- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Insights into Value Chain

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-10-2022

8:34 PM

Introduction

Today customers steer their value chain with high effort, inconsistencies and often inaccurately and after the fact has been Going forward, we want our customers to be able to steer their entire material and activity value flows in a real time, automated and consistently instantly at various levels for the legal entities, business units and Group.

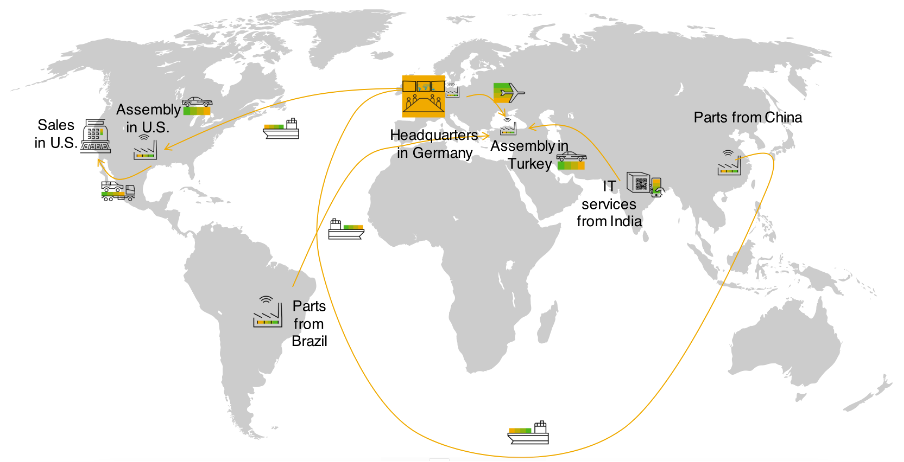

Let us look at an example of a fictional example of an automobile OEM:

Figure 1: Fictional Value Chain Today

A global value chain , it could be an intercompany stock transfer between Brazil and Germany, Intercompany Sales between Germany and US, Services Cost for IT Services from India and so on.

What Corporate Controllers struggle today is to have a consistent and uniform view of Group Margin and Cost of Goods Sold. It is not just about financials which needs to be right, but in the logistics processes today to get a full visibility into value chains by recording all material and activity flows. We have to fill the process breaks in existing processes such as Intercompany Sales Processes, Intercompany Stock Transfer, Drop Shipment Process, Customer and Supplier Consignment Process, Customer and Supplier Consignment Process, Returns Handling and what not.

How do we build this information, well we use an extended version of material ledger by collecting costs (“value added”) at each step of the operational logistics processes including the cost component split. What you see below is the intended value flows from a group perspective:

Figure 2: Fictional Value Chain in Future

In addition to filling in process breaks existing today, we need to have additional spend vectors, especially from a parallel valuation perspective like a Group View or a legal view. Since we are able to record the material flows at each step of the chain, we would also be able to provide the background for recording additional KPIs like CO2 emissions at step of the chain.

Figure 3: Fictional Value Chain in Future with Additional Vectors

The foundation to record the at each step of the chain is Universal Parallel Accounting, which was released in S/4HANA Cloud 2105 and would be available in S/4HANA PCE/OP later this year. You could find more information on Universal Parallel Accounting in video

Now let us look at one of the use cases, where we are removing the process breaks in Operational Logistics Processes of Intercompany Sales Process, which is being introduced as Advanced Intercompany Sales Process. I would try to highlight what changes with the new process and how we use Group Valuation built on Universal Parallel Accounting to capture Group Margins and COGS at each step of the process.

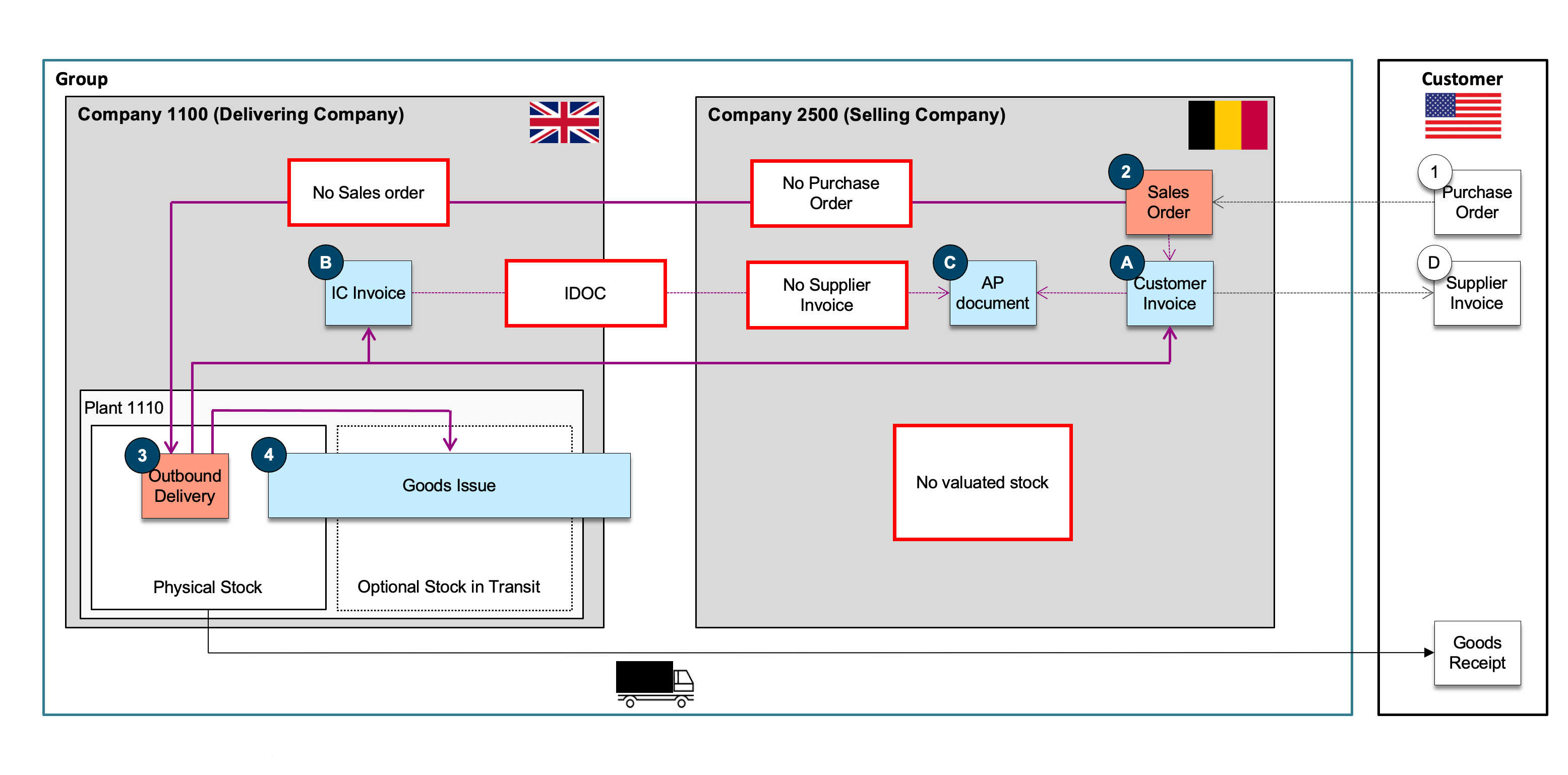

Let us look at an example of a simple Intercompany Sales Process(Classical Intercompany Sales Process) as it exists today as standard:

Figure 4: Classical Intercompany Sales Process

In this case, there is a Belgian Company selling to a customer in US, but the delivery of the goods is from a delivering company in UK. Our existing process for Classical Intercompany Sale in this case was very slim, very adaptive, but has lot of downsides:

- The operational logistics documents such as Intercompany Purchase Order, Supplier Invoices etc are missing in the selling company. Similar is the case of missing operational logistics document in Delivering company such as a Sales Order. The existing reporting solution is not able to to track the material flow along the supply chain due to missing operational documents in logistics

- Since there is no valuated stock in Selling Company, it is difficult for a Corporate Controller to have accurate and real time information on Group Margins & COGS, which is one of the most important reason for enhancing the same. In addition, there is no consistent visibility on stock in transit with clear ownership.

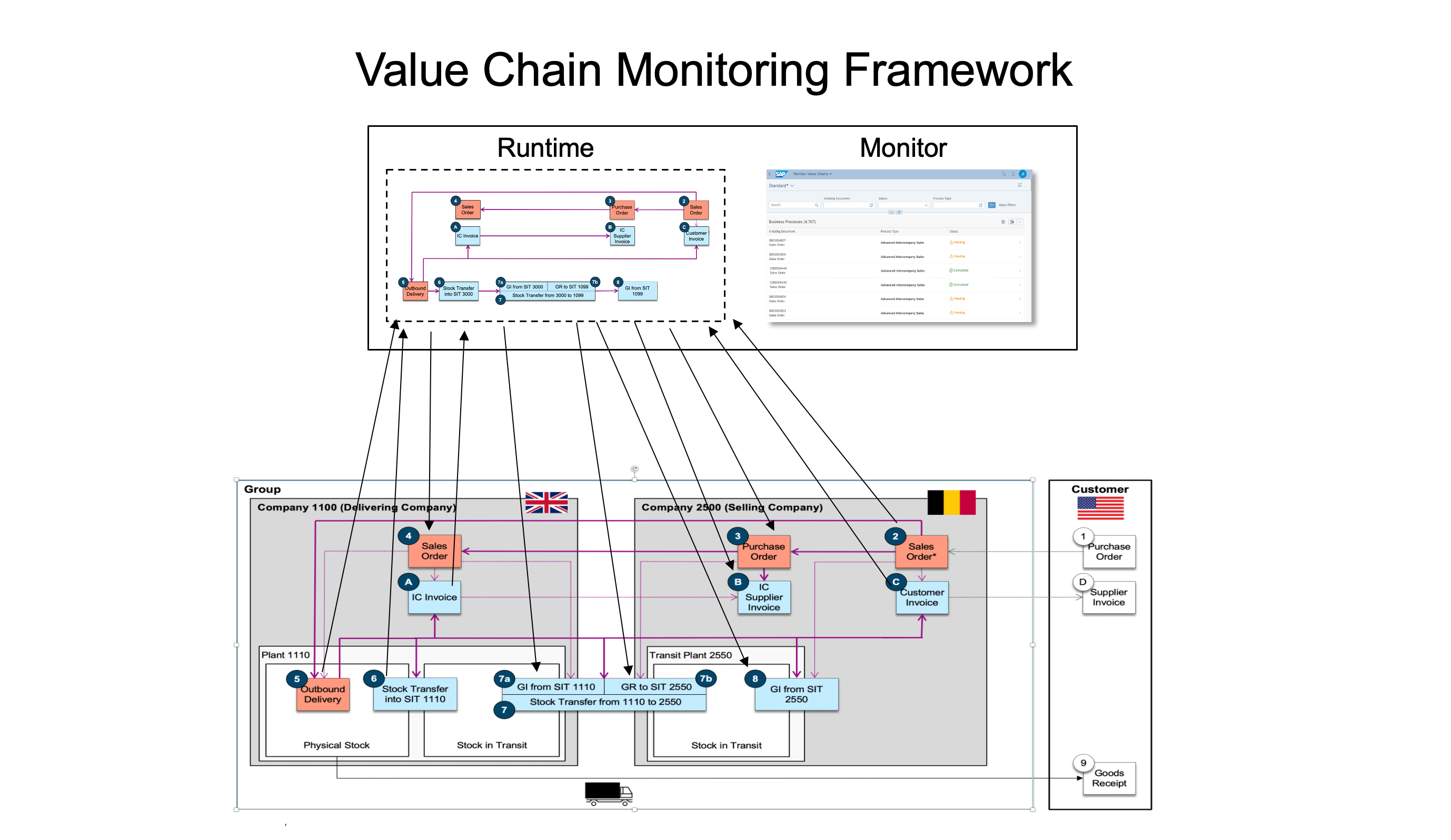

Now let us look at a simple example of Advanced Intercompany Sales Process available to be available in S/4HANA PCE/OP 2022. Please note that both Classical Intercompany Process and Advanced Intercompany Process would exist in S/4HANA 2022 PCE/OP Edition.

Figure 5 Example of Advanced Intercompany Sales Process

The scenario remains pretty much the same. However, what changes now is:

- We introduce the missing operational logistics documents like Intercompany Purchase Order in Selling Company and Intercompany Sales Order in the Delivering company

- When the Sales Order 2 is created with delivery from an Intercompany location, a new process orchestration tool called as Value Chain Monitor (VCM) makes sure that Intercompany Purchase Order in Selling Company and Intercompany Sales Order in the Delivering Company are created automatically

The new Value Chain Monitoring Framework creates all additional documents automatically:

Figure 6: Value Chain Monitoring Framework

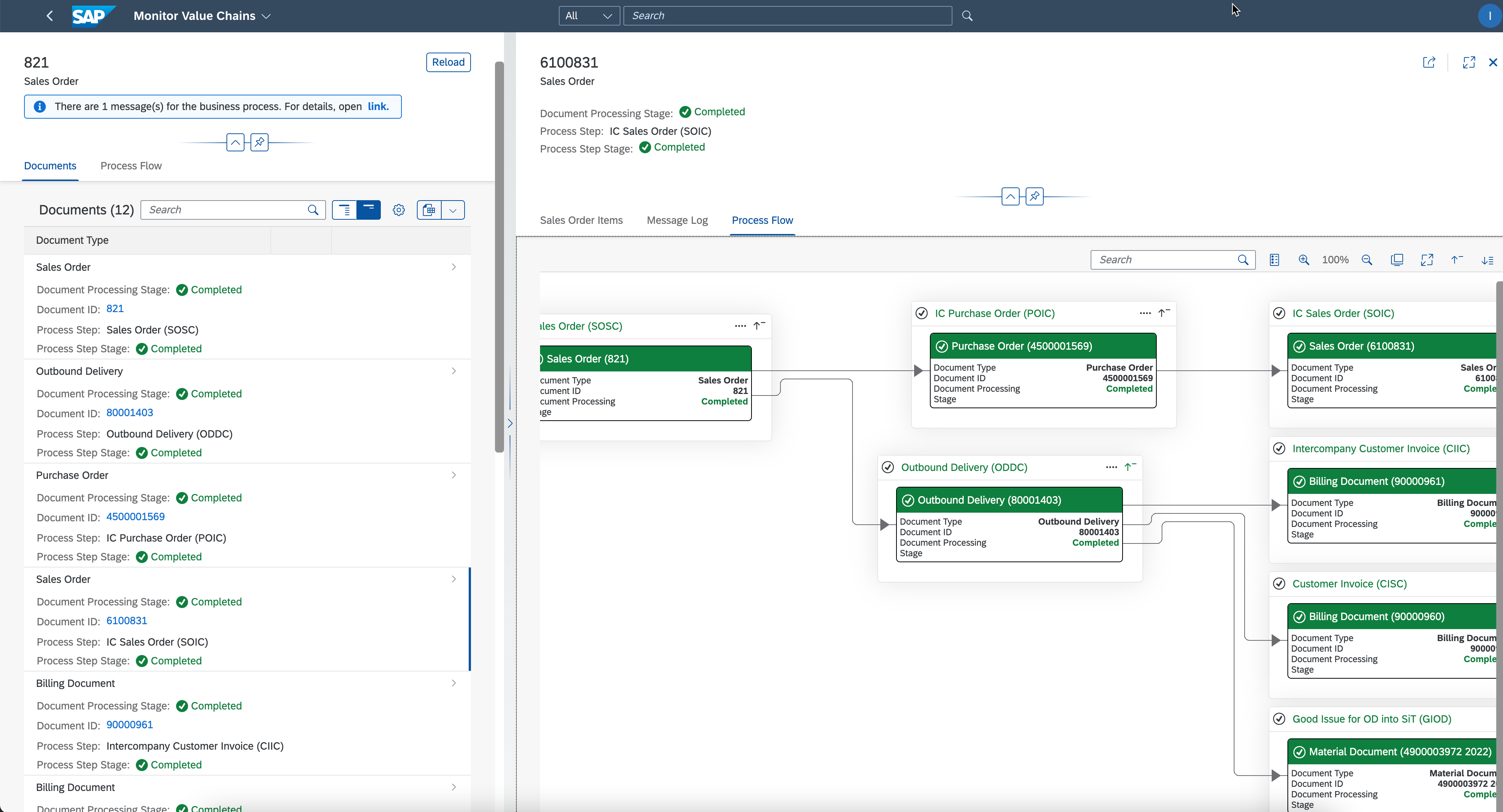

The Sales Order in selling company for external customer determines if the goods will be delivered from an Intercompany location and it would trigger the subsequent processes. A simple view of an Advanced Intercompany Process in Value Chain Monitor would look as below:

Figure 7: Single Document View in VCM

Group Financials Perspective for a value chain

Since we have filled in the process breaks for operational logistics document, we could in future also draw up a value chain for a material across the entire Value chain including at aggregated levels for both actuals and plans.

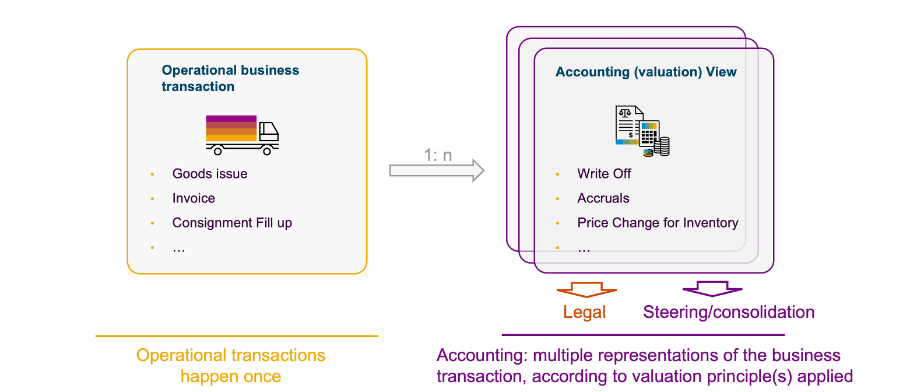

Universal Parallel Accounting forms the basis for different valuation views such as legal view, . Typically, an operational business transaction in finance represents different valuation views due to multiple accounting principle:

Figure 8: Multiple View of a single operational document

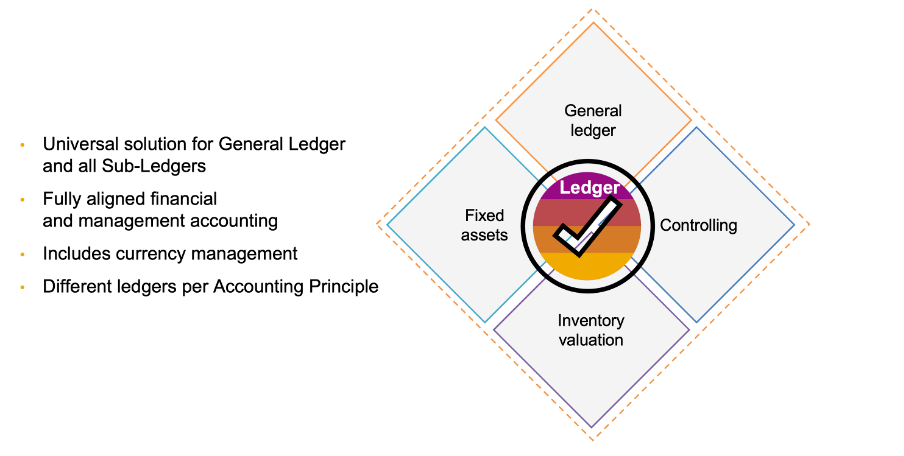

The Universal Parallel Accounting provides a coherent and unified way of looking at various applications including asset accounting, inventory management and controlling.

Figure 9 Unified Approach using Universal Parallel Accounting

With S/4HANA 2022, we would introduce real time eliminations of Intercompany Revenue and Intercompany COGS, in a new ledger called as Group Valuation Ledger (or Transactional Consolidation View)

Figure 10: Multiple Ledgers in Universal Parallel Accounting

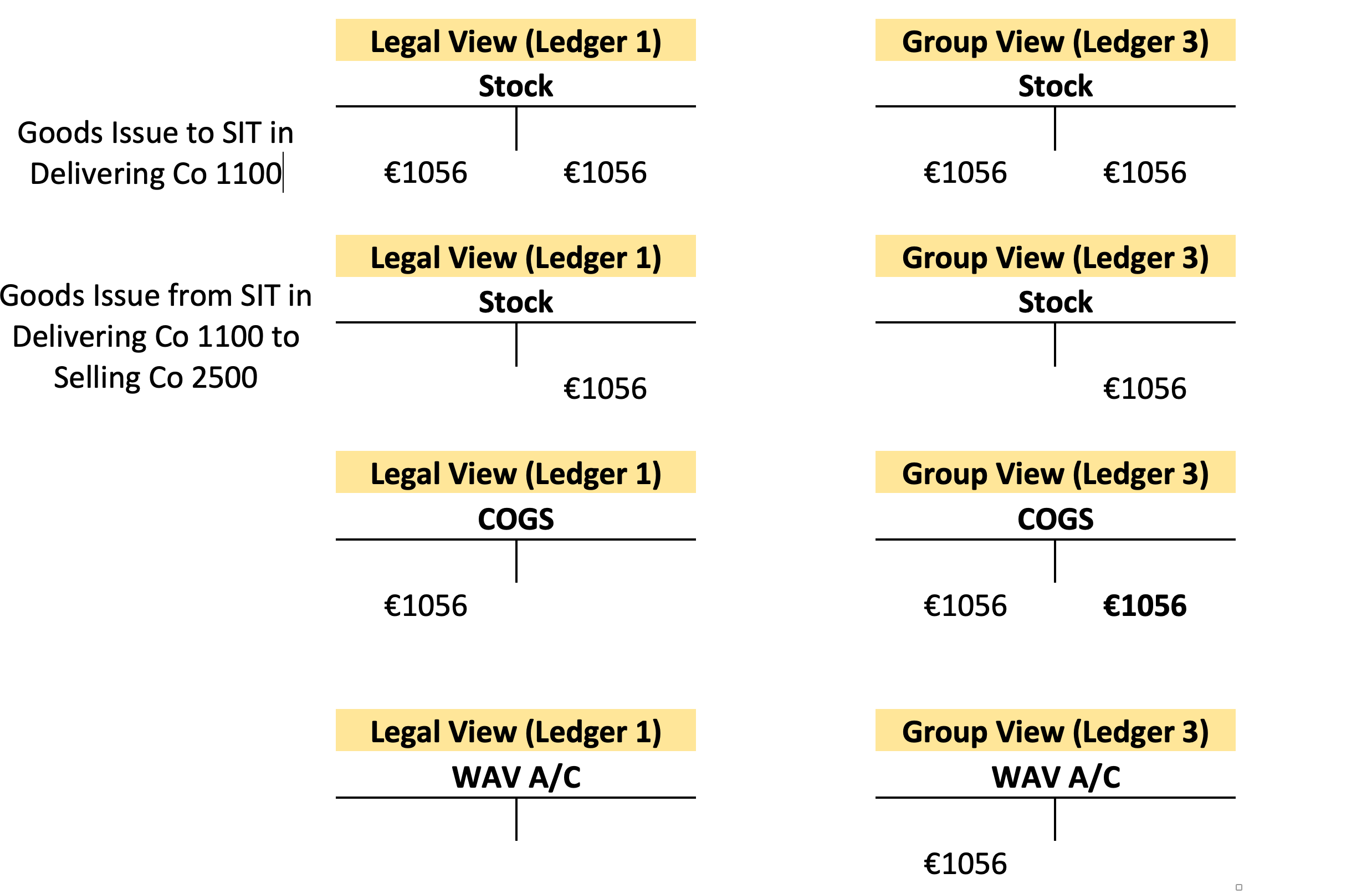

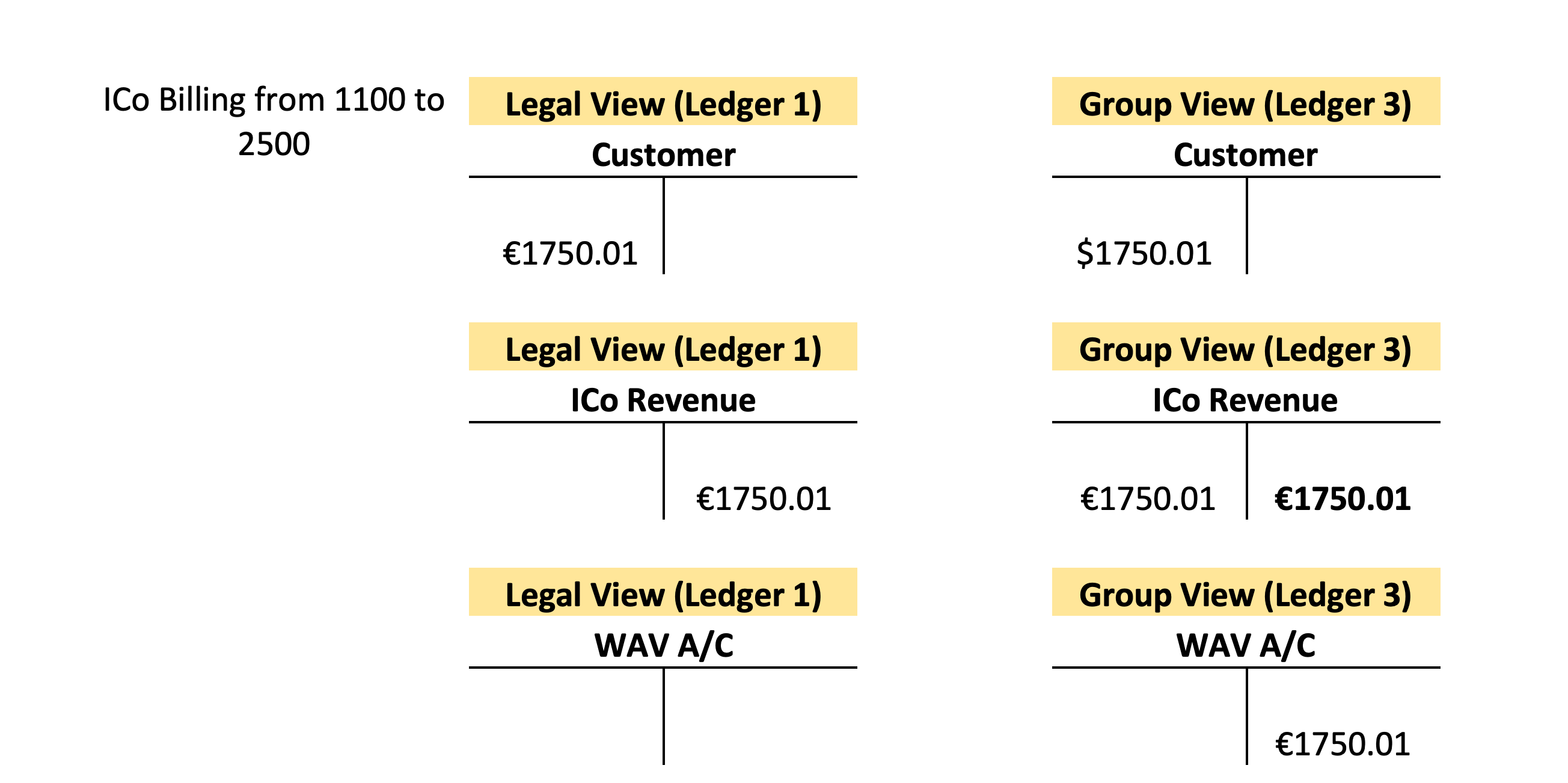

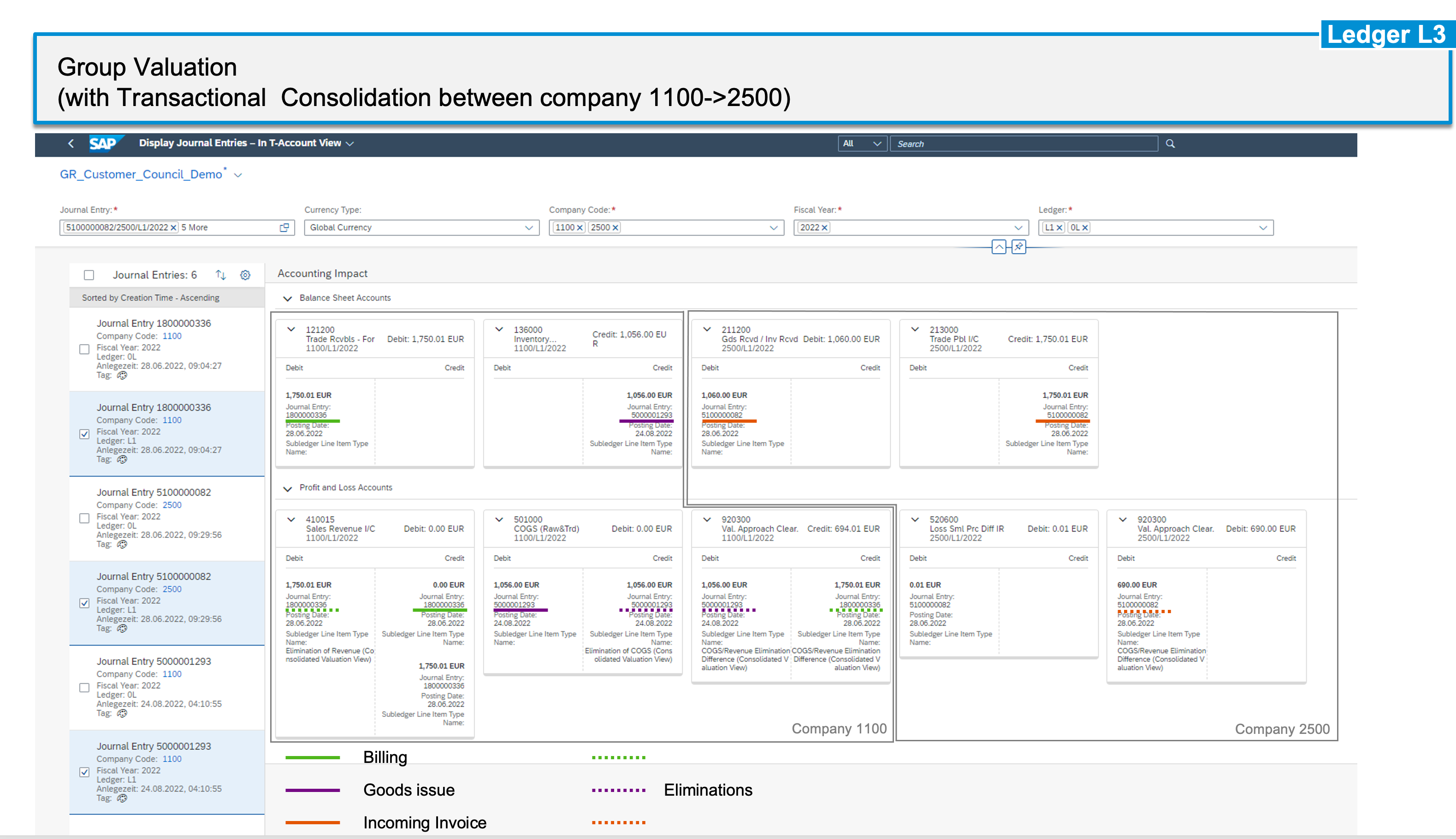

The Group Valuation View (Transactional Consolidation) is an additional ledger to record intercompany eliminations for operational transactions. From the Advanced Intercompany Sales flow in Figure 5 above, let us look how the account postings would look like:

Legal Entity 1100 (Accounting Entries)

| Company Code (Delivering) | ICo Revenue | ICo COGS | ICo Markup |

| 1100 | €1750.01 | €1056 | €694.01 |

The WAV Account holds the intercompany mark up of €694.01 in Delivering company 1100. The WAV Account is a clearing account, used to record clearing or elimination entries of Intercompany Revenue and Intercompany COGS in a legal entity. At a group level, it should balance out to zero.

Legal Entity 2500 (Accounting Entries)

| Company Code (Selling) | ICo Markup |

| 2500 | €694.01 |

The WAV A/c holds the ICo Markup of €694.01 and at a group level the markup has been eliminated. If you also view the Goods Receipt, the inventory values are different. The legal view holds inventory value with mark up added. However, in the Group Valuation ledger, that is not the case and rightly so, since the inventory should be valuated at cost from a Group Perspective.

The T Journal of system entries can be displayed as below:

Figure 11 T Entries in Parallel Valuation, Unconsolidated View

Figure 12 T Entries in Parallel Valuation, Consolidated View

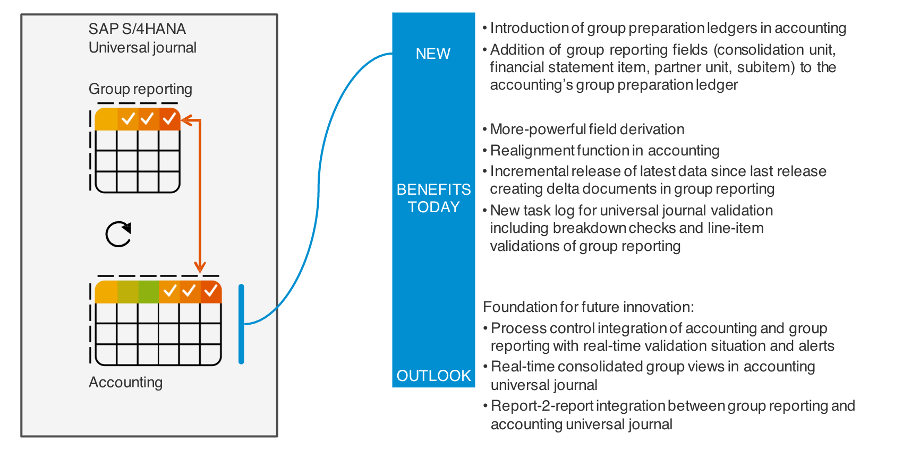

We now look at how the entries in Group Valuation ledger would be integrated with Group Reporting for preparation of Consolidated Financials.

With S/4HANA 2021 On Premise Release we had enabled the first steps for a closer integration of Accounting with Group Reporting. As shown earlier in Figure 9, a new functionality called as Group Preparation Ledger had been introduced with which certain fields like Consolidation Units, FS Items etc have been introduced in Universal Journal. With this functionality, there is no requirement to create a separate preparation ledger in Group Reporting.

With this the leading ledger (Local Ledger in the example) or Group Valuation ledger can be used as a source for preparation of Group Preparation Ledger. Since some of the GR relevant fields are available in Universal Journal, we could potentially enrich data through substitution rules in Finance to make it relevant for Group Reporting, resulting in faster close at period end. A new realignment function has been delivered so that historical data can be updated with GR relevant dimensions as well. In the future we want to further simplify the accounting integration of Universal Journal with Group Reporting to make Group Close as real time as possible.

Figure 13 Future Direction for Universal Journal Integration with Group Reporting

Now let us look at how the integration of Group Reporting and Universal Journal would look like today with S/4HANA 2022 PCE/OP using the Group Valuation View (Transactional Consolidation).

Current assets, typically inventory items, are sold within consolidation groups (for example, corporate groups). These transactions lead to interunit profits or losses. You can use the below two options to automatically eliminate interunit (IU) profits and losses. This elimination can be a statutory accounting requirement or a policy of management accounting for the group, either or both of which require that the consolidated statements portray the group as if it were a single entity. There could be two approaches to integrate Group Reporting today with S/4HANA 2022 OP/PCE:

| Approach 1 | Approach 2 |

Directly source group valuation ledger (margin-free) as a basis for financial group statements

| Keep legal valuation as leading valuation and use group valuation to calculate elimination postings.

|

The leading ledger in Universal Ledger would send full information to Group Consolidation Ledger (Balance Sheet, P&L Information). For example, the inventory information from leading ledger would be sent with Intercompany Markup without eliminations as it exists today. We can also bring in the margin free inventory data from Group Valuation Ledger (Ledger 3) via Group Reporting Data Collection (GRDC). Below is the architecture view of the integration.

Figure 14 Integration of Group Reporting with Universal Journal: Architecture View

With this approach, Group Reporting has data with Mark up as well as margin free financial .

The data from Group Valuation ledger (ledger 3) would currently be shown as statistical FS Items, so that a Corporate Controller knows ahead of period close, the ICo Margins and COGS. The leading ledger would still be the source for legal consolidation.

What happens next?

In the future we would build on foundation provided by Universal Parallel Accounting & filling gaps in existing logistics processes to provide additional reporting KPI like CO2 equivalent, group profitability etc. We would also further simplify the data models between Group Valuation and Group Reporting to provide more simplified integration between the two & deeper insight into Group Financial across the Value Chain.

Additional Resources:

Further Information on Advanced Intercompany Sales & Advanced Intercompany Stock Transfer

Advanced Intercompany Sales & Stock Transfer in SAP S/4HANA Cloud | SAP Blogs

Further Information on Universal Parallel Accounting

Inventory Accounting for Universal Parallel Accounting in SAP S/4HANA Cloud 2105 | SAP Blogs

Asset Postings with Universal Parallel Accounting | SAP Blogs

Production Accounting for Universal Parallel Accounting | SAP Blogs

Value Chain Analysis

Labels:

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

28 -

Expert Insights

114 -

Expert Insights

185 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,679 -

Product Updates

265 -

Roadmap and Strategy

1 -

Technology Updates

1,499 -

Technology Updates

97

Related Content

- Insights on SAP vs Oracle in Enterprise Resource Planning Q&A

- Dunning for CardCode not consolidating business partner in Enterprise Resource Planning Q&A

- Preferred Success Round Table Discussion with SAP Customers on 29th April @ SAP NOW India. in Enterprise Resource Planning Blogs by SAP

- Lets Send multipart/form-data to external Receiver: CPI to AI App in Enterprise Resource Planning Blogs by Members

- Celebrating the Success of the Product Expert Training H1 2024 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |