- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Fixed asset - Asset was refurbished and costs allo...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Fixed asset - Asset was refurbished and costs allocated is not depreciating Why?

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 08-15-2017 12:53 AM - last edited on 02-04-2024 2:24 AM by postmig_api_4

Hi SAP Guru's

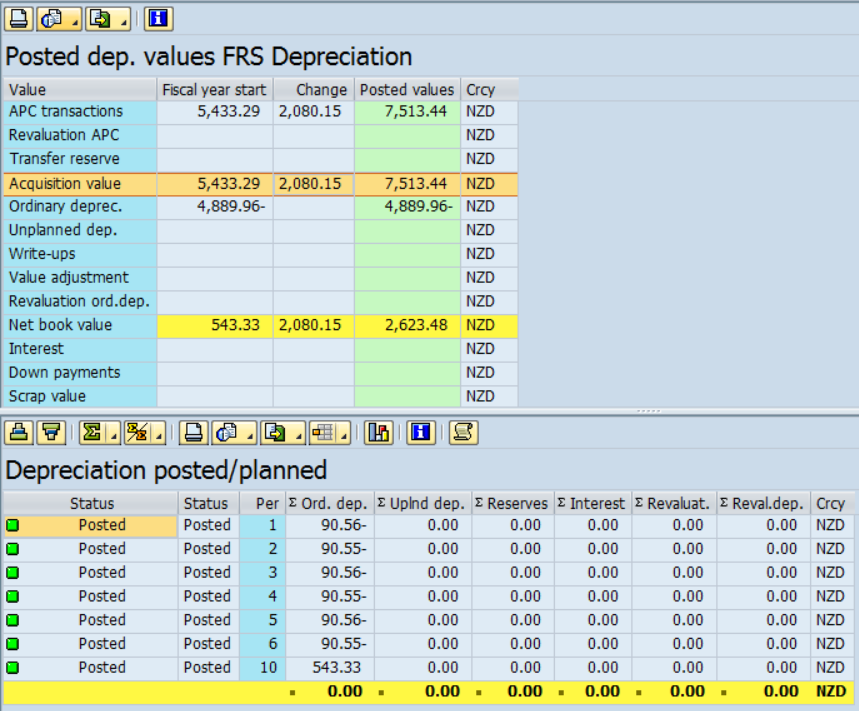

I have a few assets that we have refurbished, it looks like we had allocated the cost for the refurb to the asset and it has not depreciated.

If i give the following example:

We have an asset purchase price of $5433 (2010) useful life 5yrs its depreciated 4.5yrs with NBV $543 (2014) remaining we then refurbished the asset with the cost of $2080 and allocated this in period 10 (2014) its now 2017 and the fixed asset register is still showing this asset with a NBV of $2623. Ideally i would like to depreciate this asset from the year we allocated the refurbished cost 2014 (but I know SAP will only post for the current period) does that mean SAP will adjust for the remaining useful life?

How can do I start the asset depreciating again at the new refurbed value? What step have I missed?

Cheers

Crystal

- SAP Managed Tags:

- FIN Asset Accounting,

- PLM Enterprise Asset Management (EAM)/Plant Maintenance (PM)

Accepted Solutions (0)

Answers (2)

Answers (2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Crystal,

generally if you change any depreciation relevant parameter, the depreciation will be recalculated for all open fiscal years.

1. Please at first start a recalculation of values.

2. In AW01N press the button recalculation of values and check what the system is doing

- does refurbishment has an impact on the base value

3. In the attachment I can see that the depreciation for the year is adjusted to zero.

- perhaps useful life is zero and your settings in the depr. key are not allowing depreciate after useful life

best regards

Bernhard

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Thank you Bernhard. And yes you are correct with point 3 that is what the system is doing. I have to extend the useful life of the asset in order for it to depreciate but I must seek approval from Manager before changing this in the system.

Regards

Crystal

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Allocate depreciations in a different cost center in Enterprise Resource Planning Q&A

- SAP Business One Inventory Fixed Asset Process question in Enterprise Resource Planning Q&A

- Allocate Asset wise depreciation from Sending C.Code to the receiving Comp Codes in Enterprise Resource Planning Q&A

- Consumption of Budget in refurbishment order in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 85 | |

| 10 | |

| 10 | |

| 6 | |

| 5 | |

| 5 | |

| 5 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.