- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Double Depreciation with 4-4-5 Weighting and Short...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Double Depreciation with 4-4-5 Weighting and Shortened Fiscal Year

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 05-25-2017 7:31 PM

Hello experts,

I have here a tough situation and need your help.

We implemented here following:

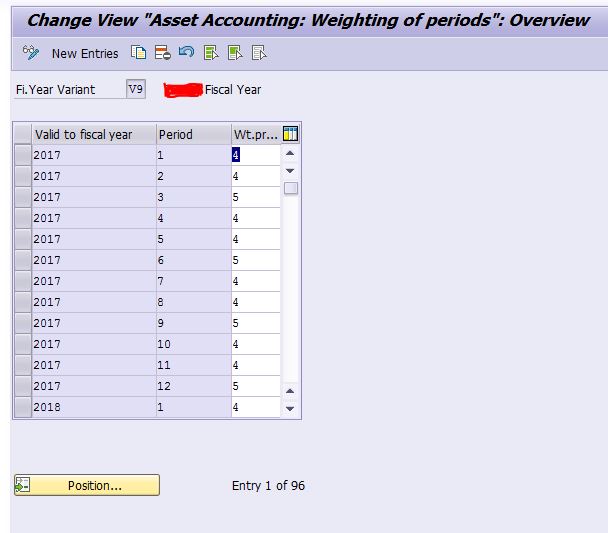

- new period weighting according to 4-4-5

- shortened fiscal year (6 periods)

- 4-4-5 weighting begins from period 4 in the shortened fiscal year

There are several depreciation areas, the most important are:

- Local GAAP

- US GAAP

Depreciation under local GAAP is controlled by a depreciation key LINS (standard one), depreciation under US GAAP is controlled by a custom depreciation key, which is basically the same as LINS except for the definition for period control, where the setting is "Pro rata at period start date". Here an overview of the cutom key.

When weighting for 4-4-5 under the transaction OAYL is activated, depreciation under US GAAP is doubled. When weighting is deactivated, depreciation is normal.

We already tried here several settings:

- exchanged depreciation key to LINS

- weighting of the periods was checked

- Period control rules were checked

- Fiscal Year variants were checked under OB29

- the reduction of the depreciation under asset accounting (Transaction OYAP) was checked

After each change the AFAR transaction was executed for the recalculation of the depreciation.

SAP Note 123026 with ZRUMPF was already implemented.

Thanks in advance for any help!

Regards,

Slava

- SAP Managed Tags:

- FIN (Finance),

- FIN Asset Accounting

Accepted Solutions (1)

Accepted Solutions (1)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Our settings were correct, no change was necessary. What was missing was an SAP Note 1400993, which eventually solved the problem.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

I checked with SAP... they filter out by default notes as from 5 years old, and since this note is dated back to 2009, it doesn't appear in the search unless a filter is removed from the search.

Good to know 🙂

Answers (2)

Answers (2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Eli,

thanks for your reply.

Some additional info: the client runs the SAP ECC 6.0, and it is Classic GL.

As for the settings under OA85, here they are (the shortened FY is being used only in one FY Variant).

The shortened year is 2017, to be sure I will post settings under 2017 and 2018 in OA85.

Here the OB29 Settings for FY 18 and 17:

Here the settings under OA85:

Let me know which further information would be helpful.

Regards,

Slava

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Slava,

I think, here lies the problem. When you activate the weighting, the system is looking into the values introduced in OA85. If 2017 is your shortened year, then I think the system receives it as contradictory values, as all the year is 'covered' by weighting factor. Hence, double amount posted (6*2). Of course, that's only my assumption and the definitive conclusion could be achieved only from debugging and tracing, but, still, it is what it looks like. Try and play with OA85 setting aligning them to the fact of shortened period and see if it affects the result.

Of course, if it seems that you exploited all the options, OSS message wouldn't do any harm. I would have opened it already, just in case.

Regards,

Eli

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

What are your settings in OA85 for this fiscal year (shortened) variant?

Regards,

Eli

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Error when executing the depreciation of lower value fixed assets in Enterprise Resource Planning Q&A

- Change to a new Fiscal Year in Enterprise Resource Planning Blogs by Members

- Tax Depreciation for Asset UL in Periods on a Shortened Fiscal Year in Enterprise Resource Planning Q&A

- Shorten Fiscal Year (SFY) in Enterprise Resource Planning Blogs by SAP

- Shortened Fiscal Year, Change Fiscal Periods, Fiscal Year conversion - what it is about in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 110 | |

| 12 | |

| 11 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.