- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Create and Opening New Depreciation Area With Diff...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Create and Opening New Depreciation Area With Different Depreciation Key for Existing Asset

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 06-15-2017 5:24 AM

Our company have 2 Depreciation Area with each Depreciation Key

Now our accounting department request to create new depreciation area for tax balance with straight line method, as per request we create new depreciation area with below detail step:

- OADB - Create new depreciation area (area 20) with copy reference from depreciation area 01 Book Depre (Straight line)

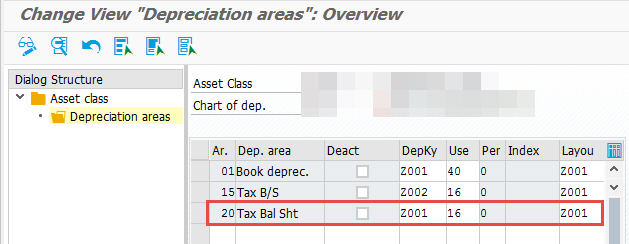

- OAYZ - Assign asset class to new depreciation area (area 20) with straight line depreciation key

- OABC - Because our accounting department want the asset value is refer from depreciation area 15 (tax balance which double decline method) as of 31 Dec 2016, we configure new depreciation area (area 20) adoption of value from depreciation area 15 (tax balance)

- AFBN - Run AFBN with not select the leave values initial (in order want to fill the value from depreciation area 15)

After AFBN run is done, asset value are copied from depreciation area 15 to 20 as we expected below the screen capture:

But the unexpected problem for the depreciation key, if we check at parameter in (AW01N) the depreciation key for new depreciation area is change to Z002 (double decline), whereas in OAYZ we configure the depreciation key set to Z001 (straight line).

Can anybody help us? what wrong with our configuration? why the depreciation key in new depreciation area change after we run AFBN?

What should we do to fix that problem?

Thanks

- SAP Managed Tags:

- FIN Asset Accounting

Accepted Solutions (1)

Accepted Solutions (1)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Dear Andra,

As your adoption of value (OABC-Step 3) of deprec.area 20 is refer to deprec area 15 (old tax dep area), so that setting dep.key Z001 on OAYZ (step 2), will take no effect for old assets when you run AFBN.

Default dep key on OAYZ will take effect only for newly created assets. It will not impact on old assets.

After AFBN done, you have to create substitution in order to change depreciation key for dep area 20.

1. Use transaction OA02 to create new subtitution for mass change

Prerequisite : asset class from A to XXX AND asset class = nn AND company code = YYY

Substitution : dep. key = ZXXX

Note : If you want to change all asset in all chart of depreciation, so input prerequisite ANLA-AFABE (chart of depre) rather than ANLA-BUKRS (company code).

Save the subtitution and assign it to the company code by clicking "new entries" button on initial screen OA02.

Example : create new deprec area 25 copying value from depre area 01 (OABC --> 01).

Dep area 01 using dep key LINS

Deprec area 25 using dep key GD10.

2. Use worklist to run asset master mass change

2.1) AR01 Generate worklist

Generate asset list to be changed (input parameter --> company code, report date deprec area. Then execute)

2.2) AR31 Edit worklist

Release worklist in this tcode to run mass change. Then click "refresh" to update the status.

2.3) AR30 Display worklist

Use this tcode for monitoring your worklist

3) Result on asset master and asset explorer

Best Regards

Nurlaila K

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Answers (0)

- Fixed Assets - Change the base value to the beggining of the first adquisition - MACRS depreciation in Enterprise Resource Planning Q&A

- Leased assets in Enterprise Resource Planning Q&A

- In SAP B1, is it possible to run Depreciation run job via DI API or Service Layer? in Enterprise Resource Planning Q&A

- Any standard program to update AFBN without editing standard Tables in Enterprise Resource Planning Q&A

- I am not sure how to configure Unplanned Depreciation for an Asset that has been posted using ABIF. in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 108 | |

| 12 | |

| 11 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.