- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- OSS Note for VAT project

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

OSS Note for VAT project

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 11-13-2017 10:18 AM

Hi,

Recently SAP released oss note for VAT of GCC.

2552954 - GCC countries: VAT Registration numbers.

I implemented this note,but donot find any impact.Can some body tell me what is the purpose of this oss note?

Regards,

- SAP Managed Tags:

- MM (Materials Management)

Accepted Solutions (1)

Accepted Solutions (1)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

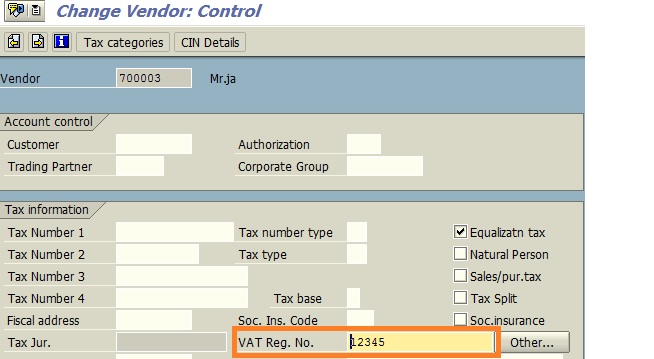

without this customizing you would either have received an error when you had tried to enter e.g. a Saudi Arabian VAT registration number in the VAT registration number field of the vendor master, or you could enter any number without validation of the right check digit.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Answers (6)

Answers (6)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Frankly, I think SAP took a poor approach with using VAT Registration Number (STCEG) for this requirement. As has been noted with OSS 1529424, you are required to turn off a hard error to implement this. SAP gives a disclaimer in OSS 1529424 that they do not provide any support for downstream issues if they do so. "The customer is solely responsible for any consequences that may arise if a VAT ID is entered for non-EU countries. SAP does not accept any responsibility for possible side effects in other Suite components (for example, CRM)"

I think SAP's prior approach of using STCEG only for European Union countries made sense. It was easy to describe to our data governance communities and easy to design data flow around. Furthermore, the CVI (Customer/Vendor Integaration) with Business Partners mapped the STCEG values into Tax Number Categories ending with "0", which again made for very clear data governance for our data communities.

For this new set of countries, I do not understand why SAP did not choose to use STCD1 as the appropriate field to use. This would have mapped through CVI into Tax Number Categories ending in "1" and our data communities would have not seen much of an impact.

Because of STCEG and Tax Number Categories ending in "0", we have to rewrite our data governance documentation and it will become less clear on which tax identification fields or categories are appropriate for a given record.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

I have similar issue.

I have performed the manual activity by updating the 2 views V_TFKTTAXNUMTYPE and V_TFKTTAXNUMTYPEC in SM30 as per the Note 2552954, but still I am getting the error that "Country BH is not an EC member" when I tried to enter VAT number in the VAT Reg No. field.

Please help.

Thanks in advance.

Kind Regards

Mohammed Saghir

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

message F2141 can be made a warning message with transaction OBA5...if you have implemented OSS note 1529424

it can even be hidden if you implement OSS note 1825074 - VAT ID for non-EU countries

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Thank you Mr.Jurgen and Mr.Patra.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

I have done it manually already in my system.what is the use of this OSS note? Where can I see the impact of this OSS in my system?

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

this OSS note does not have any program correction. You just need to perform the manual activity which are written in this OSS note.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- migration jobs in S/4HANA Cloud troubleshooting in Enterprise Resource Planning Q&A

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- How to check if a note is applied in S4HANA Public Cloud? in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 92 | |

| 11 | |

| 11 | |

| 6 | |

| 6 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.