- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- Reduce Useful Life of Asset

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Reduce Useful Life of Asset

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-29-2019 8:49 AM - edited 02-04-2024 6:27 AM

Hi Experts,

My User has an Asset whose Depreciation Start Date is 01.01.2016 and Life Time is 5 Years.

The Asset end date is 31.12.2020. Now the business has realized asset end date should be 31.12.2019 ié 4 years of life time.

When i am changing the Useful life to 4 years in AS02 the system is still showing some planned depreciation in the year 2020 in AW01N.

My Depreciation key is LINI .

Since the Asset Life will be over in 2019 , the user is not ok with certain planned depreciation in 2020.

Kindly help me how should i resolve the issue. There is no smoothening in OAYR for my company code.

Regards

Jalaj

- SAP Managed Tags:

- SAP S/4HANA,

- FIN Asset Accounting

Accepted Solutions (0)

Answers (4)

Answers (4)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi

As Georgios already mentioned, according to SAP standard system behavior, the required adjustment for the shortened lifetime should be adjusted in the first period in 2019 where the depreciation run was not executed yet. This is also the result I get if I test in my system.

If this is not working in your system you can try to set a useful life of for example 3 years and 6 months (instead of 4) to achieve the last depreciation amount for the asset to be posted in period 12.2019.

Best regards

Ignaz

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Dear Jalaj,

When you change useful life for an asset, or you change a depreciation key, the system usually recalculates planned depreciation from the open fiscal year onwards, not for the closed fiscal years.

What you can do is first calculate what the correct depreciation should be right now. Then post this extra depreciation (the difference) using ABAW-balance sheet revaluation. Use transaction type 800 and post the amount as Reval.O.Dep CY

Before that, check your customising settings in AO90, there you should enter the correct GL accounts for posting revaluation of depreciation. Also in OABW make sure that your depreciation area allows Revaluation postings.

Thanks

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Dera Jalal,

In AO90 go to the relevant Account Determination and then in Depreciation Folder. There, in Account assignment for revaluation of depreciation you should enter 2 GL accounts: These are the same 2 GL accounts you use for accumulated ordinary depreciation and the Depreciation expense account for this asset class. You do not need to use any different GL accounts.

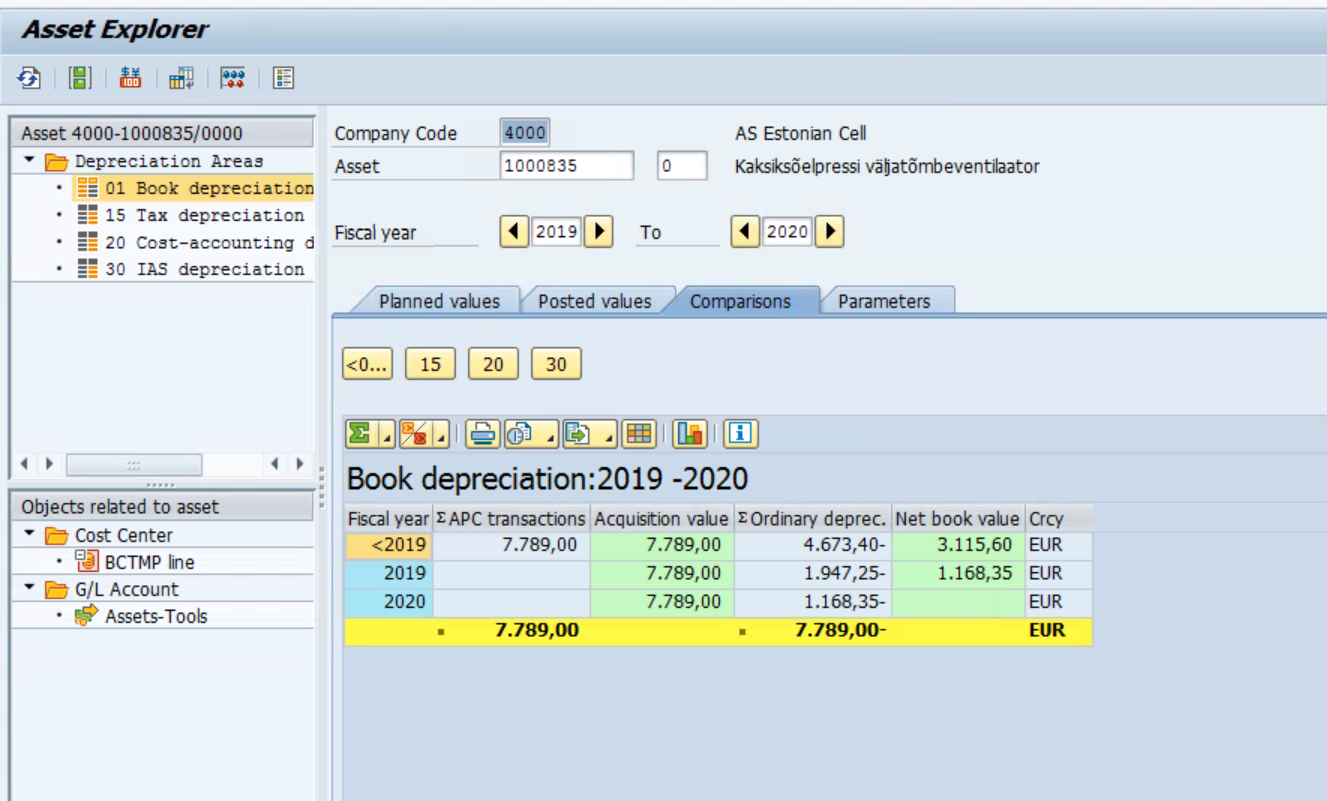

Regarding the GWG Depreciation Key, you can simulate your Fixed Asset and see what happens. It will probably work as well. Go to AW01- Asset Explorer and switch on simulation. The Simulation button is the 5th button from the left on the print screen you attached. (Below Asset Explorer title, where refresh button is etc...sorry it would be easier to copy paste the button but it is just not working)

Then go to Paremeters tab and change the depreciation key to GWG. Then go to Posted values tab and see what is going to be posted. Note this is simulation mode, you can change anything without affecting any values. I think if you do this at the end of 2019 it will work as well.

Regards

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi,

When ever you reduce the useful life of the asset, the system recalculate depreciation and it has adjusted in open fiscal years of the asset. Check with the user what is their calculation expecting from the system and compare with SAP.

Regards,

Mukthar

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- Introducing the GROW with SAP, core HR add-on in Enterprise Resource Planning Blogs by SAP

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

- explain about sub asset automation in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 90 | |

| 10 | |

| 10 | |

| 6 | |

| 5 | |

| 5 | |

| 5 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.