- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- VAT on import goods

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

VAT on import goods

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 10-23-2017 12:56 PM

Hi,

We are implementing VAT for UAE/KSA.

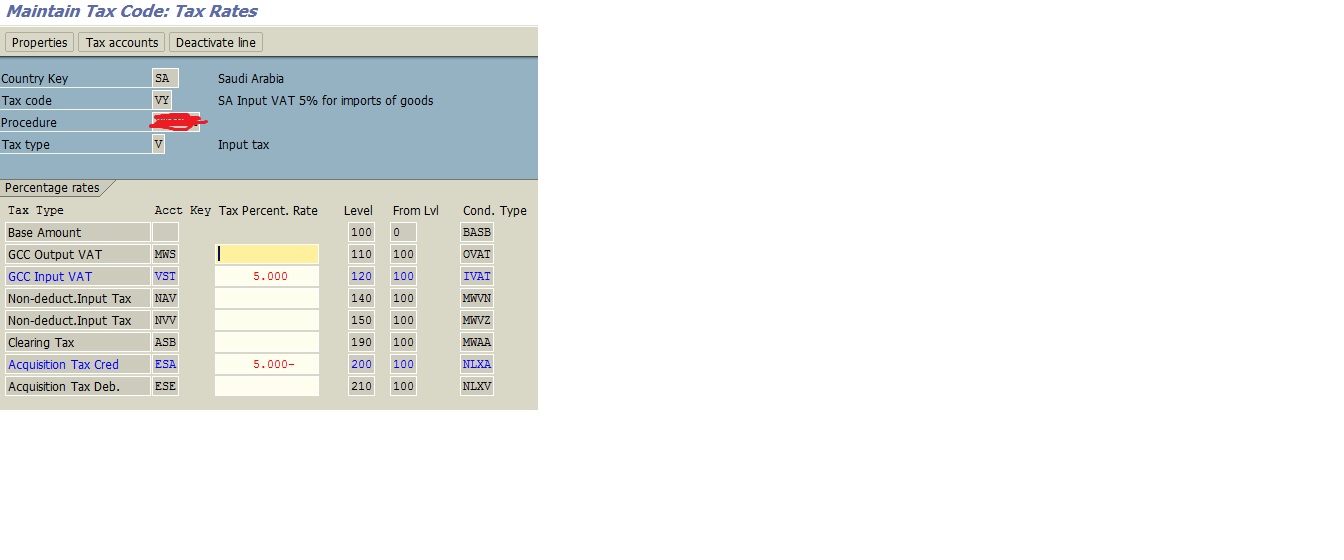

We got some problem with (PO ) import goods from non-GCC countries. For example I do import material from Turkey to KSA / UAE. Based on latest version 11(OSS note:2477105-VAT Baseline Package for Saudi Arabia) we have configured settings in the system.

We used tax code: VY. at Duty MIRO

I made duty MIRO(attached screen with account entries). Can some body confirm my account entries? Thank you.

- SAP Managed Tags:

- MM (Materials Management)

Accepted Solutions (0)

Answers (7)

Answers (7)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Ismail,

Please review the below SAP Notes

2581369 - VAT KSA and UAE : Imports Process

2583751 - VAT KSA and UAE: Tax calculation in MIRO during Imports

Regards

Praveen K. Karmukshi

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Ismail,

Also, you need to check on what amount the VAT is to calculated. Will the amount be Base Value + Vat, if so the above entries seems incorrect.

Regards,

Lakhya

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

The entry seems correct if RCM is involved.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Mohamed,

Can you please let us know what approach have you finalised for VAT on imports?

Best regards,

Mayuresh

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Mohamed,

Can you please let us know what approach have you finalised for VAT on imports?

Best regards,

Mayuresh

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Please check the business process .

For import , No VAT for main vendor . The Vat is applicable to SAUDI Customs .

And you can take output credit when you sell it and if export you get refund

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Additional TO got created with over picked quantity in Enterprise Resource Planning Q&A

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- GRDC Derive Period from file and not from global parameters in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 100 | |

| 11 | |

| 10 | |

| 6 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.