- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- FINT - Item Interest Calculation - Taxes issue

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

FINT - Item Interest Calculation - Taxes issue

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 06-14-2017 9:48 AM

Hi all ,

I have configured the Item Interest Calculation and configured a zero percent tax code for the postings as per below in "Prepare Interest on Arrears Calculation" step

I created a few customer invoices to test with tax code postings. When I execute a posting in the test system I get an error of "Line-by-line taxes not active and therefore not allowed during transfer" , error message FF 817. I did a search on this error found the below explanation but I'm not sure whether it relates to my issue.

What causes error message FF 817?

Item-by-item tax calculation is not active for the company code used in the posting. In transaction OBCO, the relevant indicator is not active for the tax calculation procedure used. However, in the data transferred to the BAPI, a value was nevertheless filled in the parameter ITEMNO_TAX in the structures ACCOUNTGL or ACCOUNTTAX. However, these fields must only be used with an item-by-item tax calculation. Therefore, do not fill these parameters in this case.

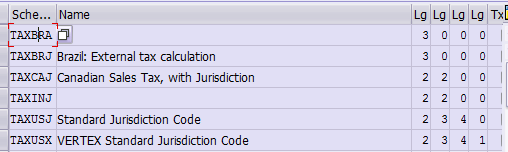

I checked OBCO but the the tax code I am using does not belong to any of these tax procedures as per below, it belongs to TAXZA. I'm not sure how to proceed to resolve this issue. Any assistance will be greatly appreciated.

Kind regards

Andre Spruit

- SAP Managed Tags:

- FIN Accounts Receivable and Payable

Accepted Solutions (0)

Answers (0)

- TCODE CO43 - Overhead Calculation not displaying in Enterprise Resource Planning Q&A

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Issue with Active Ingredient Calculation in Enterprise Resource Planning Q&A

- Result recording is not updating/Overwriting the batch characteristics value in Enterprise Resource Planning Q&A

- Asset Management in SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 108 | |

| 12 | |

| 11 | |

| 6 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.