- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Account Determination during Sales Invoice Posting

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Account Determination during Sales Invoice Posting

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 05-25-2017 3:12 PM

Hello,

We have a scenario where in the system has to hit a different G/L Account rather than the customer account (Payer) when releasing sales invoice to accounting. Is it possible to achieve this by standard? If so, kindly advice. After googling, I believe the user exit -

EXIT_SAPLV60B_XX will be useful. But if any SD experts can throw more light into this, it will be helpful. Thanks in advance.

Regards,

Mathy

- SAP Managed Tags:

- SD (Sales and Distribution)

Accepted Solutions (0)

Answers (2)

Answers (2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hello Experts,

Any guidance will be appreciated.

Regards,

Mathy

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

The requirement is, in some cases, the Business provides few services free of cost (up to certain limit) to customersIt is still not clear what do you mean by "upto certain limit" and also the settings you have in your current pricing procedure. Couple of options are there

- Have 100% discount in the pricing procedure

- Explore Rebate functionality

- Create a new Account Key and assign it to the pricing condition type and parallely, assign the required different G/L account to this Account Key in VKOA

But it all depends on how the client and their finance team are expecting the postings to happen

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Lakshmipathi,

The requirement is as below.

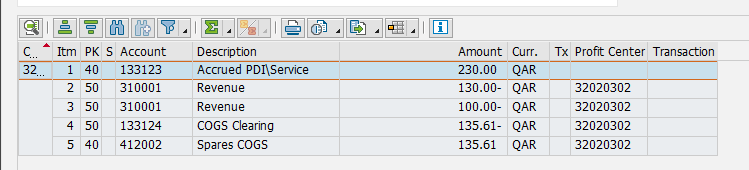

Company A sold a vehicle to Customer J. During the sale, the company offers three years free service for the vehicle i.e. up to a limit of lets say 5000$ in 3 years. So whenever the customer J brings in the vehicle for service in first 3 years, the cost incurred will be adjusted against the 5000$ credit given to J.

Present scenario: When the customer J bring the vehicle for service, invoice is issued to customer but then the customer is not actually billed i.e. he/she does not pay. But in backend since the payer is customer J, the entire invoice value is debited against customer (which is manually adjusted by finance dept).

Expected scenario: When the customer J bring the vehicle for service, invoice should be issued to customer but then the customer should not be actually billed. In backend, instead of debiting the customer, the entire invoice value has to be adjusted against the initial free credit limit allocated to the customer.

Please let me know for further clarifications required.

Regards,

Mathy

- Subscription Billing with Convergent Invoicing and Contract-Based Revenue Recognition in Enterprise Resource Planning Blogs by SAP

- PO Quantity check control in MIRO while posting Customs duty invoice in Enterprise Resource Planning Q&A

- Why YCOA? The value of the standard Chart of Accounts in S/4HANA Cloud Public Edition. in Enterprise Resource Planning Blogs by SAP

- Goods movement of errors because of account assignments in Enterprise Resource Planning Q&A

- Behavior of Advanced Foreign Currency Valuation after Clearing in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 96 | |

| 9 | |

| 8 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.