- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Revenue Recognition for Loss Project

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Revenue Recognition for Loss Project

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 02-19-2018 3:45 PM

Hi,

We are using Cost method based on POC of revenue recognition of project. I want to know what is the process of handling the revenue recognition for loss projects?

Please advise.

Regards,

Vivek

- SAP Managed Tags:

- PLM Project System (PS)

Accepted Solutions (0)

Answers (2)

Answers (2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hello Ken,

Thank you!!!

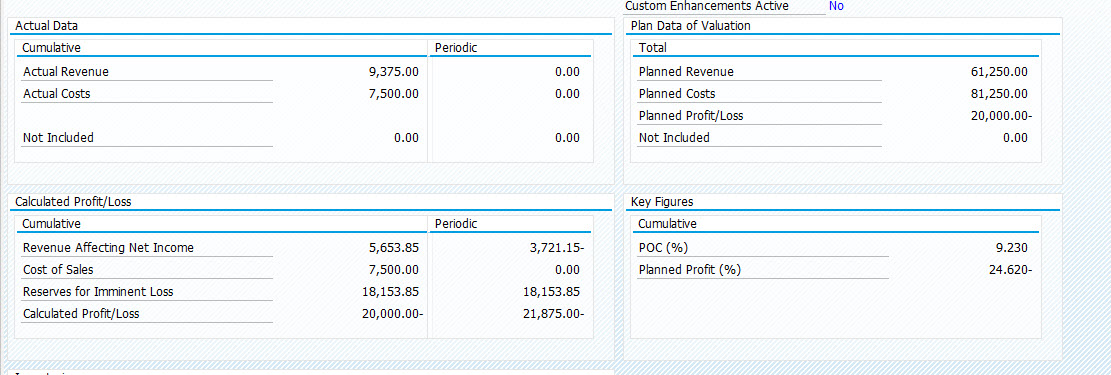

I am learning this process in project system, I have below scenario:

Estimated Rev = $ 61,250

Estimated Cost = $ 49,000

Profit = $ 12,250

The first month below are the actuals

Billing = $ 10,000

Cost = $ 7,500

Based on above figures system calculates the POC as 15.30% and adjust the revenue by $ 625 during settlement, this part if perfectly working fine

Second Month

Business realized the project is in loss, so they revised the cost estimate by loss amount i.e $ 20,000

Estimated Rev =$ 61,250

New Estimated Cost =$ 81,250

Profit = $ (20,000)

There are no actuals posted in the second month, so when I run KKA2 system is calculating revenue recognization as below, the expectation is system should post a loss of $ (21,875) in the second month. How can this be achieved?

Regards,

Vivek

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

In RA you can set up Reserves for Imminent Loss (Rp<Cp). Make sure you limit recognized revenue to no more then 100% of Rp.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Subscription Billing with Convergent Invoicing and Contract-Based Revenue Recognition in Enterprise Resource Planning Blogs by SAP

- Why YCOA? The value of the standard Chart of Accounts in S/4HANA Cloud Public Edition. in Enterprise Resource Planning Blogs by SAP

- Reclassification of Revenue Recognized Value in Enterprise Resource Planning Q&A

- Recap of SAP S/4HANA 2023 Highlights Webinar: Service in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Sales in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 95 | |

| 9 | |

| 8 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.