- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Adding new field to Tax condition for External se...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Adding new field to Tax condition for External service

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 02-28-2018 8:35 PM

Hi! All

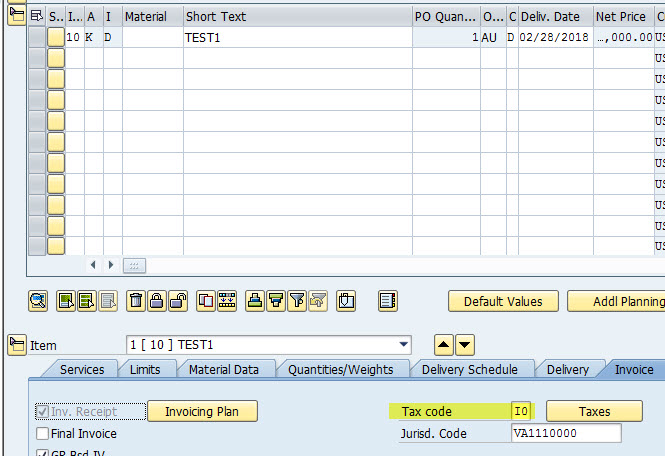

I have created a new condition table for NAVS to include item category of PO (ZZPSTYP). I have enhanced EXIT_SAPLMEKO_002. I have also added the new field in V_T681F. Now when I create a service PO, the correct tax condition is getting picked up.

However, when I create a service entry sheet for the PO item, the condition analysis shows that the specific condition table is getting skipped as it is not able to get the value for item category and therefore the correct tax condition is not getting picked up. What am I missing?

Regards

- SAP Managed Tags:

- MM (Materials Management)

Accepted Solutions (0)

Answers (5)

Answers (5)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Yes Jurgen. Tried with E_KOMP-PSTYP = I_KOMP-ZZPSTYP first. This did not work since import value I_KOMP-ZZPSTYP will be blank so the value passed to E_KOMP-PSTYP will be blank. The value of PSTYP passed to the condition table in access sequence of NAVS will be blank. Therefore the tax code was not getting determined. As mentioned, when I changed the code to E_KOMP-ZZPSTYP = I_KOMP-PSTYP, the tax code determination in the PO is correct and is working as expected. See below.

The problem is that the value does not get picked up during service entry sheet creation. If I put a break point at the code added in EXIT_SAPLMEKO_002, creation of service entry sheet does not even touch this point. The question is what needs to be done so that the correct tax code is picked up in the Service entry sheet. From my understanding, the tax code in service entry sheet should get passed from the PO. But this is not happening.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

the example from the OSS note 566002 is right the opposite to your statement: E_KOMP-PSTYP = I_KOMP-ZZPSTYP.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hello Jurgen, Here are the details

Created and added Table 590 with ZZPSTYP in purchasing

Added in V_T681F

Added Table 590 with ZZPSTYP in External Service Management

Code in include of EXIT_SAPLMEKO_002

Tax code determined correctly in Service PO based on condition table 590

Incorrect Tax code in service entry sheet

Looking at the Analysis of the conditions in the service entry sheet, it appears the value for KOMP-ZZPSTYP is not flowing not flowing. Any help is appreciated.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

it could be so much easier for those who want help and faster for you to get a solution if you would just show a few screenshots e.g. from your code in the exit and from condition analysis

You can also follow the instructions from OSS note 566002 - M/03: Can't use field PSTYP in the condition table

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- How to set up the Data Migration Cockpit in Enterprise Resource Planning Blogs by Members

- Building Low Code Extensions with Key User Extensibility in SAP S/4HANA and SAP Build in Enterprise Resource Planning Blogs by SAP

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 100 | |

| 12 | |

| 11 | |

| 6 | |

| 6 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.