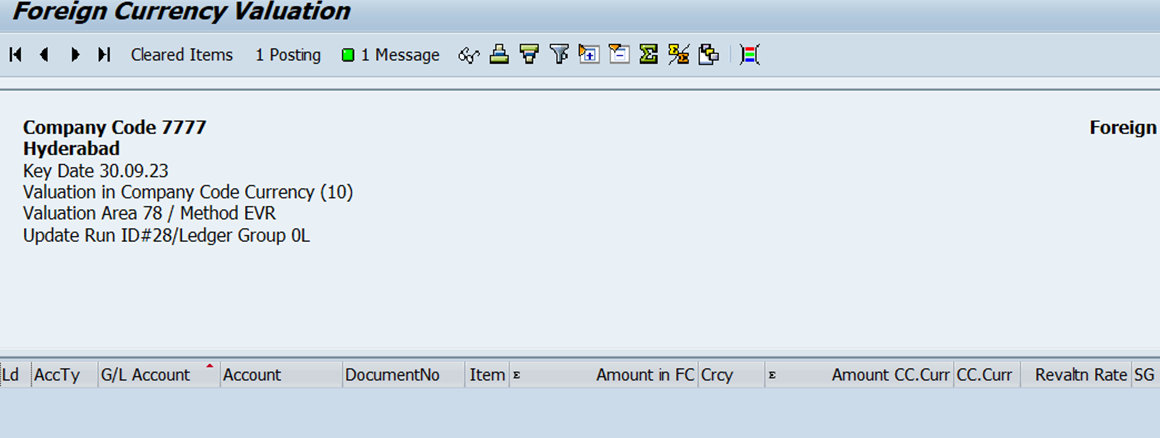

After executing the Forex revaluation system will generate accounting document as per below image.

As you can see in the above screenshot, irrespective of generating 2 Postings, system generated only 1 posting due to Delta Activation. Additionally, we have chosen Reversal after settlement date, so once the invoice has been cleared, it will reverse in the following cycle.

Assume on 1st September the rate has been updated and payment has been made.

Exchange rate at the time of clearing:

Run FCV for the end of September. In this cycle system will generate the reversal accounting document.

FAGL_FCV input parameters on September run

Note: One thing to keep in mind is that the valuation rest functionality won't support if we activate delta logic. if the business wants to reverse the document, we must reverse it manually.

Conclusion:

I trust that this blog has aided your comprehension of FCV Configuration procedures, Business Process Scenarios and end user instructions using sample data.

In this blog post, I intend to provide an overview of FCV using delta logic and reversal after settlement, including step by step instructions (Configuration & End user steps). This will aid in comprehending how the FCV works when delta logic is enabled, ultimately, benefiting the organization by preventing the impact on the Profit and loss statement.

Introduction

Accounting standards IAS 21 mandate that the foreign currency revaluation to be carried out as a part of period-end closing when preparing the financial statement to present the true value of foreign currency open items or foreign currency assets/liabilities at closing date in presentation currency.

Due to fluctuating exchange rates between currencies, this adjustment takes into account, the changing value of payables, receivables and assets. In order to produce valued account balances in presentation currency and the corresponding impact on the financial result, the valuation process generates postings for valuation difference.

Business scenario

Case:1 (Regular process “FCV unrealized Gain loss & Reversals")

When we execute FCV system will generate two accounting documents. One for the actual valuation at the end of the month and the other is for the reversal on the following day. I.e., the first day of the following month, depending on the selection screen parameters, but sometimes the next period is not open for the reversal so system will generate only one document in FCV run. You may have to open the period and keep it running by using batch input.

Case: 2 (Delta Logic)

Let’s assume that Business is obliged not to generate a reversal entry on the first day of following month and reversal needs to happen after clearing the invoice or in the year end the reversal entry will be posted in the next year P&L / Schedule 6 (balance sheet).

This we can achieve by using the “Delta logic” & “Reversal After settlement date” functionality.

Points to be considered or noted:

- The reversal document will be published with the same date as the clearing document and with the clearing date exchange rate. For example, if an invoice is cleared on 01.09.2023 and FCV has been executed on month end, in this run system will generate the reversal entry with 01.09.2023 date (Posting & document date).

- Documents will not be considered in the next month run.

Once delta logic is enabled, System will compare the exchange rate from the most recent revaluation cycle and the current revaluation cycle to identify differences for posting.

A. FCV Configuration:

SPRO - FINANCIAL ACCOUNTING - GENERAL LEDGER ACCOUTING - PERIODIC PROCESSING - VALUATE

- Define Valuation Methods

- Define Valuation Areas

- Assignment of Accounting Principles to Ledger group

- Assignment of valuation areas to Accounting Principles

- Prepare Automatic Postings for Foreign Currency Valuation

Let’s Activate Delta and Reversal after settlement date.

SPRO - FINANCIAL ACCOUNTING - GENERAL LEDGER ACCOUTING - PERIODIC PROCESSING - VALUATE - Activate Delta

Activation of Delta Logic and Reversal settlement date

B. End user Process:

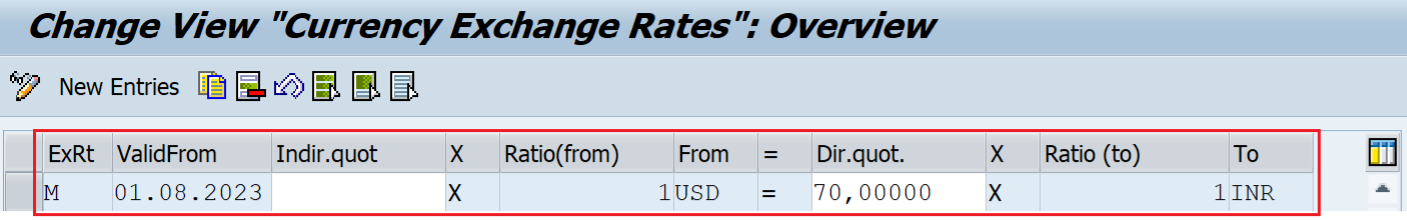

- Maintain Exchange Rates: OB08

Exchange rate at the time of posting the invoice.

Daily rate/Exchange rate during invoice posting

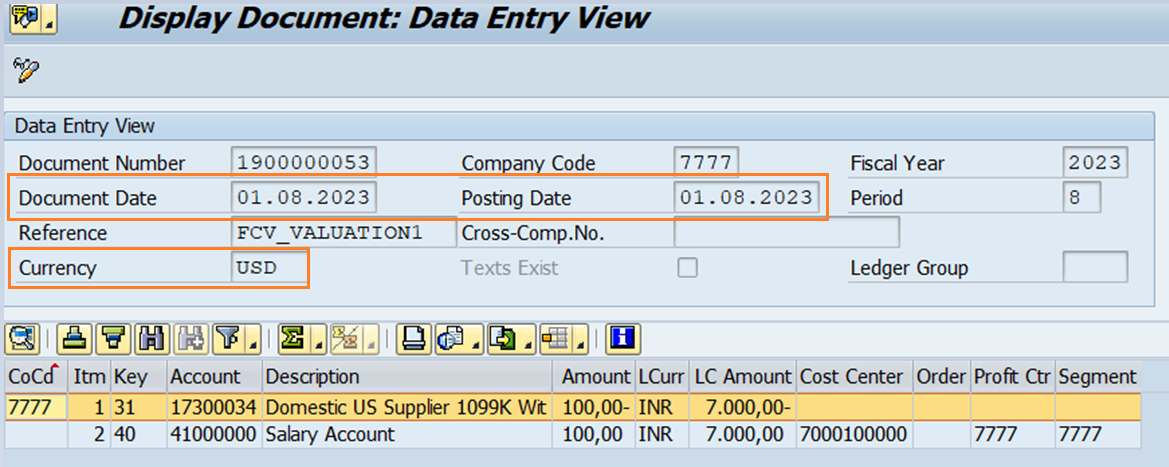

2. Post sample Invoice:

Sample Invoice

3. Maintain Exchange Rates: OB08

Daily rate/Exchange rate during FCV Run

4. Execute Foreign Currency Revaluation: FAGL_FCV

From S4 HANA, SAP has provided a new transaction code for FC Valuation FAGL_FCV. Old T. code FAGL_FC_VAL is obsolete.

Input parameters:

If you select Determine Automatically under posting parameters, system will derive the Document date and posting date automatically based on the valuation key date.

Selection Screen - FCV Run (Month end Activity)

If you select Valuate Vendors, system will perform the FCV only for Vendors. If we select both Valuate Vendors/ Customer system perform FCV for both customers and Vendors in single run.

After executing the Forex revaluation system will generate accounting document as per below image.

As you can see in the above screenshot, irrespective of generating 2 Postings, system generated only 1 posting due to Delta Activation. Additionally, we have chosen Reversal after settlement date, so once the invoice has been cleared, it will reverse in the following cycle.

Assume on 1st September the rate has been updated and payment has been made.

Exchange rate at the time of clearing:

Exchange rate at the time of clearing

Cleared Invoice

Run FCV for the end of September. In this cycle system will generate the reversal accounting document.

FAGL_FCV input parameters on September run

FCV Execution - September

FCV - Output

Note: One thing to keep in mind is that the valuation rest functionality won't support if we activate delta logic. if the business wants to reverse the document, we must reverse it manually.

Conclusion:

I trust that this blog has aided your comprehension of FCV Configuration procedures, Business Process Scenarios and end user instructions using sample data.

- SAP Managed Tags:

- FIN (Finance)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

abap cds

1 -

ABAP CDS Views

1 -

ABAP CDS Views - BW Extraction

1 -

ABAP CDS Views - CDC (Change Data Capture)

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

API and Integration

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

CDS Annotations

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

2 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Employee Central Integration (Inc. EC APIs)

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

POSTMAN

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP CI

1 -

SAP Cloud ALM

1 -

SAP CPI

1 -

SAP CPI (Cloud Platform Integration)

1 -

SAP Data Quality Management

1 -

SAP ERP

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Subcontracting Process

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Rebate Accruals validity period issue in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Public Edition 财务-成本会计常见热点问题汇总FAQ in Enterprise Resource Planning Blogs by SAP

- REFX - ERROR WHEN REVERSE SETTLEMENT in Enterprise Resource Planning Q&A

- Condition contract settlement accrual reversal: total value on first line item in Enterprise Resource Planning Q&A

- S4HANA Settlement Management : Process Overview in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 7 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |