- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Depreciation Beyond Useful Life of an Asset

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Depreciation Beyond Useful Life of an Asset

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 03-15-2024 4:22 PM

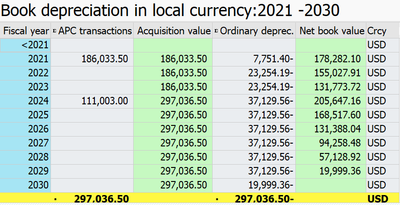

Issue: Depreciation calculation beyond 8 years (96 month or 192 half month period) which suppose to end 31st Aug 2029 but system is planning till 30 June 2030.

Asset Initial Acquisition is on 12/31/2021 for 186,033.50 and Asset value date 12/31/2021

Useful life 8 years

Original Depreciation start date 09/01/2021

Addition during the year 2024

Asset Addition on 02/29/2024 amounting $111,002.00 and relevant Asset Value date 02/29/2024

Dep Key : LINA

Base Method : 007 percentage from Life

Depreciation posted in Feb 2024 is amounting $ 4250.39 instead of 33,531.85

Excess planned depreciation $33,531.85 posted between 09/01/2029 to 07/31/2030

Question : How to Depreciate entire Asset value of assets including additions in subsequent years within 8 years of useful life.

I tried to Change base method from Yes to No as below

| Depreciation After End of Planned Life | Set this indicator, if you want the system to continue depreciation after the end of the planned useful life. |

still system is not zero-out entire NBV after end of useful life 8 years which leaves $13,248.50 balance in NBV.

Please advice.

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA,

- SAP S/4HANA Finance

Accepted Solutions (0)

Answers (1)

Answers (1)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Fixed Assets - Change the base value to the beggining of the first adquisition - MACRS depreciation in Enterprise Resource Planning Q&A

- Leased assets in Enterprise Resource Planning Q&A

- In SAP B1, is it possible to run Depreciation run job via DI API or Service Layer? in Enterprise Resource Planning Q&A

- Any standard program to update AFBN without editing standard Tables in Enterprise Resource Planning Q&A

- I am not sure how to configure Unplanned Depreciation for an Asset that has been posted using ABIF. in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 104 | |

| 12 | |

| 11 | |

| 6 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.