- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Cost Allocation for production

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Cost Allocation for production

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 01-13-2020 10:15 AM

Dear experts,

I have a question about cost allocation for production. The company hire a manager who is in charge of many of processing of products. I want to allcocate the cost ( wage for manager,...) to the production cost of each product. Could you help me. Thank in advance.

Best regards,

Anh.

- SAP Managed Tags:

- SAP Business ByDesign,

- MAN Production Planning (PP)

Accepted Solutions (0)

Answers (2)

Answers (2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Anant,

Thanks for this clarification.

I'm so sorry to dig this up two years later but this process is giving me a hard time.

I understood that with the actual cost method, all the costs recorded on the cost center of the ressource are distribued among the ressource right ?

and after some testing i understand that with the absorbing overhead method, we debit product in progess account , and crédit CSTGEN account of targeted cost centers ?

In your opinion,can the actual cost method, and the absorbing overhead costs method by procduction batch cohabit ?

What bothers me is that when I launch a cycle for allocating overhead costs to production batches, the system will indeed debit my products in progress and credit the CSTGEN type account that I have set up, on the correct cost center.

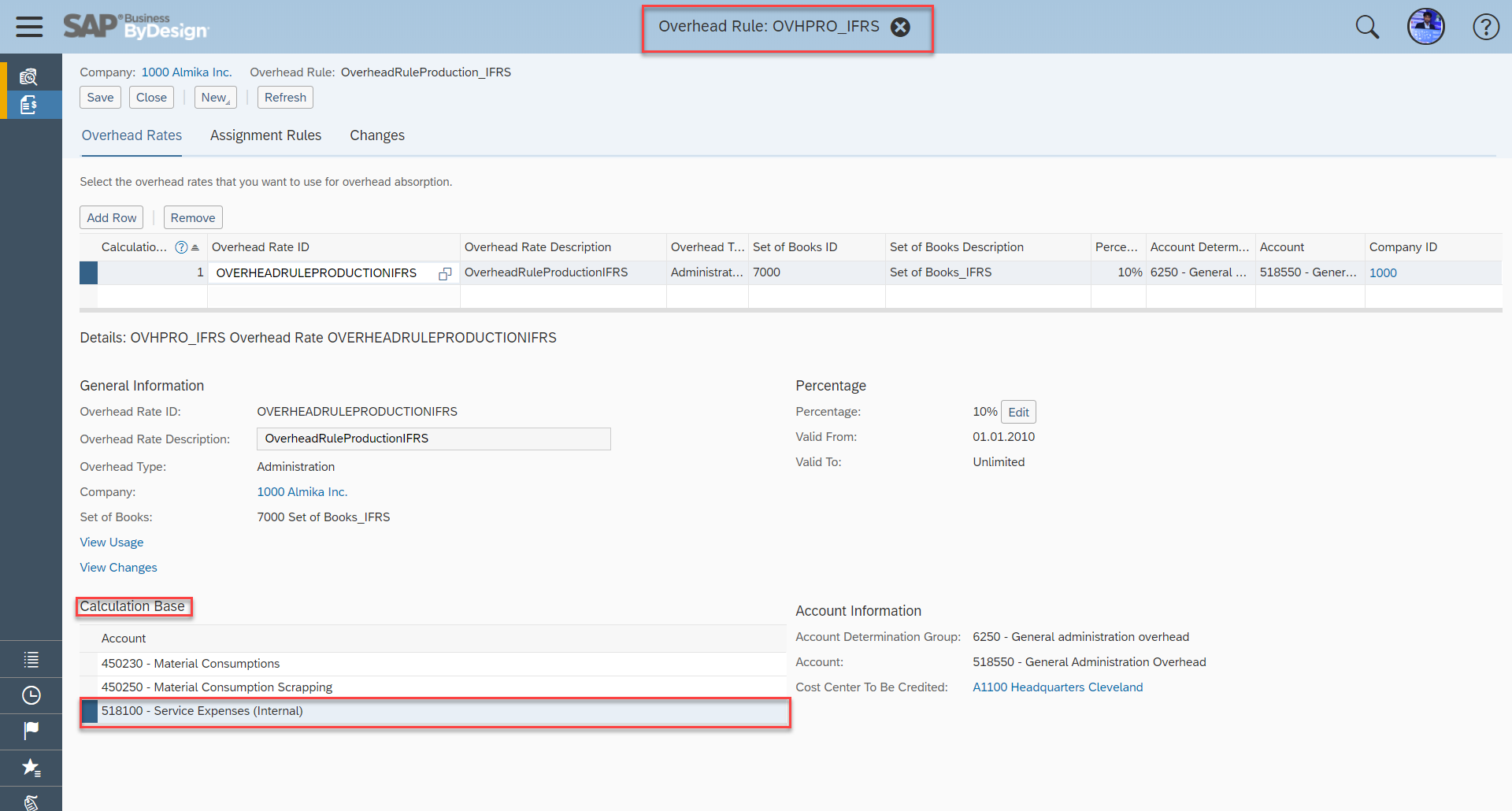

My calculation base is an internal service expense.

If I launch a calculation of the actual cost price for the item concerned, the cost price of my resource is revised upwards because it includes the costs recorded on the cost center of the resource.

The system then recalculates the overhead value accordingly to the new cost of the ressource, included the cost recorded on the cost center of the resource.

But i dont understand how this new overhead difference value, which will be taken into account when distributing the actual costs ,will be credited to the CSTGEN account configured in the rule for allocating general costs to production batches.

Regards

Etienne

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

anhpp,

Ideally, you should use the Actual Cost for this but you can also use Overhead Rule to achieve this.

1. Create an Overhead Rate.

2. Create an Overhead Rule.

3. Do the Production Run.

4. Do the Overhead Absorption Run.

5. Do the WIP Clearing Run.

You can follow the below document for Overhead:

.

Let me know if it works and mark the question as answered if your requirement is met or comment back for any further queries.

.

Thanks & Regards,

Anant Patel

SME, SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Dear Anant Patel,

Thank for your reply. With Overhead Rules, I only can distrubute overheacd cost base on the cost of material in Production task Control. I expect the function that can distribute the overhead cost base on the total cost. For example: The overhead cost ( wage for manager) is 100 $, I want to distribute this cost for 3 production lots: A: 30 $, B: 30$, C: 40$ and then when I run WIP Clearing run, this cost will be added into prodution cost. I tried to overhead rules and distribution rule but it did not solve my question.

Thank you & Best Regards,

Anh,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

anhpp,

With Overhead Rules you can't only distribute overhead cost for material in Production but you can also distribute the cost of Services or other Costs. You just need to add those G/L Accounts to the Calculation Base.

.

Also, if that doesn't fulfill your requirement then you better use Actual Cost. You can use the below link to understand it:

.

Let me know if it works and mark the question as answered if your requirement is met or comment back for any further queries.

.

Thanks & Regards,

Anant Patel

SME, SAP Business ByDesign

- SAP S4HANA Cloud Public Edition Logistics FAQ in Enterprise Resource Planning Blogs by SAP

- OKB9 problem: message no. KI235 in Enterprise Resource Planning Q&A

- Introducing the GROW with SAP, core HR add-on in Enterprise Resource Planning Blogs by SAP

- Intercompany Execution of Services (aka "Dual Order") in Enterprise Resource Planning Blogs by SAP

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 108 | |

| 12 | |

| 11 | |

| 6 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.