- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Unplanned Depreciation Reversal - 3rd Period in Ne...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Unplanned Depreciation Reversal - 3rd Period in New Fiscal Year

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 12-07-2018 6:20 PM

Hi Experts,

Business User is posted “Unplanned Depreciation” using transaction ABAA in period 12 (September) 2018 but it’s not posted to GL due to some reasons.

Note: Client is maintaining Non calendar - Fiscal Year variant (October To September)

So, now business wants to reverse the unplanned depreciation in 3rd period (Dec’18) which is new Fiscal year using transaction AB08, but got an error as “Reversal in different FY is not allowed”

Its known fact that, system will not allow reversal in new FY and also business wants to adjust in sub ledger only (AA)

I have checked in FORUM, but I didn’t find the solution for this type of issue.

Please, I want to use your expertise here,

- 1)Is there any possibility to re-open the previous FY, since we are already in 3rd period of new FY? Will business will agree with this?

- 2)Is there a possibility to use special periods to reverse the transaction?

- 3)Or what would be actual approach/ solution to be provided to Client?

Appreciated your quick help!!

- SAP Managed Tags:

- SAP ERP,

- SAP R/3,

- FIN (Finance),

- FIN Asset Accounting

Accepted Solutions (0)

Answers (5)

Answers (5)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Mukthar, Thanks for your quick response.

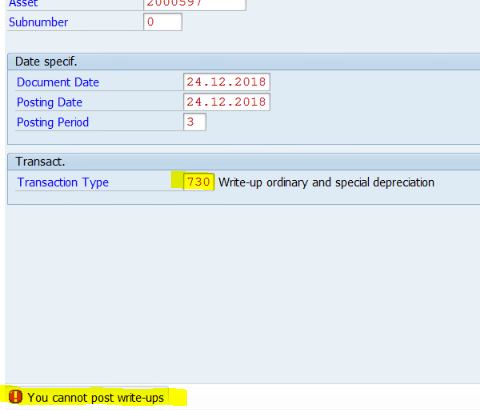

ABZU is allowing USER to Debit Accum Dep A/c and Credit Misc.Other Income Account when using transaction type 730 as shown in 1st snapshot.

Still, Should I transfer the values if this entry posted as you said above...? 2nd snapshot shows the account assignments for Depreciation.

And also will asset depreciates moving forward if we do this process ABZU...?

When i am trying with ABZU in quality, i am getting as "You Cannot Post Write-ups" shown in snapshot 3.

Please assist me same, as it has be resolved this week due to quarter end.

Snapshot 1:

Snapshot 2:

Snapshot 3:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Anil,

As Ajay suggested, you can reverse the posted unplanned depreciation with ABZU. Here system debits to accu.dep.a/c and depreciation exp a/c cr. After getting posted the entry, you have to transfer the balances from depreciation exp. to misc.income by FB01.

Regards,

Mukthar

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Dear Ajay,

USER is wants to use tcode ABZU using transaction type 730. which means, debit asset with accumulated depreciation account and credit Misc income account.

If we do this, shall asset compute depreciation periodically, since the cost is not hitting to Asset Acquisition account ? .

If i use ABSO transaction, debit posts to asset with acquisition account and credit goes to offset GL account. User is not compromising with this solution.

Please clarify.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

If you want to reverse the unplanned depreciation, you can do asset write up ABZU or see if your depreciation area settings in OADB allow to post -ve unplanned depreciation

Regards

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Anil

Your asset fiscal year for the previous year would be open, because this unplanned dep is not posted to GL yet

You should do AB08 in Sep 2018.

Another option: there is a program which deletes the Unposted dep and make posted dep = planned dep. you can search for that in the forum here. It is available via sap note

I feel AB08 in Sep should do for you

Regards

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Dear Ajay,

Thanks for your quick response.

Apologies, Unplanned depreciation is already posted to GL through planned posting run at the month end Sep 2018.

Unplanned depreciation (NBV value) posted to few assets because of "Impairment & Other reasons" in period Sep, 2018. So, finally Normal depreciation and unplanned depreciation posted to GL and also Assets Values become a ZERO.

Now, In New FY 2019 Business wants to bring back the values for only 4 assets for which Unplanned depreciation is posted already in previous year. Which means, these 4 assets physically placed in plants for working again.

So, Business confirmed that they never open the previous FY for any adjustments or reversals. However, adjustments should be done only in current FY (2019)

Now, please let me know how can we can bring back the unplanned depreciation values against Assets in new FY and also they should be charging depreciation from now on.....

Please let me know all possible scenarios.. Thanks again for your help.

- I am not sure how to configure Unplanned Depreciation for an Asset that has been posted using ABIF. in Enterprise Resource Planning Q&A

- AB08 Only Trying to Reverse for Depreciation Areas of IFRS in Enterprise Resource Planning Q&A

- Asset down payment acquisition reversal issue in Enterprise Resource Planning Q&A

- how to post unplanned depreciation auto in Enterprise Resource Planning Q&A

- Reduce AUC value in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 95 | |

| 9 | |

| 8 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.