- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- BAPI_ACC_DOC_POST not posting TAX data same as onl...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

BAPI_ACC_DOC_POST not posting TAX data same as online Transaction

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 10-27-2017 8:52 AM

Hi Experts,

I am facing a strange issue and it is only happening only for US/Canada Taxes via vendor invoice postings(where external tax calculation is on via Vertex). When I do it via transaction -> FB01, F-43 etc, with tax calculation flag on, there is no issue, tax line is posted fine in Accounting doc.

Now as per new requirement, I need to post accounting document via program (BAPI or BDC) since data will be coming from other system. I am using BAPI_ACC_DOC_POST for accounting document postings and it is working fine for all scenarios except US/Canada. Tax calculation is working fine, I feed the tax amounts to this BAPI.

Example Canada case, issue I am facing is tax data is totally ignored by this bapi...so I am getting error "balance in transaction currency" if I post gross amount - 1200, Item amount 1000 and tax 200........if I post gross amount 1000, item amount 1000 and tax 200, then document is successfully posted without any tax info ....hence BAPI is just ignoring the tax line....I am entering the Jurisdiction code etc all well as required. ...

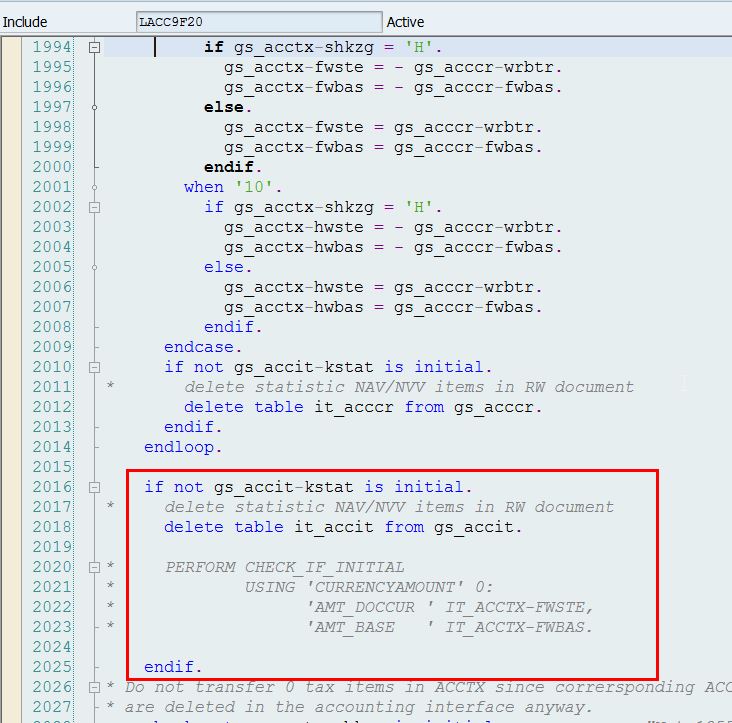

Finally after debugging the BAPI, I found out that tax is getting ignored due to "Tax acct key" for this tax code is VS1, in our system config VS1 is non-deductible tax in OBCN. As per BAPI code, for non-deductible tax (mainly written for for NVV/NAV), field KSTAT is marked as X. And there is a logic that if KSTAT is X, then delete the tax line simply. I am checking internally with functional team that why Canada tax have VS1 and why VS1 is marked as non-deductible flag. But anyhow, this is very old setting and unlikely to change. Most strange thing here is that if I do exactly same posting using FB01, then tax item is posted fine with a separate line.

So issue here is how come BAPI and Transaction are behaving differently. Whatever be the config, both should behave in same manner.

If this is not resolved, then we might have to move to BDC instead of BAPI which will be major re-test effort for all other scenarios.

Posting via FB01 direct -->

OBCN -

BAPI standard code -

Tax data getting deleted-

Any help is appreciated, please ask if you need more details.

- SAP Managed Tags:

- ABAP Development,

- SD (Sales and Distribution)

Accepted Solutions (1)

Accepted Solutions (1)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

Please follow this blog to realize your requirement.Now- a-days I am irregular to SCN due to personal obligation.

You should be able to get your solution with the help of good ABAP consultant following this blog.

https://blogs.sap.com/2017/06/23/fi-posting-via-idoc-and-generate-additional-tax-line-in-accounting/

Regards,

Avik

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Answers (6)

Answers (6)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Experts, Any comments will be very helpful here.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

Please follow this blog to realize your requirement.Now- a-days I am irregular to SCN due to personal obligation.

You should be able to get your solution with the help of good ABAP consulatant following this blog.

https://blogs.sap.com/2017/06/23/fi-posting-via-idoc-and-generate-additional-tax-line-in-accounting/

Regards,

Avik

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

There are very many similar questions on SCN. Google -> BAPI_ACC_DOC_POST tax. This one is just from the top of the list.

The note mentioned above clearly states that BAPI does not work the same way as transaction.

Do some research in Google and if it doesn't help then contact SAP Support. Also this pertains to FIN tag, not SD.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Thanks Jelena. I have done extensive search on forum before posting. I understand that BAPI n Transaction doesn't behave in same manner as BAPI can't calculate tax and needs to be fed. We are aware of this and passing tax to the bapi in required format and getting expected results for all tax scenarios except US/Canada (which use external tax calculation).

E.g. Canada - Issue is that it uses Acct Key VS1/VS2 etc in system which is marked as non-deductible. Due to this as shown in my original post, BAPI ignores tax line totally. But transaction is able to show Tax line. I can't believe it is expected as processing/calling way can be different but ultimate result should be still same.

Please go through the original post details and do provide if you have any inputs, thanks.

Diwakar

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Jelena,

I suppose that I am missing something and hence need help on SCN. To summarize my issue, BAPI is not able to post any non-deductible tax. There are many notes and threads available on the same (unluckily I haven't found my solution yet), so I don't suppose that BAPI is unable to post non-deductible tax at all.

So I don't think is the SAP standard code issue, definitely something I am missing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

ABAP/MM experts, please help !

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi team,

Any help will be appreciated, this is critical and urgent issue for us. I am just hoping that a SAP note might help on this. Also, it will be helpful if anyone can just throw some light that what is the impact of marking any tax acct key as "non-deductible" in OBCN.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

You need to follow the Solution provided in OSS note 561175

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Purchase Order Accrual in S/4HANA - Part 2 in Enterprise Resource Planning Blogs by Members

- Group Reporting Data Audit in Enterprise Resource Planning Blogs by SAP

- AB08 Only Trying to Reverse for Depreciation Areas of IFRS in Enterprise Resource Planning Q&A

- Deep Dive into SAP Build Process Automation with SAP S/4HANA Cloud Public Edition - Retail in Enterprise Resource Planning Blogs by SAP

- Service Order with Advance Shipment of Spare Parts in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 100 | |

| 12 | |

| 11 | |

| 6 | |

| 6 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.