- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Could not close Fiscal Year.

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Could not close Fiscal Year.

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 10-17-2016 10:40 AM

Hello Sap ByD users,

Could you please guide me know to close a Fiscal Year. Here is my situation:

- I released sale order then Customer Demand.

- From Delivery Proposal, I do "Create Outbound Delivery and Goods Issue" and I got this error: "... blocked by accounting"

I do some searching and most of topic tell me that because of Fiscal Year.

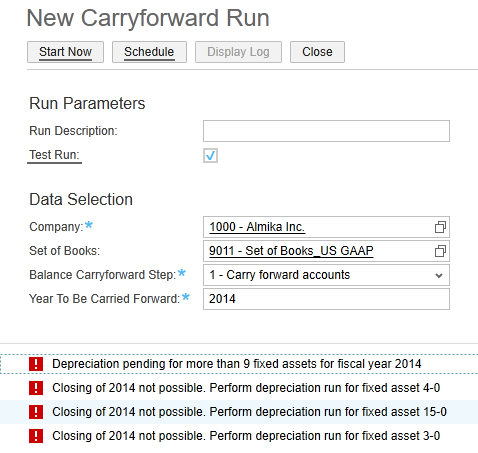

Because ByD allows only 3 fiscal years in active, I had to close one. But I got this error when i try to close:

Please help me pass by this.

Thank you so much!

Cuong Nguyen.

- SAP Managed Tags:

- SAP Business ByDesign

Accepted Solutions (1)

Accepted Solutions (1)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Cuong,

Please see blog : https://blogs.sap.com/2015/06/26/balance-carry-forward-and-closing-fiscal-year/

When Balance carry-forward run is executed, In some cases, system raise the Error message : The balance carry forward is not possible. Execute Depreciation under Fixed Assets.

While performing the Balance Carry forward, System triggers the check to verify if the depreciation run has been performed for the fiscal year to be carried forward. It is likely that some assets still need to be depreciated in the year you are trying to close period 12 or the full fiscal year itself.

Fixed assets should be depreciated for all the valuation views of all the set of books assigned to the company for which you want to close the period 12 or the Fiscal year. In other words the posted depreciation amount should equal the planned depreciation for all the valuation views of all the set of books assigned to the company for which you want to close the period 12 or the fiscal year.

To check if any depreciation (irrespective of the valuation views) has been

missed in the fiscal year you want to close period 12 of the fiscal year

itself.

1) You can run the Depreciation report available in the Fixed Asset work center to compare the Planned Depreciation and the Posted Depreciation.

- Go to the Fixed Asset work center.

- Go to the Reports view and List sub-view.

- Select the Depreciation report.

- Enter the Variables to run the report.

- Company: enter the company for which you want to perform the closing process.

- Set of Books: you need to enter a set of books assigned to the company (you need to run the report for all set of books assigned to the concerned company, but you only can enter 1 set of books at a time)

- Valuation View ID: you need to enter a valuation view assigned to the set of books entered previously (you need to run the report for all valuation views assigned to the entered set of books, but you only can enter 1 valuation view at a time).

- Accounting Period/Year: enter the fiscal year you want to close or for which you want to close the period 12.

If you notice a difference between the posted depreciation amount and the planned depreciation amount in the Depreciation report, a Depreciation run has to be performed in update mode to post the initially missing depreciation.

Optionally you can drill down to know which assets have not been depreciated by adding the Fixed Asset field from the Not Currently Shown area.

Regards,

Harshal

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

H Cuong,

As there is difference in planned and posted depreciation, you will need to execute the depreciation for the year you are trying to close. (i.e peirod 012, year 2014).

Once the depreicaiton run is executed successfully and depreciation is posted for assets in question, you will be able to exeucte the depreciation run.

General steps :

- Execute depreciation

- Execute Balance carry forward

- Close the fiscal periods and then close the year

Regards,

Harshal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hello Harshal,

I ran "Fixed Asset Depreciation Run" without errors, then i perform "Carryforward run", but this step i got the same error message (as attached pic in the question).

Addition information: i have 3 active fiscal year now: 2013, 2014, 2015 and i want to close 2013, all account periods from 001 to 011 of fiscal year 2013 is blocked, and 012 is not. (and i can not close this one).

Do you have any suggestion for me?

Thank for your help.

Best regards,

Cuong Nguyen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Cuong,

Can you please share the details of the depreciation run executed in the system? (Selection parameters).

Also selection parameters of Balance carry forward run (I saw the screenshot and If i remember, Balance carry forward run had an year to be carried forward as 2014, but I don't see that screenshot available here. Its gone missing now. 😞 ).

Steps :

1) Depreciation run for period 012/2103

2) Balance carry forward run for 2013 - Step1 and step 2

3) Close periods and close fiscal year.

Help center :

Closing Fiscal Years

Balance carryforward

Balance carryforward quick Guide

Reach out to me in case of further questions. If this asnwers to your question, Please accept this as answered and close the thread.

Regards,

Harshal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hello Harshal,

Thank for your quick answered. Follow your steps to view report, there is different between depreciation amount, but i could not do "Balance Carryforward".

I have 3 open fiscal years: 2013, 2014 and 2015. Now i want to close 2013. When i follow your blog to run Carryforward, i have same error when i close fiscal year:

Do i miss something? Thank you for your help.

Best regards,

Cuong Nguyen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hello Cuong,

Since you have 3 year open, 2013,2014 and 2015,

First you will need to close the year 2013.

1) execute depreciation run in update mode for period 012/2013 or 999/9999 (Close all other periods in year 2013)

2) Execute balance carry forward step 1 and 2 with the year to be carried forward as 2013.

3) Close the period 012/2013

4) Close fiscal year 2013

repeat the same for the year 2014 and 2015.

At any point in time you can only have 3 years open. So if you close 2013, you will be able to open the year 2016 in the system and proceed with the postings.

Feel free to reach out to me in case of questions. Alternatively, you can also raise an incident referring to this thread. So that I can take over and look at the other settings in your system.

Regards,

Harshal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Answers (0)

- Update of the SAP Activate Roadmap for SAP S/4HANA (on prem) upgrades with the Clean Core Strategy in Enterprise Resource Planning Blogs by SAP

- fiscal year and standard year in the same model in SAP Analytics Cloud in Enterprise Resource Planning Q&A

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- MUV not charged to parent item during close out in Enterprise Resource Planning Q&A

- SAP Document and Reporting Compliance Brazil: Dashboard do Usage Analytics in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 100 | |

| 12 | |

| 11 | |

| 6 | |

| 6 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.